A Guide to Emissions Tracking for Financial Institutions

Karel Maly

September 21, 2025

For financial institutions, tracking emissions used to be a niche activity, tucked away in the ESG department. Now, it's front and centre. Measuring the greenhouse gas emissions tied to lending, investment, and underwriting activities—what we call financed emissions accounting—is no longer just a metric. It's become a core part of risk management and strategic planning, thanks to a groundswell of regulatory and investor pressure.

Why Emissions Tracking Is Now a Business Imperative

The entire landscape has shifted under our feet. What was once a voluntary exercise in corporate responsibility is now a critical business function that directly impacts your bottom line, your standing with regulators, and your brand's reputation. The days of treating climate risk as a far-off problem are well and truly over.

This isn't happening in a vacuum. A perfect storm of forces is driving this change. Regulators, investors, and even your clients are looking past the emissions from your own office buildings and branch electricity. They want to know about the vastly larger carbon impact of your portfolio—the emissions generated by the businesses and projects you finance.

The Regulatory Tsunami

If there's one single driver pushing this forward, it's the sheer weight of new regulation. Frameworks like the European Union's Corporate Sustainability Reporting Directive (CSRD) are creating mandatory, non-negotiable standards for transparency. These rules demand detailed disclosures on climate-related risks and financed emissions, turning what was a "nice-to-have" into a legal requirement.

Ignoring this isn't just about risking a fine. It’s a red flag to the market that your institution isn't ready for the transition to a low-carbon economy, which can hit your credit rating and raise your cost of capital. Here in the Czech Republic, for instance, our financial institutions are pivotal to meeting national climate targets. The country has pledged to slash greenhouse gas emissions by at least 40% by 2030, which puts direct pressure on banks and asset managers to get a firm grip on the climate risks hidden in their portfolios.

Unmasking Hidden Financial Risks

Strip away the compliance checklists, and you'll find that emissions tracking is, at its heart, a sophisticated risk management tool. If your portfolio is heavily exposed to carbon-intensive sectors—think fossil fuels, heavy industry, or certain agricultural practices—you're carrying a significant amount of transition risk that often isn't properly priced in.

This risk can pop up in a few different ways:

- Credit Risk: A borrower in a high-emitting industry could get slammed with carbon taxes or simply fail to adapt their business model, making them more likely to default on their loans.

- Market Risk: As regulations tighten and public sentiment shifts, assets in these sectors could devalue rapidly, forcing you to stomach major write-downs.

- Reputational Risk: Nobody wants to be known as the bank funding polluters. That kind of label can damage your brand, drive away customers, and make you a target for activist campaigns.

A financial institution that can’t measure its financed emissions is essentially flying blind into a major source of financial turbulence. Getting a clear picture of your portfolio's carbon profile is the essential first step to future-proofing your entire lending and investment strategy.

From Obligation to Opportunity

While the initial motivation might be managing risk and staying compliant, the most forward-thinking institutions are finding that this process opens up real business opportunities. The data you gather gives you incredible insight into which clients are leading the charge on decarbonisation and which are falling behind.

This intelligence is gold. It lets you engage proactively and design innovative green finance products. We're talking about sustainability-linked loans where the interest rate is tied to a client's emission reduction targets, or specialised financing for green infrastructure projects. By understanding the carbon footprint, you can more accurately calculate the financial return on sustainable investments and show clear, tangible value to your stakeholders.

Suddenly, a compliance headache becomes a powerful competitive advantage, helping you drive decarbonisation and open up entirely new revenue streams at the same time.

Building Your Carbon Accounting Framework

Before you can even think about measuring a single tonne of carbon, you need a blueprint. Diving into emissions tracking without a solid framework is a bit like trying to build a house without architectural plans—it's a recipe for a structure that's inconsistent, unreliable, and simply won't stand up to scrutiny. This framework is what gives you the rules, methodologies, and overall structure to ensure your calculations are credible right from the start.

