A Guide to Renewable Energy Certificates (RECs) Reporting

Karel Maly

September 29, 2025

So, you’re diving into the world of Renewable Energy Certificates (RECs), but what does it actually mean to report them? Think of it as the final, crucial step that turns your green energy purchase into a legitimate, verifiable sustainability claim.

It’s all about documenting, tracking, and ultimately retiring the RECs you’ve acquired. This process proves your organisation’s energy use is backed by real, clean power generation. Without it, you’re just holding a certificate; with it, you’re demonstrating transparent, compliant environmental action. For any company serious about its public commitments to renewable energy, getting this right is non-negotiable.

Getting to Grips With Your REC Reporting Obligations

Before we get into the nitty-gritty, let’s make sure we’re on the same page about why this matters so much. A REC is essentially a birth certificate for one megawatt-hour (MWh) of renewable electricity. It holds all the key details: where the power came from, when it was generated, and what technology was used. When you buy that REC, you’re buying the exclusive right to claim that specific MWh of clean energy.

But just purchasing the certificate doesn't cut it. The formal process of renewable energy certificates (RECs) reporting is what makes your claim valid. This journey ends with the retirement of the REC, which takes it out of circulation for good. This prevents double-counting—the cardinal sin of renewable energy claims—and ensures no one else can claim credit for the same MWh. It’s the only way to make a credible environmental assertion.

Playing By The Rules: The Role of Reporting Standards

Your entire reporting strategy will be guided by established frameworks. These standards aren't just suggestions; they are the rulebook for making credible claims and ensuring your efforts are comparable and understood across your industry.

You’ll want to get familiar with a few key players:

- The GHG Protocol Scope 2 Guidance: This is the gold standard for corporate greenhouse gas accounting. It dictates how companies must report emissions from purchased electricity, explaining the difference between location-based and the all-important market-based methods, which is where RECs come in.

- RE100: This is a global initiative for influential businesses committed to sourcing 100% renewable electricity. RE100 has very specific technical criteria for what counts as a legitimate renewable energy purchase and how you can claim it.

Sticking to these standards isn’t just about ticking a compliance box. It’s about building trust with everyone from investors and customers to regulators. This structured approach is a cornerstone of any serious corporate sustainability programme. You can see how this fits into the broader context in our guide to ESG reporting.

Why The Local Picture Is So Important

The demand for solid REC reporting is also heating up due to national and regional energy policies. Take the Czech Republic, for instance. In 2023, the country's energy mix was still heavily reliant on fossil fuels and nuclear power, with renewables only making up about 17%.

With EU climate targets and legislative pressure pushing for faster decarbonisation, precise REC tracking has become essential for businesses operating here. It’s the mechanism that allows them to meet their obligations and prove they are part of the solution.

In the end, meticulous REC reporting is what transforms a simple purchase into a concrete, verifiable environmental action. It creates the auditable trail that links your company’s electricity bill directly to a specific megawatt-hour of clean energy—a trail that will stand up to any scrutiny.

Building a Framework for Data Collection

Solid reporting on your renewable energy certificates (RECs) doesn’t just happen when you sit down to write the report. The real work begins much earlier, with a rock-solid, organised system for capturing every bit of crucial data from the moment a REC enters your portfolio. If you don't get this framework right from the start, you’re setting yourself up for headaches and potential errors down the line.

The aim is to create a complete, auditable trail for every single certificate. This isn’t just about counting how many RECs you have; it’s about documenting the details that give each one its value and prove its compliance. Think of it as building a comprehensive file for every megawatt-hour (MWh) of clean energy you claim.

Identifying Your Must-Have Data Points

Whatever system you use—whether it's a dedicated software platform or just a very well-managed spreadsheet—it absolutely has to capture a few key pieces of information for every REC. Miss just one, and you could face a major snag during an audit.

Here’s the essential checklist you can't skip:

- Unique Certificate ID Number: This is the non-negotiable serial number. It’s what proves each REC is a distinct asset and stops any chance of it being double-counted.

- Generation Facility Details: You need the specifics: the name of the power plant, its location, and what technology it uses (e.g., wind, solar, hydro).

- Generation Date (Vintage): The exact month and year the MWh was generated is critical. This is how you match the REC to your energy consumption period.

- Issuing Registry: You must document which official registry issued the certificate, like the Czech OTE.

- Ownership and Transfer History: Keep a crystal-clear log of when the REC was officially transferred into your account.

