Carbon Removal Credits vs Offsets A Guide for Leaders

Karel Maly

September 25, 2025

The real difference boils down to this: carbon removal credits are about actively cleaning up CO₂ that’s already in the atmosphere, while traditional carbon offsets are about preventing or reducing future emissions.

It’s like the difference between mopping up a spilt drink and trying not to knock it over in the first place. This distinction is absolutely critical for building a climate strategy that holds up to scrutiny.

Understanding the Core Difference

To really get to grips with corporate climate action, you first need to understand the distinct roles carbon removal credits and offsets play. While both are tools for tackling greenhouse gas emissions, their mechanics and their ultimate impact on the atmosphere are poles apart. Getting this right is the first step in creating a transparent and effective net-zero plan.

A company's journey towards sustainability almost always starts with understanding its own impact. If you're just starting, check out our guide on how to calculate your business's carbon footprint.

What Are Carbon Offsets?

Carbon offsets, which you might also hear called avoidance or reduction credits, represent an action that stops one metric tonne of CO₂ from ever entering the atmosphere. These projects are all about avoiding emissions that would have happened otherwise.

Some common examples include:

- Renewable energy projects: Funding a new wind farm to replace an old coal-fired power plant.

- Avoided deforestation: Paying to protect a forest that was scheduled to be logged.

- Energy efficiency upgrades: Helping to install better insulation in buildings to cut down on heating fuel.

The central idea is counterfactual—you're measuring a hypothetical "what if" scenario against what actually happened. While these projects are valuable, this approach often faces tough questions about its verifiability and whether it truly neutralises a company's ongoing emissions.