The foundation for any serious financed emissions accounting effort is a globally recognised standard. For the financial sector, this isn't just a nice-to-have; it's essential. Without it, you get a chaotic free-for-all where every bank invents its own rules, making meaningful comparison impossible.

Aligning With a Global Standard

For financial institutions in the Czech Republic and across Europe, the conversation almost always starts with the Partnership for Carbon Accounting Financials (PCAF). Since 2015, PCAF has provided the go-to methodology for banks and asset managers to get a handle on the greenhouse gas emissions tied to their loans and investments. It’s the standard that empowers them to set science-based targets and have informed conversations with clients about their carbon intensity.

Adopting the PCAF standard isn't just about ticking a box for compliance. It’s about building credibility. It gives you a common language for measuring and talking about financed emissions, which is precisely what regulators, investors, and other stakeholders want to see. When you report your portfolio's carbon footprint using PCAF, the market understands and trusts those numbers.

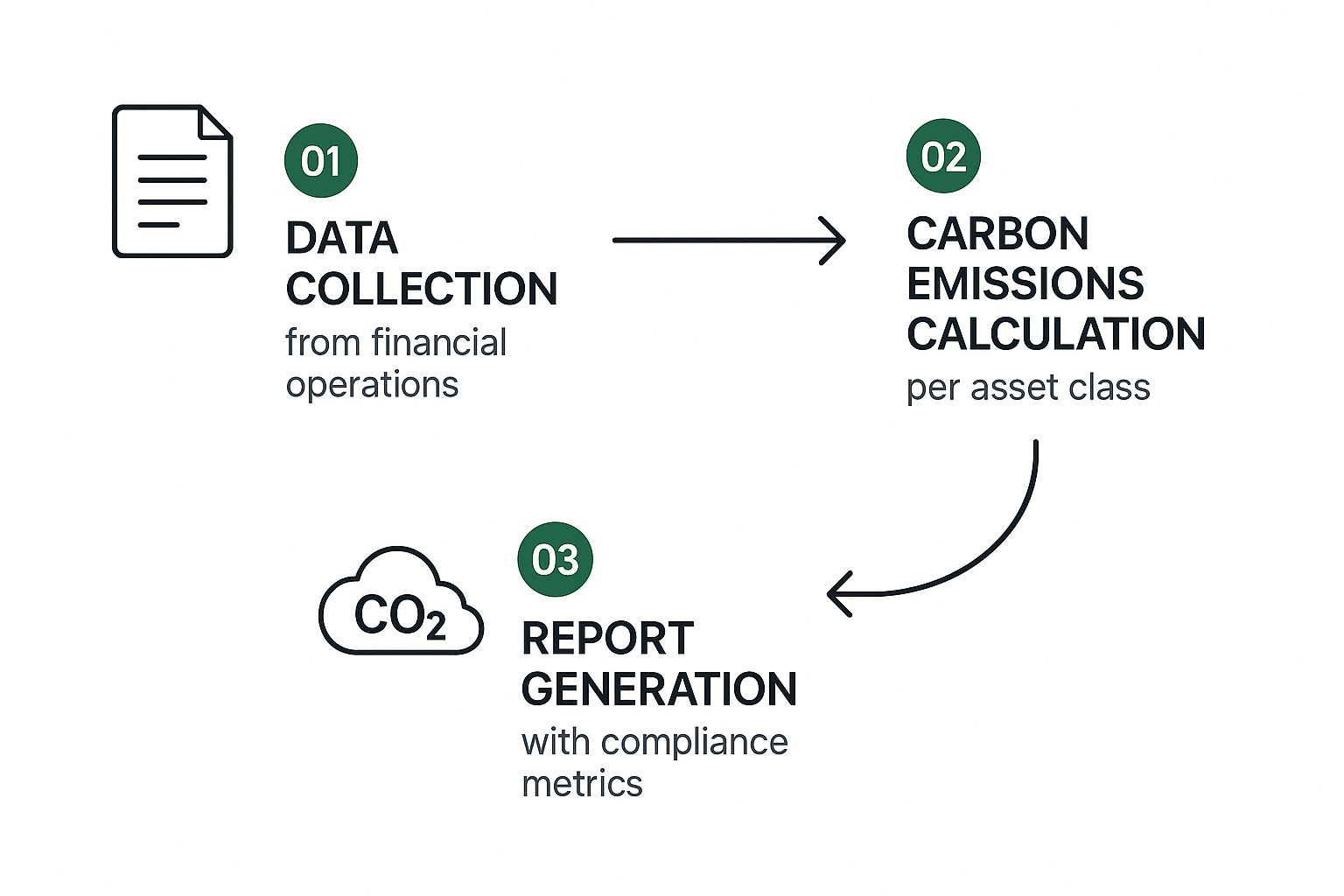

This process flow gives a clear picture of how data moves through a typical emissions tracking system, from initial collection all the way to the final report.

As you can see, it’s a logical journey where raw financial data is methodically turned into actionable, compliance-ready intelligence on your portfolio's climate impact.

To put this into practice, here are the core components you'll need to establish for a robust, PCAF-aligned system.

Core Components of a PCAF-Aligned Framework

| Component | Key Objective | Example Action Item |

|---|---|---|

| Boundary Setting | Clearly define which assets and operations are included in the analysis. | Start with the most material asset classes, like listed equities and commercial real estate. |

| Data Collection | Establish processes for gathering reliable emissions and financial data. | Integrate with public ESG databases and create templates for direct client data requests. |

| Methodology Application | Consistently apply PCAF calculation methodologies across the defined scope. | Use recognised emission factors and document all data quality scores for each calculation. |

| Reporting & Disclosure | Generate transparent, audit-ready reports for internal and external stakeholders. | Develop report templates aligned with CSRD, SFDR, and other relevant regulations. |

| Governance | Assign clear roles and responsibilities for managing the framework. | Create a cross-functional steering committee with members from risk, finance, and sustainability. |

