Your Guide to Choosing an ESG SaaS Platform

Karel Maly

July 5, 2025

Think about your company's finances for a moment. Would you ever try to manage them with a jumble of disconnected spreadsheets? Of course not. Yet, that's exactly how many organisations are still handling their sustainability data. An ESG SaaS platform is the modern solution to this chaos, acting as a centralised, intelligent system for your environmental, social, and governance performance.

Why Your Business Needs an ESG SaaS Platform Now

The era of treating environmental, social, and governance (ESG) factors as a side project or a simple "nice-to-have" is definitively over. Especially for businesses in the Czech Republic and across Europe, the landscape is shifting fast. What were once voluntary good deeds are quickly becoming mandatory, legally-binding requirements, creating an urgent need for proper data management tools.

Trying to track emissions, supply chain ethics, and governance policies manually across countless spreadsheets isn't just inefficient anymore; it's a major business risk. This messy, ad-hoc approach is a recipe for inaccurate data, missed reporting deadlines, and an inability to make smart, timely decisions.

An ESG SaaS platform brings order to this complexity. It organises scattered data points into a clear, actionable picture of your company's sustainability performance, much like a good accounting system provides a reliable view of your financial health.

This isn't just about ticking boxes for regulators. It's a fundamental shift from reactive reporting to proactive, intelligent strategy. Instead of a last-minute scramble to pull together numbers for an annual report, a dedicated platform gives you real-time insights that can drive genuine operational improvements and even uncover new cost savings.

Moving Beyond Manual Mayhem

Let's be honest: relying on manual processes for ESG data is a headache waiting to happen. It’s painstakingly slow, riddled with human error, and simply doesn't scale as your business grows and regulations become more demanding. The main drawbacks are all too common:

- Inaccurate and Inconsistent Data: When information is pulled manually from different departments, it rarely lines up. This leads to reports that are unreliable at best and non-compliant at worst.

- Time-Consuming Data Collection: Your team could be spending hundreds of hours just chasing down information from various sources instead of focusing on high-value strategic work.

- A Complete Lack of Real-Time Visibility: By the time you’ve manually compiled a report, the data is already old news, making it useless for guiding day-to-day business decisions.

An ESG SaaS platform automates this entire process. It connects directly with your existing systems—from logistics software to HR platforms—and pulls in the data automatically. This ensures your information is always up-to-date, consistent, and ready for an audit at a moment's notice.

Turning Obligation into Opportunity

The right technology can transform a regulatory chore into a real strategic advantage. When you have a clear, accurate view of your environmental footprint, you can finally spot the inefficiencies hiding in your operations. Maybe you'll identify a carbon-heavy shipping route that could be optimised or realise that a specific supplier is a major risk. You can even explore how a specialised decarbonisation platform can boost your climate strategy and achieve real, measurable reductions.

Ultimately, an ESG SaaS platform is no longer a luxury investment. It has become a foundational tool for any modern business that wants to build resilience, ensure compliance, and achieve long-term growth in a world that now measures success by a lot more than just the bottom line.

Navigating Czech ESG Regulations and Deadlines

The days of treating ESG reporting as a nice-to-have are officially over. For any company operating in the Czech Republic, a wave of new regulations is shifting sustainability from a simple talking point to a concrete legal duty. This change makes having a solid ESG SaaS platform not just helpful, but essential for handling the intricate data and reporting now required.

At the heart of this shift are the European Sustainability Reporting Standards (ESRS). These aren't vague guidelines; they provide a detailed, mandatory framework for how businesses must report on their environmental, social, and governance impacts. And this isn't some far-off deadline. The rollout is happening in phases, with compliance dates looming for many Czech companies.