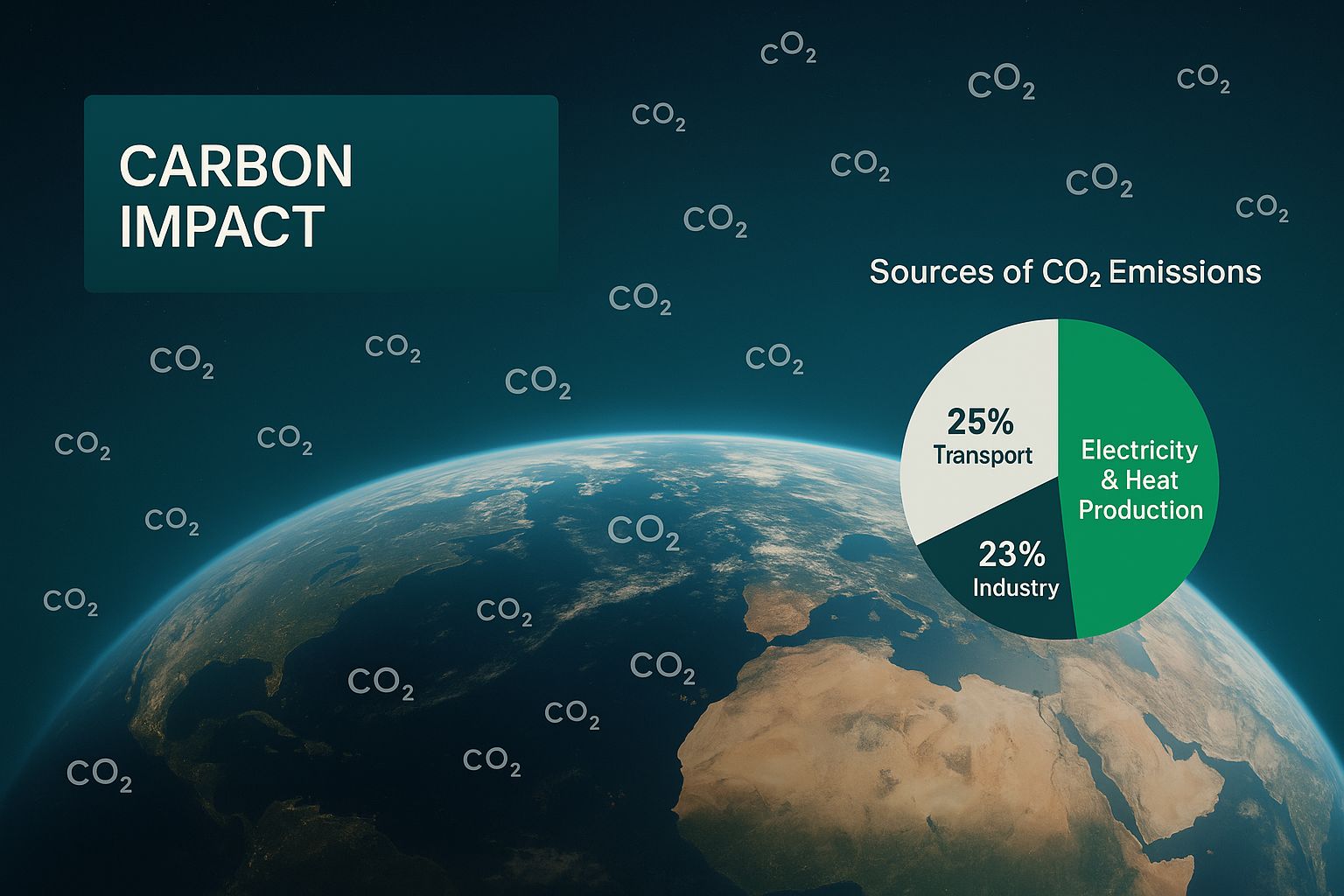

This infographic does a great job of visualising the flow of carbon in both scenarios. You can clearly see the direct impact of removals versus the preventative nature of offsets.

The image really drives home how removal credits directly tackle the legacy carbon already hanging around in our atmosphere—a vital piece of the puzzle for achieving any kind of long-term climate balance.

What Are Carbon Removal Credits?

On the other hand, carbon removal credits certify that one metric tonne of CO₂ has been physically pulled out of the atmosphere and stored away for the long term. This is a direct intervention designed to reverse emissions, not just stop new ones from happening.

Carbon removal is the only method that addresses historical and residual emissions, making it an indispensable tool for any organisation aiming for true net-zero.

This is a subtle but important point that's gaining traction. It’s not just about slowing the damage; it's about actively repairing it. Think of it as a necessary corrective action for the emissions we can't eliminate right now.

For a quick reference, here's a side-by-side comparison that lays out the key differences.

Quick Comparison: Carbon Removal Credits vs Offsets

| Attribute | Carbon Removal Credits | Carbon Offsets (Avoidance/Reduction) |

|---|---|---|

| Primary Goal | To physically remove existing CO₂ from the atmosphere. | To prevent or reduce future CO₂ emissions from occurring. |

| Climate Impact | Addresses historical and unavoidable emissions (corrective). | Addresses future potential emissions (preventative). |

| Analogy | Cleaning up an existing oil spill. | Preventing an oil tanker from leaking in the first place. |

| Typical Projects | Direct air capture, biochar, afforestation, enhanced weathering. | Renewable energy, avoided deforestation, methane capture. |

| Permanence | Often higher, especially with technological solutions (1,000+ years). | Variable and can be harder to guarantee (e.g., forest fire risk). |

As you can see, while both have a place, their functions are fundamentally different. Carbon removal is about taking carbon out, while offsets are about not putting it in. Understanding which one to use, and when, is key to a robust climate strategy.

A Look Under the Bonnet: Methodologies and Real-World Impact

To get to the heart of the carbon removal credits vs offsets debate, you have to look past the labels and examine the projects on the ground. The real difference isn't just in the name; it's in the application, the scientific backing, and the actual, lasting benefit to our climate. One pulls carbon out of the air, the other stops it from getting there in the first place.

Carbon removal credits come from projects designed to physically draw down and lock away CO₂ that’s already in the atmosphere. These fall into two main camps: nature-based solutions and engineered technology, each with its own set of realities.

On the other side of the coin, carbon offset projects are all about avoidance. They fund activities that offer a cleaner alternative to what would have happened otherwise, preventing new emissions from ever entering the atmosphere.

How Carbon Removal Actually Works

Technological carbon removal is a direct, engineered approach to cleaning up the air. A leading example is Direct Air Capture (DAC), which uses massive fans to pull air through filters that trap CO₂ molecules. Once captured, this CO₂ is typically pumped deep underground and stored permanently in stable geological formations.

Another powerful method is biochar production. This process takes biomass, like leftover farm waste, and heats it in a low-oxygen chamber, creating a stable, carbon-dense charcoal. This biochar is then worked into the soil, where it can lock carbon away for centuries while simultaneously boosting soil fertility.

Of course, nature-based solutions are just as vital:

- Afforestation and Reforestation: This is the classic approach of planting new forests or restoring degraded ones. As trees grow, they absorb CO₂ through photosynthesis, storing it in their trunks, roots, and the surrounding soil.

