Achieve EU CBAM Compliance: Essential Guide

Karel Maly

August 23, 2025

The EU's Carbon Border Adjustment Mechanism (CBAM) is more than just another regulation; it's a fundamental shift in how trade and climate policy intersect. Essentially, it puts a price on the carbon emissions of certain goods imported into the European Union, making sure they face the same carbon costs as products made within the EU. Getting EU Carbon Border Adjustment Mechanism (CBAM) compliance right means preparing your business for a new reality where carbon is a direct factor in your bottom line.

What CBAM Really Means for Your Business

At its heart, the EU's CBAM is a core component of the ambitious Green Deal. It's designed to solve a tricky problem that has plagued climate policy for years: carbon leakage. This happens when businesses move their production to countries with weaker environmental laws just to avoid stricter standards at home, which ultimately negates the EU's own climate progress.

CBAM tackles this head-on by pricing the carbon embedded in specific imports. This ensures that climate accountability doesn't stop at the EU's borders.

The goal is simple: fair competition. For a long time, EU producers have been paying for their emissions under the EU Emissions Trading System (ETS). CBAM applies a similar logic to importers, removing the unfair cost advantage that some non-EU manufacturers have enjoyed. The ripple effect? It encourages cleaner, more sustainable production methods on a global scale.

The Phased Rollout Explained

The implementation timeline isn't a sudden shock; it's a gradual ramp-up designed to give businesses time to adjust. Knowing these dates is absolutely critical.

- The Transitional Period (2023–2025): We're in this phase right now. It's all about reporting, not paying. Since October 1, 2023, importers across the EU, including here in the Czech Republic, have been required to submit quarterly reports detailing the greenhouse gas emissions embedded in their high-carbon imports. No financial penalties are applied yet, but make no mistake, accurate reporting is mandatory. You can get into the nitty-gritty of the rules on the official EU Commission website.

- The Definitive Period (From 2026): This is when things get real financially. Starting in 2026, importers will need to buy and surrender a corresponding number of CBAM certificates to cover the embedded emissions of their goods.

Are You on the Hook?

In this initial stage, CBAM is laser-focused on sectors that are not only carbon-intensive but also at a high risk of carbon leakage. If your business imports goods from these categories, you have reporting obligations today.

The sectors currently in the spotlight are:

- Iron and Steel

- Aluminium

- Cement

- Fertilisers

- Electricity

- Hydrogen

For anyone working with these materials, this transitional period isn't a time to sit back and watch. It's your crucial window to get your house in order. You need to be setting up solid data collection systems, talking to your non-EU suppliers, and getting a clear picture of your future financial liabilities. Kicking this can down the road will put you at a serious competitive and financial disadvantage come 2026. The foundation for successful EU Carbon Border Adjustment Mechanism (CBAM) compliance is being built right now.

Defining Your Company's CBAM Obligations

Before you can even think about compliance, you first need to get your arms around how the EU Carbon Border Adjustment Mechanism (CBAM) regulation actually applies to your business. This isn’t a task for high-level strategy meetings; it’s about getting into the weeds of your import portfolio to figure out exactly what your obligations are.

The first real step is a practical one: mapping the goods you import against the Combined Nomenclature (CN) codes listed in the CBAM regulation. These codes are your single source of truth for what’s in scope. If you’re importing products under these specific codes, you have reporting duties starting now.

Let's say you’re a Czech-based firm bringing in steel fasteners and structural parts from a supplier in Türkiye. You’ll need to pull the CN codes for every single one of those products and check them against the official CBAM list. It’s this granular, product-by-product analysis that tells you precisely which parts of your supply chain fall under these new rules.

Auditing Your Import Portfolio

A systematic audit of your imports is non-negotiable. You can’t rely on general product descriptions—you have to dig into your customs declarations and procurement records to move from guesswork to a clear action plan.

Kick things off by building a master list of all goods you import from outside the EU. For each and every item, you need to pin down:

- The precise CN code: This is the most crucial piece of the puzzle.

- The country of origin: This tells you which non-EU production processes you'll need emissions data for.

- The volume and frequency of imports: This helps you gauge the scale of your reporting burden and prioritise your efforts.