This kind of structured data is fundamental to building a reliable reporting framework.

The organised layout shown here is exactly what you should be aiming for. When your REC data is this tidy, you can be confident that every detail is accounted for when it’s time to report.

Choosing Your Data Management Tools

The right tool for the job really depends on your scale. If you're a company that only handles a small number of RECs each year, a meticulously organised spreadsheet can actually work just fine. You can set up columns for all the data points we just covered and simply update it as you go.

But what happens when you’re managing hundreds, or even thousands, of RECs from different sources? That manual spreadsheet quickly becomes a massive liability. The risk of human error goes way up, and the time spent on data entry becomes a real drain. This is the point where investing in a dedicated Energy Management System (EMS) or a specialised carbon accounting platform starts to make a lot of sense.

The real advantage of a dedicated system is its power to automate data entry and verification. It can link directly with registries, pull in certificate data automatically, and flag any oddities long before they turn into a reporting crisis.

For instance, a good EMS can instantly check that a REC’s vintage is valid for your reporting year. That's a simple but crucial check that's surprisingly easy to overlook when you're staring at rows and rows of data in a spreadsheet. This kind of proactive data management is what separates mediocre renewable energy certificates (RECs) reporting from great reporting.

Ultimately, shifting towards automation isn't just about being more efficient; it's about being more accurate. To see how these ideas work in a broader context, you can explore how businesses are using carbon data automation to boost efficiency. A proper framework guarantees your data is always clean, complete, and ready for any scrutiny that comes its way.

Working with REC Tracking and Registry Systems

With your data collection process sorted, it’s time to get hands-on with the platforms where RECs are actually created, traded, and retired. These REC tracking and registry systems are the official digital ledgers that maintain the integrity of the entire renewable energy market. Without them, the same megawatt-hour of green energy could be claimed over and over again.

Think of a REC registry as the central bank for renewable energy claims. Every single certificate gets a unique serial number and is meticulously tracked from the moment it’s generated to its final retirement. If you’re operating in Europe, you’ll typically be dealing with national or regional registries. In the Czech Republic, for example, the main registry is managed by OTE, the national electricity and gas market operator.

Navigating a REC Registry Platform

Getting set up on a platform like OTE means creating an account, which essentially becomes your digital wallet for holding and managing RECs. The process is usually quite direct, but you need to be precise. These platforms are built for compliance and accuracy, not for a slick user experience.

You'll find yourself using a few core functions regularly:

- Receiving Transfers: When you buy RECs, the seller initiates a transfer to your account. You have to log in and formally accept it to take ownership.

- Retiring Certificates: This is the most crucial step for reporting. When you "retire" a REC, you are officially claiming its environmental benefit, permanently taking it out of circulation so no one else can use it.

- Generating Reports: Registries have tools that let you generate statements of your holdings and retirement activity. These documents are your primary evidence for sustainability reports.