- Enhanced Weathering: This fascinating process gives a natural geological cycle a helping hand. It involves spreading finely crushed silicate rocks, like basalt, over farmland. As these rocks slowly dissolve, they react with CO₂ in the atmosphere and trap it as stable carbonate minerals within the soil.

These removal methods are gaining traction because they offer a high degree of measurability and the promise of long-term, verifiable storage—exactly what's needed to neutralise those stubborn, hard-to-abate emissions.

The World of Carbon Offset Projects

Carbon offset projects work on a completely different principle: avoidance. Think of renewable energy projects in regions powered by coal. Funding a new wind or solar farm generates carbon credits equivalent to the emissions that were avoided by not burning fossil fuels.

Another major category is avoided deforestation, often under the banner of REDD+ (Reducing Emissions from Deforestation and forest Degradation). These initiatives protect existing, at-risk forests, preventing the release of the massive stores of carbon they hold.

The persistent challenge with avoidance offsets is proving additionality. You have to be certain that the project—the wind farm, the forest protection—would not have gone ahead without the money from the carbon credit sale. This is a tough counterfactual to prove with 100% confidence.

The Make-or-Break Factors: Permanence and Leakage

When you’re weighing the climate impact of carbon removal credits vs offsets, two concepts are non-negotiable: permanence and leakage. Permanence is simply how long the carbon is kept out of the atmosphere.

This is where the difference becomes stark. Technological removals like DAC coupled with geological storage offer incredible permanence, locking CO₂ away for over 10,000 years. Nature-based removals like forests are also great, but they're vulnerable to risks like wildfires, disease, or illegal logging, which could send all that stored carbon straight back into the air. Avoidance offsets don’t store carbon at all, so permanence isn't quite the right word, but the long-term viability of the project is just as crucial.

Leakage is the other big headache, mostly for avoidance projects. It happens when reducing emissions in one spot inadvertently pushes them up somewhere else. For example, if you protect one patch of forest from being logged, the logging operation might just move to an unprotected forest next door. The net result for the climate? Zero.

This deeper dive shows why high-quality carbon removal is becoming non-negotiable. For context, even with ambitious climate policies, Czechia’s National Energy and Climate Plan forecasts 6.3 million tonnes of residual CO₂ emissions by 2050. To reach true net-zero, every last tonne of those emissions will need to be neutralised with permanent carbon removal. You can learn more about these national climate strategies and what they mean for businesses.

Getting to Grips with the Market and Regulations

Diving into carbon credits means stepping into a complex world of different rules, standards, and market dynamics. The first thing to understand is the split between the compliance market and the voluntary carbon market (VCM), as this really sets the stage for whether you're looking at carbon removal credits or offsets. Each market operates under its own distinct framework, which dictates which instruments are in play and where.

The compliance market is all about regulation. Think of big schemes like the EU Emissions Trading System (EU ETS), where certain industries are legally required to cut their emissions. Participation isn't optional. On the other hand, the voluntary carbon market is where companies choose to buy credits to hit their own climate targets. This is usually driven by a sense of corporate responsibility, pressure from investors, or customer demand. It's in the VCM where most of the innovation and activity around both removals and offsets is happening right now.

Who Decides What's a "Good" Credit?

For the VCM to have any credibility, the credits need to be trustworthy. That's where third-party verification bodies come in. Groups like Verra and Gold Standard are the gatekeepers; they create the rulebooks and certify that a project genuinely delivers measurable and lasting climate benefits. They're looking for proof of key things like additionality (would this have happened anyway?), permanence, and leakage prevention.

While they share a common goal, their approaches and the projects they certify can be quite different:

- Verra’s Verified Carbon Standard (VCS) is the biggest player on the field. It’s the most widely used programme globally and covers everything from traditional avoidance offsets (like forest protection through REDD+) to the latest removal technologies.

- Gold Standard is often seen as the more rigorous of the two. They place a huge emphasis on projects that don't just reduce carbon but also bring tangible benefits to local communities and the environment.

As businesses get more sophisticated with their climate strategies, we're seeing a clear shift from simply buying the cheapest credits to demanding high-quality ones. Companies are now looking much more closely at the integrity of what they’re buying, steering clear of dodgy offsets in favour of credits that will stand up to scrutiny.