Each of these building blocks is crucial for creating a system that is not only accurate but also defensible under the watchful eye of auditors and regulators.

Defining Your Boundaries and Scope

One of the first, and frankly most critical, decisions you'll make is setting your organisational and operational boundaries. You need to decide exactly which parts of your business will be included in the first pass. A common mistake I see is trying to boil the ocean—measuring everything at once. This almost always leads to analysis paralysis.

A much more practical approach is to start with a prioritised list. Focus on the most material asset classes first, which are usually the parts of your portfolio with the highest financial value or known climate exposure.

- Listed Equities and Corporate Bonds: This is often the most logical place to start. Data from public companies is generally more accessible, giving you a quicker win.

- Commercial Real Estate: A huge source of emissions, but it demands specific methodologies to properly account for things like building energy consumption.

- Business Loans and Unlisted Equity: These can be tougher nuts to crack. Data is often scarce, which means you’ll likely rely on industry averages, estimates, or direct engagement with your clients.

The goal here is progress, not perfection on day one. By starting with a focused scope, you can build up your team's expertise and show some tangible results to leadership. That makes it much easier to get the buy-in and resources you need to expand the programme later.

Assembling Your Internal Team and Tools

This is not a one-person job. A successful emissions tracking programme needs a cross-functional team with a clear mandate from the top. Ideally, this group should include people from risk management, finance, sustainability, and IT. Their first job is to champion the project, secure a budget, and establish clear governance.

This is also the point where you need to get serious about your technology. While it's tempting to start with spreadsheets, that approach quickly becomes unmanageable and riddled with errors as your scope and complexity grow. Modern greenhouse gas tracking software is built specifically to automate data collection, apply the right calculation standards, and produce audit-ready reports far more efficiently. Taking a look at a guide to greenhouse gas tracking software can help you figure out which features are non-negotiable for a financial institution.

Ultimately, building this framework is all about creating a process that is both repeatable and defensible. It sets the foundation for everything that follows, ensuring your entire emissions tracking effort is built on rigour and transparency.