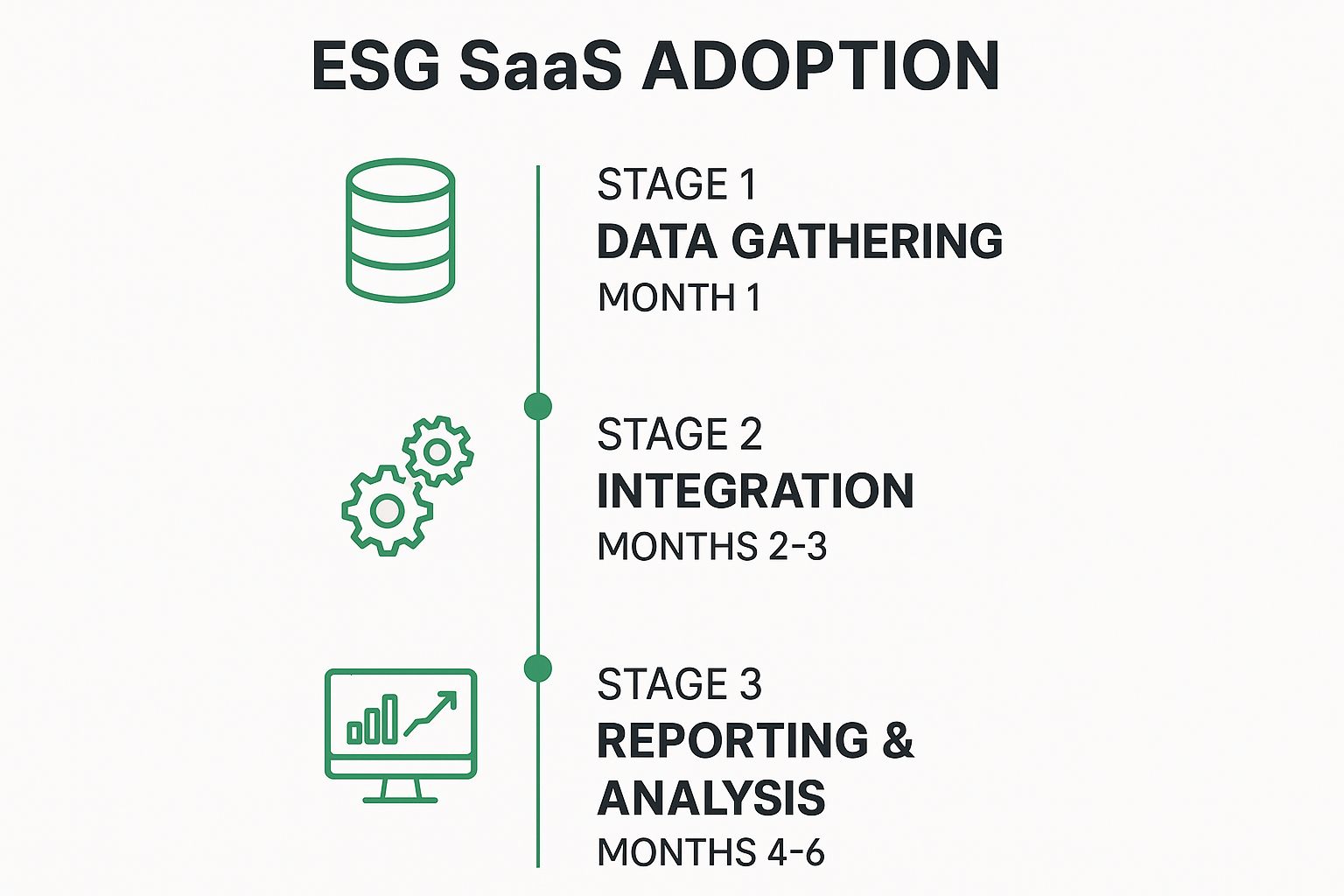

Think of getting ready for this as a journey. It starts with gathering your data, moves into implementing a system to manage it, and finally leads to strategic analysis and reporting.

As you can see, becoming report-ready with an ESG platform is a process. It takes planning and several months of work to get your data and systems aligned before the regulatory deadlines arrive. You don't want to be scrambling at the last minute.

So, Who Exactly Needs to Comply?

It’s a common misconception that these new rules are only for massive, publicly-listed corporations. The reality is that the mandate now covers a much broader range of businesses, including many small and medium-sized enterprises (SMEs) that are either listed on regulated markets or are critical suppliers to larger companies.

The message from regulators is crystal clear: if your business meets the criteria, preparing for mandatory ESG reporting is no longer a choice. It’s a core operational priority that needs a systematic approach to data management.

New legal frameworks are set to be fully in place by 2025, which will fundamentally change reporting duties. According to guidance from the Prague Stock Exchange, companies that meet certain thresholds—a balance sheet total over €20 million, net turnover exceeding €40 million, or more than 250 employees—will have to comply. You can find more specifics in the official ESG guidelines.

Even if your company doesn't directly hit these numbers, there's a good chance your major customers do. This creates a ripple effect, as they will need detailed ESG data from you to complete their own mandatory Scope 3 emissions reports.

Your Roadmap to Compliance

With all this new legal jargon, it’s easy to feel overwhelmed. To help simplify things, we've broken down the timeline into a clear roadmap. The table below outlines who needs to report and by when, turning complex regulations into a practical checklist.