This audit is what will ultimately reveal the true scope of your CBAM exposure. For our steel importer, this process might show that their standard steel bolts (CN code 7318) are covered, but perhaps some specialised alloy components are not. That level of detail is absolutely essential for focusing your compliance efforts where they really count.

The table below outlines the primary sectors covered by CBAM during its transitional phase, giving you a clear picture of the goods in question and the reporting deadlines you can't afford to miss.

CBAM Covered Sectors and Key Reporting Deadlines

| Covered Sector | Examples of Goods | Reporting Period | Submission Deadline |

|---|---|---|---|

| Cement | Portland cement, aluminous cement, clinkers | Q4 2023 | 31 January 2024 |

| Iron and Steel | Raw materials, pipes, tubes, bolts, screws | Q1 2024 | 30 April 2024 |

| Aluminium | Raw aluminium, foils, tubes, pipes, structures | Q2 2024 | 31 July 2024 |

| Fertilisers | Nitric acid, ammonia, urea, various nitrates | Q3 2024 | 31 October 2024 |

| Electricity | Imported electricity from non-EU grids | Q4 2024 | 31 January 2025 |

| Hydrogen | Gaseous hydrogen | Q1 2025 | 30 April 2025 |

Understanding these deadlines is the first step, but remember that each report requires detailed emissions data from the preceding quarter.

Identifying the Official CBAM Declarant

Once you’ve established which goods are in scope, the next critical question is: who is actually responsible for filing the reports? The EU legislation is very clear that this duty falls to the CBAM declarant. This role is typically filled by one of two parties.

The declarant is either the importer who lodges the customs declaration in their own name and on their own behalf, or if the importer isn’t based in the EU, it’s their indirect customs representative. Your organisation must formally identify and empower this person or entity. They are the one legally on the hook for submitting accurate quarterly reports through the CBAM Transitional Registry.

A common mistake I see is companies assuming their logistics partner or freight forwarder will just handle CBAM. That's a dangerous assumption. The legal responsibility rests squarely with the officially designated declarant. Clarifying this role internally isn't just admin; it's a foundational step in building a compliant operation.

For our Czech steel importer, this means their in-house customs compliance officer—the person actually named on the import declarations—is now the designated CBAM declarant. That individual is now personally responsible for getting the emissions data from the Turkish supplier and filing those quarterly reports on time.

Tracing Products and Confirming Requirements

With your scope defined and your declarant identified, the focus has to shift to data. You need to trace each covered product right back to the specific facility that produced it. This is a key detail: CBAM demands emissions data from the actual installation where the goods were manufactured, not just a generic country-level average.

Think back to those steel components from Türkiye. The importer can't just ask the supplier for "an emissions number." They need to engage them to get specific data on both the direct and indirect emissions generated at the factory that produced those exact fasteners. This is where proactive and clear communication becomes your most valuable tool.

Your supplier needs to understand what data you need, why you need it, and in what format. It’s about building a solid data-sharing process, not just making a one-off request. This might mean sharing the EU's guidance documents with them or using a platform like Carbonpunk that helps get suppliers on board and streamlines the whole data collection process.

By working through these steps—auditing your CN codes, appointing a declarant, and tracing product origins—you turn a daunting regulation into a clear and actionable roadmap. This initial groundwork is what separates businesses that are prepared for EU Carbon Border Adjustment Mechanism (CBAM) compliance from those that are going to be scrambling to avoid penalties and supply chain chaos.

Getting Your Data Collection Strategy Right

When it comes to the EU Carbon Border Adjustment Mechanism (CBAM), everything boils down to one thing: accurate data. Without a solid plan for gathering and calculating the embedded emissions in your imported goods, your reports will be built on a foundation of sand.

This is much more than just asking your supplier for a number. You need to understand exactly what that number represents. CBAM requires you to account for both direct and indirect emissions that were generated when your goods were made.

The Difference Between Direct and Indirect Emissions

Getting a handle on these two types of emissions is fundamental. It shapes what you need to ask your non-EU suppliers for and is absolutely critical for correct reporting.