The Big Swing Towards High-Integrity Removals

There's a major market shift happening, and a lot of the momentum is coming from influential groups like the Science Based Targets initiative (SBTi). The SBTi's guidance is fast becoming the benchmark for what a credible corporate net-zero claim looks like, and it draws a very clear line in the sand. It says that traditional offsets are fine for compensating for emissions beyond your direct value chain, but only permanent carbon removals can be used to neutralise those last, stubborn emissions to claim you've truly reached net-zero.

This guidance is completely changing what companies are buying. It's a clear signal that while offsets might have a role to play for now, high-quality, permanent carbon removal credits are the only scientifically sound way to get to a credible net-zero finish line.

This has lit a fire under the demand for durable removal solutions like direct air capture (DAC) and biochar, even though they come with a higher price tag. Businesses are realising that buying these credits isn't just an expense; it's an investment in their reputation and a way to future-proof their climate strategy against tougher standards down the road. To manage this transition, you need solid tools, and it's worth taking a look at https://www.carbonpunk.ai/en/blog/explore-the-best-carbon-offset-reporting-platform-options to make sure your data is transparent and ready for any audit.

How Local Rules Shape the Game

You can't ignore the impact of national and regional policies. These regulations can either spark innovation or stifle certain types of projects, which directly affects what's available on the market. The Czech Republic offers a perfect example of how local rules create unique challenges and opportunities.

Unlike some countries that are all-in on geological carbon storage, CZ currently prohibits storage of more than 1 Mt CO₂, which puts a cap on CCS-based removal projects. This legal landscape naturally puts more weight on nature-based carbon removal credits instead of traditional offsets. We're expecting a policy update that will hopefully clarify and strengthen the country's carbon removal targets and how they fit into the national net-zero plan. You can read more about Czech Republic’s climate policy on zerotracker.net. Understanding this local context is absolutely crucial when buying credits, as it determines which projects are even possible.

Analysing Costs and Long-Term Investment Value

When it comes to carbon credits, the conversation often gets stuck on the price tag. But a smart investment strategy looks past the immediate sticker shock to weigh up long-term value, risk, and how it all fits into the bigger picture. The price gap between a removal credit and an offset isn't random; it reflects a world of difference in technology, permanence, and market maturity.

Right now, technological carbon removal credits are pricey, often running into hundreds of euros per tonne. That cost comes from the massive capital, energy, and R&D needed to get something like a Direct Air Capture (DAC) facility off the ground. These are complex industrial processes just beginning to scale, and that early-stage development doesn't come cheap.

On the other hand, you can find traditional avoidance offsets for a fraction of that price. Projects supporting renewable energy or preventing deforestation have been around longer and generally have lower running costs. While the low price is tempting, it can hide serious risks around quality and whether the emission reduction is real and permanent. A cheap offset today could easily turn into a reputational headache tomorrow if it's exposed as ineffective.

Looking Beyond Price to Real Value

The real financial question isn't just about price, but what you get for your money. A low-cost offset might look like a win for this quarter's budget, but it could become a liability as soon as next year. With regulators and the public watching more closely, low-quality credits are being called out, wiping out their value and damaging corporate climate claims.

Investing in high-quality, permanent carbon removal isn't just an expense; it's an investment in your company's credibility. It shows you're aligning your climate action with scientific reality and building a strategy that will stand up to the tougher regulations we all know are coming.

This simple shift in thinking changes the whole dynamic. The money spent moves from the 'operational cost' column to the 'strategic investment' column—an investment in brand integrity, investor confidence, and a net-zero strategy that can actually be defended.

Building a Carbon Portfolio for the Future

For most businesses, the smartest path forward is building a balanced portfolio. This approach is pragmatic, acknowledging today's budget realities while actively preparing for the climate demands of tomorrow. It usually means continuing to use high-integrity avoidance offsets for immediate goals while steadily increasing your investment in permanent carbon removals over time.

This phased strategy allows a company to:

- Manage costs now by using carefully vetted, more affordable offsets for compensation targets.

- Help scale new technologies by dedicating part of the budget to promising removal projects, which in turn helps bring their future costs down for everyone.

- Stay ahead of evolving standards, like those from the Science Based Targets initiative (SBTi), which are already stating that only permanent removals can be used to neutralise residual emissions for a credible net-zero claim.