ESRS Compliance Timeline for Czech Companies

| Fiscal Year for Reporting | Compliance Deadline | Affected Companies |

|---|---|---|

| 2024 | 2025 | Large, listed EU companies with over 500 employees, already subject to the Non-Financial Reporting Directive (NFRD). |

| 2025 | 2026 | All other large companies (listed or not) meeting two of three criteria: >250 employees, >€40M turnover, or >€20M in total assets. |

| 2026 | 2027 | Listed SMEs, small and non-complex credit institutions, and captive insurance undertakings. (SMEs have an opt-out option until 2028). |

This structured timeline helps you pinpoint exactly when your organisation needs to be ready. By planning your adoption of an ESG SaaS platform well in advance of these dates, you can avoid a last-minute rush and ensure your first mandatory report is accurate, complete, and fully compliant.

What to Look for in a Top ESG SaaS Platform

When you start looking at different ESG SaaS platforms, it’s easy to get lost in slick marketing promises. The real test, however, is what the software can actually do. There's a world of difference between a basic tool that just helps you tick a compliance box and a strategic one that actually improves your operations and gives you a competitive edge.

To help you cut through the noise, let's break down the must-have features across the three pillars of ESG. Think of this as your practical checklist for finding a solution that fits where your company is today and where you want it to be tomorrow. A genuinely powerful platform needs to deliver across all three areas.

The Environmental Pillar

This is where the data gets heavy, and frankly, where automation becomes your best friend. Trying to track environmental metrics manually is a recipe for slow, error-prone work. A top-tier platform absolutely has to offer:

-

Automated Carbon Accounting: The ability to automatically calculate your carbon footprint across Scope 1 (your direct emissions), Scope 2 (indirect emissions from energy you buy), and the notoriously complex Scope 3 (all other emissions in your value chain) is non-negotiable. This isn’t magic; it requires direct connections to your operational systems.

-

Resource Management Dashboards: You need to see your water, energy, and raw material consumption at a glance. Clear, visual dashboards are essential for spotting inefficiencies and, more importantly, finding opportunities to save money.

-

Waste and Circularity Tracking: The platform should do more than just measure what you throw away. It needs to help you monitor waste streams and track your progress toward circular economy goals, shifting your perspective from waste as a cost to waste as a potential resource.

The Social Pillar

The 'S' in ESG is all about your relationships—with your employees, your suppliers, your customers, and the communities you work in. The right software helps you put numbers to these often-qualitative areas. Key features to look for include:

-

Employee Wellbeing Analytics: You need the ability to track metrics like employee turnover, training hours logged, and health and safety incidents. This isn't just about reporting; it's about gathering the data you need to build a stronger, more resilient team.

-

Supply Chain Ethics Monitoring: This is huge. The software must have tools to assess and document the labour practices and human rights records of your suppliers. It’s a critical function for reducing risk and making sure your entire value chain lives up to your company's standards.

A truly effective ESG SaaS platform doesn't just collect data; it connects it. It shows you how a risk in your supply chain (Social) could impact your emissions targets (Environmental) and your brand reputation (Governance).

The Governance Pillar

Finally, the 'G' is the glue that holds your entire ESG strategy together. It’s all about being transparent, accountable, and ethically managed. You should be looking for a platform with solid governance tools built-in, such as:

-

Policy and Document Management: A single, central place to store, update, and share all your ESG-related policies and procedures. This ensures everyone is working from the same playbook.

-

Risk Assessment Frameworks: You need tools that help you identify, assess, and manage ESG-related risks. This can be anything from a sudden regulatory change to the physical risks posed by climate change.

-

Board-Ready Reporting: The platform must be able to generate customisable, audit-ready reports for different audiences, from regulators to your own board. This means being able to easily produce reports compliant with major standards like ESRS and GRI.

Of course. Here is the rewritten section with a more natural, human-written feel, following all your specific instructions.

The Strategic Value of ESG Beyond Compliance

Yes, meeting regulatory deadlines is a must, but that’s just the starting block, not the finish line. Thinking of an ESG SaaS platform as purely a compliance gadget is like owning a supercar and never taking it out of first gear. The real magic happens when you use its insights to create serious, long-term business value that goes way beyond just ticking boxes for an auditor.

Let's be clear: smart investors, valuable partners, and even the best employees now see strong ESG performance as a hallmark of a well-managed, forward-thinking company. A solid ESG strategy, backed by hard data from your platform, polishes your brand and makes you a far more appealing prospect for everyone, from customers to financiers. It sends a powerful signal that your organisation is serious about managing risk and building for the long haul.

The data your ESG SaaS platform gathers isn't just for filling out reports; it's a goldmine for strategic planning. It gives you a new way to look at your entire operation, uncovering opportunities you never knew existed.