Mastering Your Data Collection Strategy

Any emissions tracking system, no matter how sophisticated, is only as good as the data feeding it. While setting up a framework is a great start, the real work—the day-in, day-out grind—is in gathering, managing, and validating the enormous amount of information needed to accurately calculate your portfolio's carbon footprint. This is where theory crashes into the messy reality of the market.

Any emissions tracking system, no matter how sophisticated, is only as good as the data feeding it. While setting up a framework is a great start, the real work—the day-in, day-out grind—is in gathering, managing, and validating the enormous amount of information needed to accurately calculate your portfolio's carbon footprint. This is where theory crashes into the messy reality of the market.

Effective data collection isn't just about grabbing numbers. It's about knowing where they came from, how reliable they are, and what their limitations are. Get this wrong, and you risk building your entire climate programme on a foundation of sand, which will inevitably lead to shaky insights and reports that crumble under regulatory or investor scrutiny.

Navigating The Data Quality Hierarchy

Let's be clear: not all emissions data is created equal. The Partnership for Carbon Accounting Financials (PCAF) gives us a handy hierarchy for data quality, and it’s crucial to understand where your information sits. Think of it as a ladder—your goal is always to climb as high as you can.

At the very top rung, you have reported emissions. This is the gold standard, coming directly from your clients or the companies in your portfolio. It’s specific, it's verified, but it’s also the hardest to get, especially from smaller or private businesses.

One step down, you'll find physical activity data. This could be a company’s electricity consumption in kilowatt-hours or their fuel usage in litres. This is still excellent quality because you can apply specific emission factors and calculate the carbon footprint with a high degree of confidence.

Finally, at the bottom, you have modelled or estimated data. This is usually based on industry averages or economic activity, like calculating emissions per million EUR of revenue for a specific sector. It’s less precise, but it’s absolutely essential for filling the inevitable gaps where better data simply doesn't exist.

In the real world, you'll almost certainly use a mix of all three. The trick is to be completely transparent about your data sources and have a concrete plan to improve data quality over time. Always be pushing for more reported and activity-based data wherever you can.

Building a Centralised Data Hub

One of the biggest operational headaches I see is data chaos. Information gets trapped in disconnected silos all over the institution—in loan origination systems, investment management platforms, and various ESG databases. Trying to wrangle all of that with spreadsheets is a one-way ticket to manual errors and version control nightmares.

This is why setting up a centralised data warehouse or using a dedicated carbon management platform is non-negotiable. Creating a single source of truth ensures that everyone, from the risk team to the sustainability department, is working from the same script.

This central hub needs to do a few key things really well:

- Ingest data from multiple sources: It must pull information from internal financial systems, third-party ESG data providers, and even direct submissions from your clients.

- Automate quality checks: You need to build in rules that automatically flag anomalies. Think of a sudden, unexplained spike in a company's reported emissions or data that falls wildly outside industry norms.

- Maintain a full audit trail: Every single data point has to be traceable back to its origin, with a clear record of any changes or estimations applied along the way.

Getting all your data sources integrated can be a heavy lift, but it’s an investment that pays off. For a deeper look into the nuts and bolts, this carbon footprint API integration guide offers some great insights on making the data flow smoothly.

Vetting Third-Party Data Providers

Let's face it, no institution can gather all this data on its own. You're going to rely on third-party providers for corporate emissions data, emission factors, and industry benchmarks. The problem is, the quality and methodologies between these providers can be worlds apart.

When you're choosing a data partner, don't just get wowed by their coverage stats. You have to dig deeper into their process.

- Transparency: How do they actually source their data? What estimation models are they using when reported numbers aren't available? A provider worth their salt will be an open book.

- Data Validation: What are they doing to verify the information they sell you? Do they have a clear process for correcting things when they get them wrong?

- Alignment with Standards: Make sure their data and methods are aligned with global standards like the GHG Protocol and PCAF.