This long-term view is critical, especially when you look at local environmental challenges. Here in the Czech Republic, for example, our forestry and land-use sector recently became a net emitter of around 15 Mt CO2e. A huge part of that was due to bark beetle infestations damaging our forests and weakening their ability to absorb carbon. The government's response is to push new forestry programmes to build more resilient ecosystems, a clear sign that the focus is shifting towards durable, nature-based removals. You can find more detail on Czech climate initiatives on zerotracker.net.

Ultimately, your financial analysis has to connect back to your core business strategy. The costs and benefits of your carbon credit portfolio are tangled up with your company's broader sustainability mission. By tracking these investments and their impact, you get a much clearer picture of the real financial upside of taking climate action seriously. You can dive deeper into the ROI of carbon footprint tracking for your business in our dedicated guide. The mark of a true financial leader today is building a portfolio that balances this year's budget with the non-negotiable climate targets of tomorrow.

Building a Credible Corporate Climate Strategy

Crafting a climate strategy that holds up under scrutiny is about more than just good intentions. It demands a clear, hierarchical approach that puts genuine decarbonisation first, long before you start talking about credits. The whole carbon removal credits vs offsets debate is central to this, but their roles are distinct and should never be confused.

A solid strategy always starts with one non-negotiable step: measuring your emissions baseline with accuracy. If you don't know where you're starting from, everything that follows is just guesswork. The second, and most important, phase is getting your own house in order through aggressive internal reduction. This means optimising operations, boosting energy efficiency, and tackling supply chain emissions head-on. Only after you've made real progress here should you even begin to consider external instruments like carbon credits.

The Mitigation Hierarchy in Action

There’s a simple but powerful framework for this called the mitigation hierarchy. It’s not about picking one tool over another; it's about using them in the right order.

- Measure Accurately: First, get a robust system in place to track your emissions across Scopes 1, 2, and 3. This is the bedrock of your entire strategy.

- Reduce Aggressively: Next, make operational changes to cut emissions at the source. This is the single most impactful climate action any business can take.

- Compensate with Caution (Offsets): For the emissions that remain while you're decarbonising, you can use high-integrity avoidance offsets as a temporary tool.

- Neutralise with Precision (Removals): Finally, for the last, hard-to-abate emissions, you must deploy permanent carbon removal credits to achieve a genuine state of net-zero.

Following this structure stops companies from falling into the common trap of using offsets as a licence to keep polluting. It correctly frames them as a transitional bridge, not the final destination.

A robust climate strategy is built on a foundation of deep, internal emissions reduction. Carbon credits are a complement to this effort, not a substitute for it. Relying on offsets without a serious plan to decarbonise is a direct path to accusations of greenwashing.

Positioning Offsets as a Transitional Tool

While the market is rightly shifting its focus towards removals, high-quality avoidance offsets still have a strategic part to play. This is especially true for companies just starting their climate journey. They offer a way to take immediate responsibility for today’s unavoidable emissions while the bigger, capital-intensive reduction projects get off the ground.

Think about a large manufacturing firm. It might take years to retool a factory or switch its entire vehicle fleet to electric. During that transition, the company can purchase verified offsets from, say, a renewable energy project to compensate for its ongoing operational emissions. This is a perfectly legitimate step, but only if it’s paired with a transparent and ambitious plan to decarbonise internally.

The key is to see these offsets as a temporary measure—a way to bridge the gap while the hard work of operational change is happening.

Framing Removals as the Net-Zero Endgame

As a company gets closer to its net-zero target, the emissions left over are the really tough ones. These are the residual emissions from processes that are technologically or financially impossible to eliminate right now—think of specific chemical reactions in manufacturing or the realities of long-haul aviation.

This is where carbon removal credits become absolutely essential. According to scientific bodies like the Science Based Targets initiative (SBTi), only permanent carbon removal can be used to neutralise these residual emissions and make a credible net-zero claim. An avoidance offset stops a tonne of CO₂ from being emitted in the first place, but a removal credit physically pulls a tonne of CO₂ out of the air that's already there. That distinction is crucial for achieving a true, balanced carbon ledger.

For example, an airline can reduce its footprint with more efficient aircraft and sustainable aviation fuels (SAFs), but some emissions will inevitably remain. To neutralise that final slice, the airline has to invest in carbon removal credits from projects like Direct Air Capture (DAC) or biochar, which verifiably pull that exact amount of CO₂ from the atmosphere and lock it away for good.