For example, detailed emissions data might expose an inefficient delivery route, which, once optimised, saves you money on fuel and cuts your carbon footprint. Or, analysing your social metrics could reveal simple ways to improve employee satisfaction, reducing the high costs of recruitment and training. These aren't just feel-good sustainability wins; they're genuine financial victories that directly impact your bottom line.

From Risk Management to Profitable Growth

The insights your platform uncovers quickly become a powerful tool for getting ahead of the competition. When you can pinpoint and address risks in your supply chain—whether they’re environmental or social—you build a much stronger, more reliable business from the ground up. This kind of proactive management is exactly what investors want to see, because they know that today’s ESG risks are tomorrow’s financial headaches.

This shift in thinking is fuelling a sustained demand for these solutions. Here in the Czech Republic, the growing focus from regulators and investors is creating a real market for specialised ESG software. In fact, forecasts for Europe point to a strong compound annual growth rate (CAGR) of around 7.9% for ESG software between 2025 and 2035, showing just how widely these tools are being adopted. You can read more about the expanding European ESG software market on Market Research Future.

Ultimately, a well-executed ESG programme turns sustainability from a cost centre into a source of profitable growth. By using resources more efficiently, building stronger relationships with stakeholders, and making your business model resilient, you’re doing more than just following the rules—you’re building a more valuable and enduring company. To get a closer look at this process, check out our guide on corporate sustainability software for your complete ESG journey.

How to Select the Right ESG Software Solution

Choosing the right ESG SaaS platform can feel like a high-stakes decision, but with a clear evaluation process, it becomes much more manageable. The goal isn't just to tick a compliance box for today; it's about finding a partner that fits your budget, goals, and long-term vision.

For Czech SMEs, a cloud-based Software-as-a-Service (SaaS) model is often the most practical route. It sidesteps the need for huge upfront investments in servers or dedicated IT staff, offering a more flexible and affordable way in. This is what allows smaller companies to access the same powerful tools as their larger competitors without breaking the bank.

The market for these tools is booming. Valued at roughly USD 1.16 billion in 2024, the ESG software space is expected to surge to USD 3.17 billion by 2029. This explosive growth is a direct result of new mandatory disclosure rules and intense market pressure. You can dive deeper into these figures in a comprehensive report on ESG reporting market trends.

Key Evaluation Criteria

When you start comparing platforms, you need to look past the shiny sales pitches and dig into the functionalities that actually matter. A structured approach will help you pinpoint the tool that will genuinely serve your business for years to come.

- Scalability and Future-Proofing: Ask yourself: will this platform grow with us? You need a system that can handle more data and adapt to new regulations without forcing you to start from scratch in a few years.

- Seamless Integration: A standalone platform that doesn't talk to your other systems is a recipe for manual data entry nightmares. Look for proven API integrations with the software you already use, like your ERP (SAP, Oracle) and HR systems. Automation is key.

- Multi-Framework Support: Your reporting requirements might expand or shift. The best platforms are flexible, supporting major standards like ESRS and GRI. This agility means you can report to different stakeholders without needing different tools.

A common mistake is picking a tool that only solves an immediate problem. Think of your ESG SaaS platform as a long-term partner. It must be capable of adapting as your strategy matures from basic compliance to genuine value creation.

Compliance Tool vs. Strategic Platform

It's crucial to understand that not all ESG software is built the same. Some are simple compliance tools, while others are comprehensive strategic platforms. Knowing the difference is fundamental to making the right choice.

This table breaks down what separates them.

| Feature | Basic Compliance Tool | Comprehensive Strategic Platform |

|---|---|---|

| Primary Goal | Generate mandatory reports. | Drive business improvement and strategy. |

| Data Scope | Covers essential compliance metrics. | Integrates operational, financial, and ESG data. |

| Analytics | Basic data aggregation. | Advanced analytics, forecasting, and "what-if" scenarios. |

| Focus | Backward-looking (reporting on the past). | Forward-looking (identifying future risks and opportunities). |

Ultimately, your ambition should guide your choice. If your sole objective is to meet the bare minimum regulatory requirements, a basic tool might get the job done. But if you see ESG as an opportunity to boost efficiency, manage risk, and find a competitive edge, then investing in a strategic platform is the smarter long-term play. To get a better sense of the reporting journey, check out our guide on the fundamentals of ESG reporting.

Right, so you've picked your ESG SaaS platform. That’s a great first step, but now comes the real work: getting it woven into the fabric of your business. A top-tier platform is only as powerful as its implementation, and frankly, a sloppy rollout can turn a brilliant investment into a frustrating waste of time.