Treat this process like you’re conducting due diligence on a major investment. Your choice of data provider directly affects the credibility of your own reporting, so it's a decision that requires serious thought. The right partner will put you on the fast track; the wrong one can sabotage your entire effort.

Turning Emissions Data into Strategic Action

Collecting gigabytes of emissions data is one thing, but actually using it to make smarter decisions is a whole different ball game. Let’s be blunt: raw numbers gathering dust in a database are worthless. The real goal of emissions tracking for financial institutions is to forge that data into powerful business intelligence—the kind that guides your strategy, sharpens your risk management, and uncovers opportunities you didn't know existed.

This is the exact moment where the technical drudgery of carbon accounting shifts into a strategic imperative. You stop being a passive reporter of numbers and become an active manager, using this insight to finally understand the transition risks buried deep within your loan books and investment portfolios. It’s all about asking the right questions.

Pinpointing Carbon Hotspots and Concentration Risk

Your first job is to find the carbon hotspots. This isn't about getting a single, portfolio-wide number. It’s about digging deeper to see which specific sectors, asset classes, or even individual clients are driving the bulk of your financed emissions. When you visualise this on a dashboard, the results can be genuinely eye-opening.

You might find, for instance, that a mere 10% of your commercial loan book is responsible for 60% of its total emissions. This isn't just an environmental data point; it's a massive, flashing red light signalling concentrated transition risk. These are the clients most exposed to future carbon taxes, changing consumer tastes, and ever-tightening regulations.

Understanding where your carbon is concentrated is fundamental to proactive risk management. It allows you to move from a reactive compliance posture to a forward-looking strategy that protects the long-term value of your portfolio.

Once you’ve got these hotspots locked down, you can start modelling different scenarios. What happens to the creditworthiness of these clients if a €100-per-tonne carbon price comes into play? How does their business model actually stand up in a world aligned with a 1.5°C target? Your risk and credit teams need to be having these conversations, and solid emissions data is the essential ticket to the game.

From Tough Conversations to Smart Product Innovation

Armed with this kind of detailed analysis, you can completely change the tone of your client relationships. Instead of a routine annual review, you can kick off a strategic dialogue about their decarbonisation journey. This isn't about being punitive—it's about positioning yourself as an indispensable transition partner.

Imagine a high-emitting manufacturing client. You could show them benchmark data for their sector and discuss tangible investments in energy efficiency that you could help finance. You can model how a specific capital injection could lower their carbon footprint, cut their operational costs, and ultimately make them a more resilient, lower-risk borrower. Suddenly, a difficult conversation becomes a collaborative, value-adding partnership.

This data-driven approach also becomes a fantastic engine for product innovation. The insights from your emissions tracking are a goldmine for creating new green finance products that meet a very real market need. Think about things like:

- Sustainability-Linked Loans: Offering better financing terms to clients who hit pre-agreed emissions reduction targets.

- Green Mortgages: Giving preferential rates for properties that meet high energy-efficiency standards.

- Transition Finance Bonds: Raising capital specifically to fund projects that help carbon-intensive industries clean up their act.

These products create a virtuous cycle. They open up new revenue streams for your institution while actively incentivising the real-world emissions cuts needed to meet your own climate commitments.

Capitalising on the Czech Decarbonisation Drive

Right here in the Czech Republic, there's a significant opportunity for financial institutions that are ahead of the curve. Recent findings show that while 89% of Czech firms are taking some steps to reduce their emissions, only about a third of them have set—and are actively monitoring—clear reduction targets.

What's more, while many firms are investing in energy efficiency (59%) and waste reduction (74%), there's a clear gap between good intentions and structured, strategic action. You can get the full picture in the European Investment Bank Investment Survey 2023. This gap is precisely where you can step in. Using your emissions insights, you can offer the tailored financing and advisory services these businesses desperately need to turn their sustainability goals into reality.