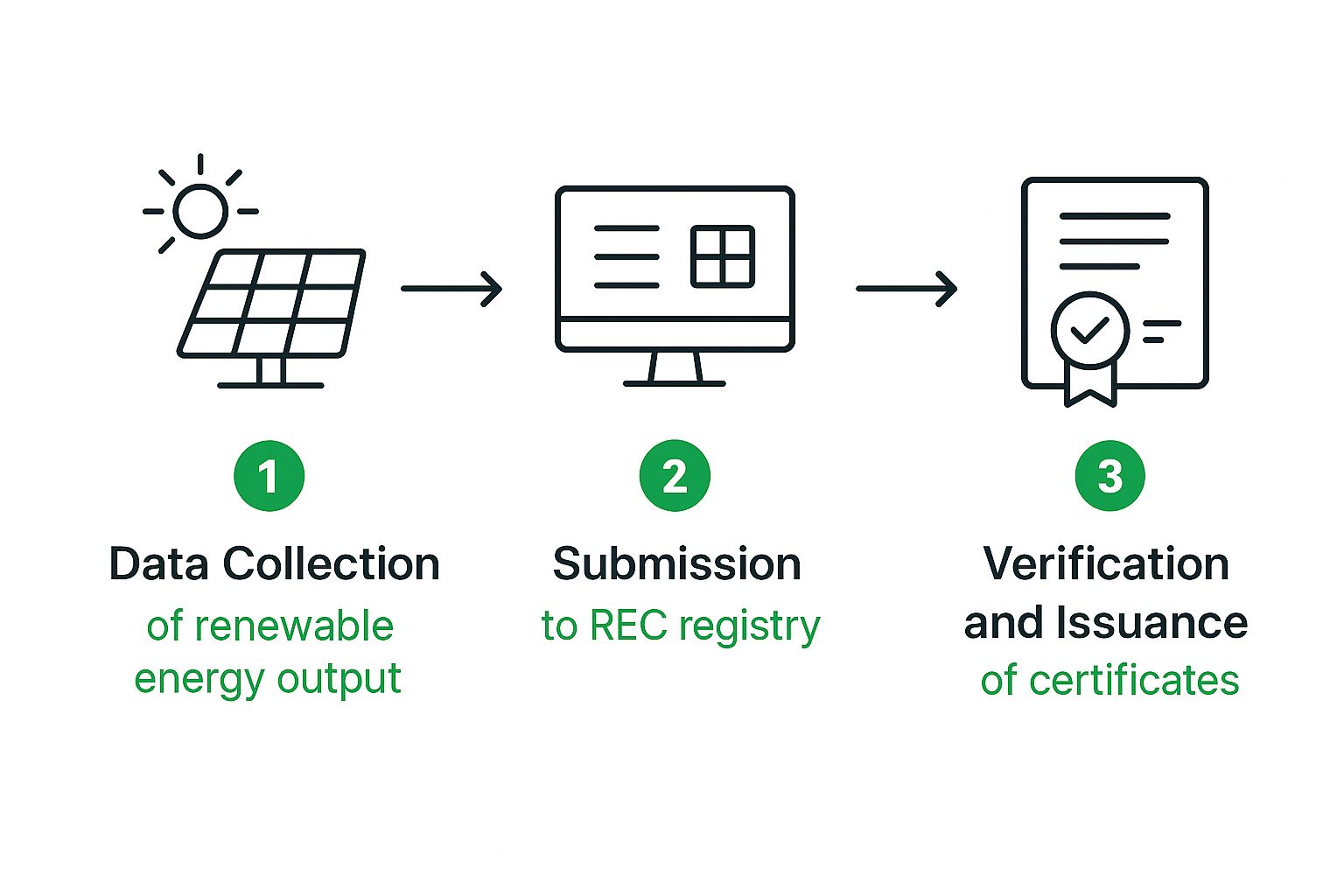

This is how raw generation data gets transformed into a verifiable certificate that has real authority and value.

The entire process, from data collection to official issuance, is what underpins a REC’s credibility.

A Practical Scenario Unpacked

Let’s walk through a real-world example. Imagine a manufacturing firm in Brno needs to offset its annual electricity consumption. They purchase enough RECs from a Czech solar farm to cover their usage.

The firm's sustainability manager then logs into their OTE account. There, they’ll see a pending transfer of 1,000 RECs, with each one representing one MWh of solar power.

After confirming all the details are correct—the generation date, the facility’s name, and the unique serial numbers—they accept the transfer. To finalise the claim for that reporting year, they select all 1,000 certificates and use the "retire" function. The system then produces a retirement statement, a simple PDF that serves as indisputable proof for their annual ESG report.

Insider Tip: A classic mistake I see all the time is retiring RECs in the wrong reporting period. Always, always double-check that the certificate's generation vintage matches the consumption period you’re claiming it for. A simple mismatch can invalidate your entire claim during an audit.

Choosing Your REC Management Approach

How you manage this process can vary a lot, from old-school spreadsheets to sophisticated software. It really depends on the scale of your operations and how many certificates you're handling.

Let's break down the common methods.

Comparison of REC Management Approaches

A look at different methods for managing and tracking Renewable Energy Certificates, from manual processes to fully automated platforms.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Manual (Spreadsheets) | Small businesses with low REC volume (fewer than 50 per year). | Low cost, simple to set up. | Highly error-prone, time-consuming, difficult to scale. |

| Broker-Managed | Companies new to RECs or those without dedicated staff. | Expert guidance, market access. | Higher costs, less direct control over transactions. |

| REC Management Software | Medium to large enterprises with regular reporting needs. | Automation, compliance checks, centralisation. | Subscription fees, requires implementation and training. |

| Full ERP Integration | Large corporations with complex, multi-national energy needs. | Seamless data flow, real-time tracking, strategic insights. | Significant investment in cost and time to implement. |

Ultimately, the goal is to find a system that gives you confidence in your data and simplifies your reporting obligations, letting you focus on your broader sustainability strategy.