This isn't just a tech project; it's a strategic one. Before you even think about flipping the 'on' switch, you need to get your house in order. We call this ‘data readiness’.

Think of it like cooking a complex meal. You wouldn't just start throwing ingredients in a pan. You’d prep everything first—chopping the vegetables, measuring the spices, and laying it all out. The same principle applies here. You need to gather and organise your existing data—from dusty energy bills to scattered employee records—into a clean, usable format. This groundwork is absolutely critical to avoid the classic "garbage in, garbage out" trap that dooms so many data initiatives.

A successful platform integration stands on two pillars: clean data and engaged people. If one is shaky, the whole structure will eventually wobble, undermining your investment and delaying any real insight.

Getting this right isn't a one-person job, either. Your ESG data is spread across the entire company, so you need buy-in from the people who hold the keys to that information.

Assembling Your Internal Dream Team

Let's be clear: integration is a team sport. Pulling people in early and keeping them involved is the only way to guarantee a smooth flow of accurate data. Your core team should be a cross-section of the business, including people from:

- Finance: They hold the purse strings and have the hard numbers on investments, assets, and operational costs.

- Operations: These are the folks on the ground who know everything about energy use, resource management, and logistics.

- Human Resources: Your source for all the 'S' in ESG—workforce diversity stats, safety records, and training programmes.

- Procurement: They have the all-important data on who’s in your supply chain and what their performance looks like.

Bringing these departments together does more than just gather data; it breaks down the silos that can completely derail a project like this. When everyone understands their part, the whole process runs smoother.

With your data prepped and your team aligned, you can finally connect the technology. Modern ESG platforms are built to play nicely with the other software you already use. This connection usually happens through APIs (Application Programming Interfaces), which act like secure pipelines, allowing different systems to talk to each other.

For instance, an API can automatically pull electricity consumption figures from your building management system or import shipping data straight from your logistics software, whether it's SAP or Oracle. This automation is the secret sauce. It eliminates hundreds of hours of mind-numbing manual data entry and drastically cuts down the risk of human error. By getting the three key elements right—data, people, and technology—you’ll sidestep the common pitfalls and see a much faster return on your investment.

Your Top Questions About ESG Software Answered

As Czech business leaders start seriously looking into ESG platforms, the same questions tend to pop up. Getting straight answers to these is the first step toward making a smart decision for your company's future.

What’s the Investment for an ESG SaaS Platform?

There’s really no one-size-fits-all price. Think of it less like a fixed cost and more like a subscription that grows with you. The final figure depends on factors like your company’s size, how many people need to use the system, and which specific modules you need.

A smaller business might start with a very manageable monthly fee for the basics. On the other hand, a large enterprise needing sophisticated Scope 3 supply chain calculations and deep analytics will naturally be looking at a more significant investment. The key is that the cost scales directly with your requirements.

Are We Too Small for This Kind of Software?

This is probably the biggest myth we hear. The idea that ESG software is only for massive corporations is simply outdated. Today, many of the best platforms are built to be scalable, offering powerful tools designed specifically for small and medium-sized enterprises (SMEs).

If your business is a supplier to a larger company or you operate in an industry facing new regulations, having a dedicated platform isn't a luxury—it's a competitive must-have, no matter your headcount.

Don't write off ESG software as something for the corporate giants. Modern, scalable platforms are levelling the playing field, making robust reporting tools accessible to businesses of all sizes and turning what feels like a burden into a real advantage.

How Long Does It Take to Get Everything Set Up?

The timeline can vary quite a bit, but you should probably plan for anywhere between a few weeks and a few months. The most important factor, by far, is the state of your data. If your information is already organised and easy to access, you'll be up and running much faster.

What extends the timeline is complexity. If you need to integrate the ESG platform with several other systems you already use—like your ERP, HR, or logistics software—that will naturally add more time to the project.

Can a Single Platform Handle All the Different Reporting Standards?

Yes, and honestly, this is one of their biggest selling points. Any top-tier ESG SaaS platform is designed for flexibility. They are built from the ground up to support all the major reporting frameworks you’ll encounter, including ESRS, GRI, and SASB.

This isn't just a nice-to-have feature; for any Czech business with international customers or expansion plans, it's absolutely essential. It means you can meet a variety of reporting demands from one place, without juggling multiple, disconnected tools.

Ready to move beyond spreadsheets and take control of your sustainability data? Carbonpunk offers an AI-driven platform that automates emissions tracking, simplifies compliance, and delivers the actionable insights you need to build a more resilient and profitable business. Start your ESG journey today.