Delivering Transparent and Audit-Ready Reports

You’ve done the heavy lifting—you’ve built your framework, wrangled the data, and analysed your portfolio. Now comes the final, and perhaps most critical, step: communicating what you’ve found. This is where your entire emissions tracking for financial institutions programme is put to the test. With regulations like the Corporate Sustainability Reporting Directive (CSRD) raising the bar, your disclosures need to be clear, comprehensive, and utterly bulletproof.

An audit-ready report is much more than a collection of numbers. It’s a narrative that proves your process is rigorous and credible. It tells the story of your methodology, your data sources, and your strategic response to climate risk. Getting this part right is absolutely essential for satisfying regulators, building trust with investors, and showing the world your climate commitments are more than just talk.

Crafting an Unassailable Audit Trail

At the heart of any credible report lies a complete and unbroken audit trail. Think about it from an auditor’s perspective: they should be able to pick any single number from your final disclosure and trace it all the way back to its source. Anything less than that level of traceability is a non-starter.

This means you have to meticulously document every decision and calculation along the way. Why did you select a specific emission factor for the commercial real estate portfolio? What assumptions did you make to fill a data gap for a private equity investment? Every single choice has to be recorded and, more importantly, justified.

A good reporting platform will automate much of this legwork, logging data sources, timestamps, and the specific methodologies applied. The aim is to create a transparent record that leaves zero room for ambiguity, ensuring every figure can stand up to intense scrutiny.

Think of your audit trail as the structural support for your entire report. Without it, even the most accurate calculations can appear arbitrary, undermining the credibility of your entire disclosure and exposing you to regulatory risk.

Key Components of a Strong Emissions Report

A well-structured report should anticipate and answer the key questions your stakeholders will have. It has to go beyond simply stating your total financed emissions. A truly transparent disclosure provides the context and detail needed for a genuine understanding of your position.

Make sure your report clearly articulates these core elements:

- Methodology and Standards: Be explicit. State that you are following the PCAF standard or another recognised framework. Detail the specific calculation approaches you used for different asset classes.

- Scope and Boundaries: Define exactly what's included in your report. Which asset classes, geographies, and business lines are covered? It’s just as important to state what is not covered and explain why.

- Data Sources and Quality: Disclose the mix of data you relied on—how much was reported directly by clients, how much you had to estimate, and what third-party data providers were used. Assigning PCAF data quality scores adds a powerful layer of transparency that sophisticated stakeholders now expect.

- Assumptions and Limitations: Be upfront about any assumptions made, especially when using industry averages or proxies to fill gaps. Acknowledging limitations isn't a sign of weakness; it shows honesty and a commitment to continuous improvement.

This checklist can help ensure your financed emissions disclosures are hitting the right notes for regulatory compliance and stakeholder trust.

Reporting Checklist for CSRD Compliance

| Checklist Item | Purpose | Common Pitfall to Avoid |

|---|---|---|

| Clear Methodology Statement | Builds credibility and demonstrates adherence to global standards. | Vaguely referencing "industry best practices" without naming the specific framework used (e.g., PCAF). |

| Defined Reporting Boundary | Provides clarity on what portion of the portfolio is covered. | Failing to disclose significant exclusions, which can misrepresent the total carbon footprint. |

| Data Quality Disclosure | Allows stakeholders to assess the reliability of the emissions figures. | Presenting all data as equally certain, without distinguishing between reported and estimated figures. |

| Forward-Looking Targets | Shows commitment to future action and alignment with climate goals. | Setting a vague, long-term 2050 goal without clear interim targets for 2030. |

A solid report is grounded in these details. They provide the evidence that your numbers are not just numbers, but the product of a diligent and well-managed process.

Communicating Progress and Building Trust

Finally, never forget that your report is a public-facing document and a powerful communication tool. This is your chance to shape the narrative around your institution’s climate strategy. Use it to showcase not just your current emissions profile, but also your decarbonisation pathway.

Be sure to include your near-term (e.g., 2030) and long-term (e.g., 2050) emission reduction targets. Explain the strategies you're putting in place to achieve them, whether it’s through deeper client engagement, investment in green technologies, or deliberate shifts in portfolio allocation. This kind of proactive communication demonstrates a credible, strategic approach to the climate transition, helping you build lasting trust with all your stakeholders.