Situational Use Case Guide

Deciding which instrument to use, and when, is key to a credible climate strategy. This table breaks down the strategic thinking behind each choice based on your specific climate goals.

| Climate Goal | Recommended Instrument | Strategic Rationale |

|---|---|---|

| Immediate Compensation (Transitional) | High-Integrity Avoidance Offsets | Take responsibility for current, unavoidable emissions while actively implementing long-term reduction projects. |

| Beyond Value Chain Mitigation (Leadership) | Both Offsets and Removals | Fund climate action outside your direct value chain to accelerate global decarbonisation and support innovation. |

| Achieving True Net-Zero (Final Step) | Permanent Carbon Removal Credits | Neutralise the final, hard-to-abate residual emissions in alignment with scientific net-zero standards (e.g., SBTi). |

By strategically sequencing these tools, a company can build a climate strategy that is not just ambitious but also scientifically sound and resilient to stakeholder scrutiny. It shows a clear understanding of the difference between temporary compensation and permanent neutralisation—a distinction that matters more and more.

Frequently Asked Questions

When it comes to carbon removal credits versus offsets, business leaders often have a lot of questions. That’s perfectly understandable. Getting clear, straightforward answers is crucial for building a climate strategy that actually works and holds up to scrutiny. Here, we'll tackle some of the most common queries we hear from companies just like yours.

The easiest way to grasp the difference is with an analogy. Imagine the atmosphere is an overflowing bathtub. Carbon offsets are like turning down the tap—they slow the flow of new emissions into the air. Carbon removals, on the other hand, are like bailing water out of the tub—they actively clean up the carbon that's already there.

Offsets focus on avoiding future emissions, while removals are all about cleaning up existing atmospheric carbon. This distinction is absolutely critical for anyone serious about achieving genuine climate balance.

Can a Company Use Both Offsets and Removal Credits?

Yes, absolutely. In fact, most well-designed climate strategies depend on using both. The best approach is to build a hybrid portfolio that changes over time, all while sticking to the golden rule: reduce your own emissions first.

A smart strategy usually looks something like this:

- Near-Term Action: You can use high-quality avoidance offsets to take responsibility for today's unavoidable emissions right away. Think of this as a bridge while you get your more complex, long-term decarbonisation projects off the ground.

- Long-Term Neutralisation: At the same time, you should start investing in permanent carbon removal credits. This not only helps scale up the critical technologies we need but also prepares your company to meet the much tougher net-zero standards of the future.

This dual approach lets you manage your costs today while making sure your climate claims are solid for tomorrow. Over time, the balance of your portfolio should shift, with permanent removals making up a larger and larger share as you get closer to your net-zero target.

The real aim is to move from a portfolio that relies mostly on avoidance offsets to one that is anchored in permanent removals. This shows you have a sophisticated grasp of climate science and are committed to reaching a true, scientifically-backed net-zero.

Why Are Carbon Removal Credits So Expensive?

It's true, there's a significant price gap between carbon removal credits and many traditional offsets. This difference really comes down to the technology involved, the permanence of the solution, and how rigorously it can be verified. While the cost is higher, you're paying for a much higher quality and more durable climate solution.

Three main things drive up the price:

- Technology Maturity: Many removal technologies, like Direct Air Capture (DAC), are still in their early days. The price reflects the huge R&D costs and capital needed to build these complex industrial plants. These are pioneering projects, and we expect their costs to come down as the industry scales.

- Guaranteed Permanence: You're paying a premium for the certainty that the captured carbon will stay locked away. Tech-based solutions that store CO₂ underground can guarantee permanence for 10,000+ years. That’s a level of security that many nature-based avoidance projects can't promise, given risks like wildfires or changes in land use.

- Rigorous Verification: The process to measure, report, and verify (MRV) the exact amount of CO₂ pulled from the atmosphere is incredibly precise. This scientific rigour leaves no room for doubt or guesswork, giving you complete confidence in the climate benefit you’re buying.

At the end of the day, the higher price of a carbon removal credit buys you certainty. It confirms that one tonne of CO₂ has been verifiably and permanently taken out of the atmosphere, directly neutralising one tonne of your own residual emissions. For any company making a credible net-zero claim, that's non-negotiable.

Ready to build a credible, data-driven climate strategy? Carbonpunk uses AI to automate emissions tracking across your supply chain, delivering audit-ready reports and actionable insights to accelerate your journey to net-zero. Discover how our platform can transform your carbon management at https://www.carbonpunk.ai/en.