The growth in the Czech renewable sector really highlights why efficient REC management is so critical. By the end of 2021, the country's installed renewable capacity reached 4,415 MW, with solar power accounting for more than half. This expansion means more and more RECs are flowing through the system, making transparent renewable energy certificates (RECs) reporting more important than ever.

For a look at a similar system that tracks and incentivises renewable generation, it's worth understanding the Renewable Heat Incentive (RHI) Tariff Guarantee. While focused on heat, its framework offers useful parallels for anyone managing environmental commodities.

From Purchase to Proof: How to Validate and Retire Your RECs

So, you've purchased a Renewable Energy Certificate (REC). That's a great first step, but it's not the end of the story. To make a genuine, credible claim about your renewable energy use, you have to formally retire it. This is the single most critical action in your entire reporting process, as it permanently takes that specific certificate out of circulation.

Think of it like this: when you buy a concert ticket, you haven't seen the show yet. When the ticket taker scans and tears it, it's used. It can't be used again. Retiring a REC does the same thing—it assigns the environmental benefit of that clean energy exclusively to your company, ensuring no one else can claim credit for the same megawatt-hour (MWh). This final, decisive step is what makes your sustainability claims bulletproof and ready for any audit.

How REC Retirement Actually Works

The whole process happens directly within a REC registry. If you're operating in the Czech Republic, for example, you'd be using the OTE system. Once you log into your account, you simply select the specific certificates you want to claim and execute the "retire" command.

Almost immediately, the system will generate a retirement statement or some form of certificate of proof. This document is your golden ticket for reporting.

You'll want to file it away safely, as it contains all the essential details:

- Your organisation’s name listed as the official beneficiary.

- The unique serial numbers of every single REC you retired.

- The exact date of retirement.

This official record is non-negotiable. It's the hard evidence you need to prove you have legitimately claimed the environmental attributes from that specific batch of renewable energy.

A Quick Sanity Check Before You Retire

Hold on before you click that final button. A few quick checks are absolutely essential to avoid headaches down the line. First, look at the REC’s generation vintage—the year and month it was produced. Does it line up with the electricity consumption period you're reporting on? A very common mistake is trying to claim a 2024 REC against your 2023 energy usage, which can get your claim flagged under standards like the GHG Protocol.

Next, double-check the facility details and technology type. Do they match what you intended to buy? Getting these details right is crucial for accurate reporting. To really nail this, understanding essential data validation techniques is a massive help. These practices help you spot small discrepancies before they snowball into big reporting problems.

The biggest pitfall in the REC world is, without a doubt, double counting. This is when the environmental benefit from a single REC is claimed by more than one company. Your only defence is a diligent, well-documented retirement and validation process.

At the end of the day, the integrity of your claim boils down to one simple fact: proving that each REC was used once, and only once, by you.

This core principle of tracking and retiring unique environmental assets isn't limited to RECs. You'll find similar mechanics in other markets. For anyone curious about the broader context, seeing how carbon offset marketplaces function provides some valuable parallels. We cover this in our detailed explanation of carbon offset marketplaces.

By truly mastering the retirement and validation process, you elevate your REC purchases from a simple transaction to a powerful, defensible statement about your commitment to sustainability.

Compiling and Disclosing Your REC Data

You’ve organised the data and retired the certificates. Now comes the crucial final step: telling your story. Transparent disclosure is what transforms all that behind-the-scenes work on REC management into a powerful narrative for your stakeholders. This is your chance to translate technical actions into a clear message for sustainability reports, corporate social responsibility (CSR) filings, and compliance documents.

The aim here is to present your renewable energy certificates (RECs) reporting in a way that’s both compelling and easy to digest. You're not just throwing numbers on a page; you're proving a genuine commitment to clean energy. This means getting specific and providing the details that build trust with investors, customers, and regulators.

Crafting a Transparent Disclosure Statement

Your disclosure needs to be direct, concise, and packed with the right details to meet best practices. Essentially, you want to answer the important questions before anyone even has to ask. These days, vague claims like "we support renewable energy" just don't cut it. People expect the specifics.

To make sure your report is rock-solid, it must include these core elements:

- Total MWh Claimed: State the exact amount of electricity consumption, in megawatt-hours, that you’ve matched with retired RECs.