Tackling Your Toughest Emissions Tracking Questions

Moving from a high-level climate strategy to the practical details of tracking financed emissions can feel like a huge leap. As you get into the nitty-gritty, a lot of practical questions pop up. This is where the theory meets reality.

This section is all about those real-world challenges. We'll answer the most common questions we hear from finance professionals on the ground, cutting through the jargon to give you straight, actionable advice. Let's dive into what you really need to know to handle tricky data situations and sidestep the common mistakes that can trip you up.

"We're a Small Bank in the Czech Republic. Where Do We Even Start?"

This is a great question. For smaller institutions, the biggest mistake is trying to boil the ocean. You don't need to tackle every single asset class from day one. The smart move is to start small and focused.

Pick one area that’s significant for your business—maybe your corporate loan book or a specific listed equity portfolio. This lets you build expertise internally and show real progress quickly. The goal at the beginning isn’t perfection; it’s about getting a process in place and building momentum.

Here’s a simple starting plan:

- Lean on the PCAF standard: It’s a globally recognised framework, it’s free, and it gives you the methodologies you need without a big upfront cost.

- Use industry averages first: If you can't get direct emissions data from a client, PCAF allows you to start with sector-based estimates. This is a perfectly valid first step.

- Focus on building your team's skills: Use this initial project as a training ground. Let your team get comfortable with the data collection, test the workflow, and really understand the process.

From my experience, regulators and stakeholders are much more impressed by a clear, committed plan with tangible first steps than they are by waiting for a perfect, all-encompassing system that never materialises. Progress over perfection is the name of the game here.

"How Can We Possibly Handle Data From Private SMEs?"

This is the question on everyone's mind. Private small and medium-sized enterprises (SMEs) are the backbone of the economy, but they rarely have the resources to measure and report their own carbon emissions. Don't worry, the PCAF methodology was built for this exact problem and gives you a clear path forward.

Your first move is to use proxies. By applying sector-based emissions factors—like tonnes of CO₂e per million EUR of revenue for a specific industry—you can calculate a reasonable and defensible estimate. It gives you a data point, albeit a low-quality one, to start with.

But here’s the key: that initial number isn’t just for reporting. It's a conversation starter.

Once you have these estimates, you can engage with your clients in a much more constructive way. The next step is to weave simple, non-intrusive questions into your regular check-ins, like during the annual loan review. You can offer them guidance and resources to help them start measuring their own footprint. Suddenly, your tracking data shifts from a compliance headache to a powerful tool for building stronger, more collaborative client relationships.

"What Are the Biggest Mistakes We Should Avoid?"

While getting the technical details right is important, I’ve seen that the most damaging failures in emissions tracking for financial institutions are usually strategic, not operational. Avoiding these common traps is absolutely critical if you want this to succeed long-term.

The single biggest misstep is treating emissions tracking as just a compliance chore. If the data is collected, put into a report, and then filed away in the sustainability department, you've completely missed the point. Real value is unlocked when you integrate these insights into the core of your business—informing risk management, credit analysis, and even new product development.

Another classic pitfall is underestimating the data management side of things right from the start. If you don't have a clear data governance framework and a central system, you’ll end up with a house of cards built on messy spreadsheets and manual errors. It's a recipe for disaster when the auditors come knocking.

Finally, don’t fall into the "one-and-done" trap. This isn't a project you finish. It’s a continuous process. Methodologies will get better, data quality will improve, and your own business priorities will change. You have to be ready to adapt and refine your approach over time.

Ready to move beyond spreadsheets and build a truly strategic, audit-ready emissions tracking programme? Carbonpunk’s AI-driven platform automates data collection, delivers powerful analytics, and generates compliant reports, turning your climate data into a competitive advantage. Discover a smarter way to manage your financed emissions by exploring our solutions.