- Technology and Origin Breakdown: Detail where the energy came from. For example, specify if it was 60% solar and 40% wind, and mention the geographical location of the facilities.

- Clear Retirement Statement: This is non-negotiable. Explicitly state that the RECs have been retired in a recognised registry and cannot be sold, traded, or used again.

Following this structure aligns your claims with leading frameworks like the GHG Protocol Scope 2 Guidance, which gives them real credibility.

Sample Language for Your Report

Pulling this all together can feel a bit overwhelming, but you don't need to reinvent the wheel. The key is to use clear and direct language that leaves no room for doubt.

Here’s a practical example of what a solid disclosure statement could look like:

In the 2024 reporting period, [Your Company Name] matched 100% of its electricity consumption, totalling 5,000 MWh, with Renewable Energy Certificates. These certificates were sourced from wind (3,000 MWh) and solar (2,000 MWh) facilities located within the Czech Republic. All 5,000 RECs have been permanently retired on our behalf in the OTE registry to substantiate this claim.

This wording is unambiguous. It provides the auditable details that make for robust, trustworthy reporting.

The landscape for renewable energy certificates (RECs) reporting in the Czech Republic is constantly shifting. After a solar boom from 2009-2011 hit a wall with subsidy cuts, interest has picked up again since 2018. This revival, pushed by initiatives like RES+, has strengthened the REC market as the country works to meet its EU commitments. For a deeper dive, you can get more insights into the Czech solar market outlook from Renewable Market Watch.

By presenting your data with this level of clarity, you successfully turn your REC activities into a verifiable cornerstone of your sustainability story.

Common Questions About REC Reporting

Diving into the world of Renewable Energy Certificate (REC) reporting can feel like learning a new language, and a few common questions pop up time and again. Getting these sorted is the key to making sure your claims are not just accurate, but totally credible. Let's clear up some of the usual sticking points so you can move forward with confidence.

One of the first things people grapple with is the jargon. You'll constantly hear about "bundled" versus "unbundled" RECs, and the difference really shapes how you'll buy and report them.

A bundled REC is pretty straightforward: it’s sold along with the actual electricity generated by a renewable project. You can think of it like a package deal, often what you get when you sign up for a green tariff with your utility. On the other hand, an unbundled REC is sold completely separately from the power itself. This gives you the freedom to buy your electricity from the grid as you normally would, and then purchase RECs from a different project to offset that consumption. While unbundled RECs offer a lot more flexibility, they also demand rigorous tracking to get it right.

Can I Use RECs From Different Countries?

This is a big one. People often ask if they can buy RECs from a project in another country to cover their local energy use. The short answer? It really depends on the specific rules you're reporting under.

If you’re following the GHG Protocol's market-based method for Scope 2 emissions, for instance, the guidelines are quite specific. Generally, the rule of thumb is that the RECs must originate from the same electricity market where your energy consumption happens. For a company in Europe, this typically means the interconnected European grid.

But be careful—some voluntary programmes or even national laws can have much tighter "geographical proximity" requirements, insisting the renewable project be in the same country or even the same region.

The single most important thing you can do is check the rulebook for your specific reporting standard before you buy international RECs. Sourcing an invalid REC can unravel your entire claim, so this initial due diligence is absolutely non-negotiable.

How Do I Avoid Double Counting RECs?

And now for the cardinal sin of REC reporting: double counting. This is what happens when the environmental benefit from a single megawatt-hour (MWh) of green energy gets claimed by more than one company. It’s a serious problem that can completely undermine the integrity of the whole system.

Fortunately, the primary safeguard against this is simple, but it has to be followed without exception: every single REC you claim must be officially retired in a recognised tracking registry.

Retiring a REC accomplishes two critical things:

- It permanently takes the certificate out of circulation. Once it's retired, it can never be sold or used again.

- It assigns that unique environmental attribute directly to your organisation, creating a clear, auditable paper trail.

Bottom line: never, ever make a renewable energy claim based on certificates that are still active or sitting in someone else's account. Always insist that your supplier provides a formal retirement statement or certificate as definitive proof.

Ready to move beyond spreadsheets and ensure your REC reporting is always audit-ready? Carbonpunk's AI-driven platform automates the entire process, from data validation to generating compliant reports, giving you complete confidence in your sustainability claims. Learn more at https://www.carbonpunk.ai/en.