-

Direct Emissions: Think of these as emissions released right at the production facility. For a steel manufacturer, this is the CO₂ from burning coal in their blast furnaces. A fertiliser producer would count the emissions from the chemical processes used to create ammonia.

-

Indirect Emissions: This is all about the electricity used by the production facility. If an aluminium smelter is powered by a coal-fired plant, the emissions from generating that electricity are counted as indirect emissions for the aluminium itself.

Let's put this into practice. Imagine a Czech company importing aluminium extrusions from Turkey. They can't just get data on the smelting process. They also need to know the carbon intensity of the electricity grid that powers the Turkish factory. This level of detail isn't a "nice-to-have"; it's non-negotiable for EU Carbon Border Adjustment Mechanism (CBAM) compliance.

How to Talk to Your Non-EU Suppliers

Your suppliers hold the keys to the data you need, which makes your relationship with them more important than ever. Firing off a demanding email asking for "emissions data" is a recipe for confusion, delays, or worse, incomplete information. You need a structured, supportive approach.

Start by framing the request as a shared regulatory hurdle for continuing to do business in the EU market, not just another burden you're placing on them. Give them clear, simple information about what CBAM is and why this data has become mandatory.

In our experience, the key is to make the process as easy as possible for your suppliers. They're far more likely to respond positively if you provide a simple template or checklist outlining the exact data points you need—production volumes, energy consumption, emissions factors, and so on. It removes the guesswork and shows you’ve done your homework.

Here’s a simple communication template you can adapt to get the conversation started:

Subject: Important Request for EU CBAM Compliance Data

Dear [Supplier Name],

As part of new EU regulations (the Carbon Border Adjustment Mechanism), we are now required to report the embedded carbon emissions of the [Product Name] we import from you.

To ensure our continued partnership and the smooth entry of your goods into the EU, we need your help in providing some specific data from your production facility for the period [Start Date] to [End Date].

Specifically, we need the following:

- Total direct GHG emissions from the production process (in tonnes of CO₂e).

- Total electricity consumed during production (in MWh).

- Information on the source/carbon intensity of your electricity.

We understand this is a new requirement and are here to support you. Please don’t hesitate to ask if you have any questions. We really appreciate your cooperation in helping us meet these legal obligations.

Best regards,

[Your Name]

This is where platforms like Carbonpunk can make a world of difference. By giving your suppliers a central system to upload their data, you can automate reminders, validate information, and keep all your records in one place. It’s a huge step toward building an audit-ready compliance system. To learn more about what to look for, check out our guide on choosing the top carbon accounting platform for sustainable success.

A Word of Warning on Default Emissions Values

The EU provides default emissions values as a fallback. These are pre-calculated figures you can use if you simply can't get actual data from your supplier. While it might seem like an easy way out, relying on them is a major strategic mistake.

Here in the Czech Republic, preparing for CBAM means businesses must get serious about collecting and verifying real emissions data. During the transitional phase (until the end of 2025), importers can use the default values published by the European Commission if their suppliers miss the July 31, 2024 deadline for providing actual data. But be warned: the EU deliberately sets these default values higher than typical real-world emissions to push companies towards getting precise data.

For Czech businesses, failing to move beyond these default values could lead to financial penalties starting in 2025, ranging from 10 to 50 euros per tonne of CO₂ equivalent that is unreported or underreported. It's clear that these defaults are designed to be punitive.

Using them means you will almost certainly over-report your emissions and, starting in 2026, overpay for your CBAM certificates. The only smart, long-term strategy is to build a rock-solid system for collecting actual, verified data directly from your supply chain.

Getting Your CBAM Report Across the Finish Line

Once your emissions data is collected and organised, it’s time for the final, critical step: submitting your quarterly report. This isn’t just a box-ticking exercise; it’s where all your hard data-gathering work gets put to the test. The gateway for all this is the CBAM Transitional Registry, the EU’s dedicated portal for handling these submissions.

That first quarterly report can feel like a pretty big mountain to climb. Each submission needs a much deeper breakdown of your imports than what you'd find on a typical customs declaration. You'll have to input specific data points for every single consignment of CBAM-covered goods that entered the EU during the previous quarter.

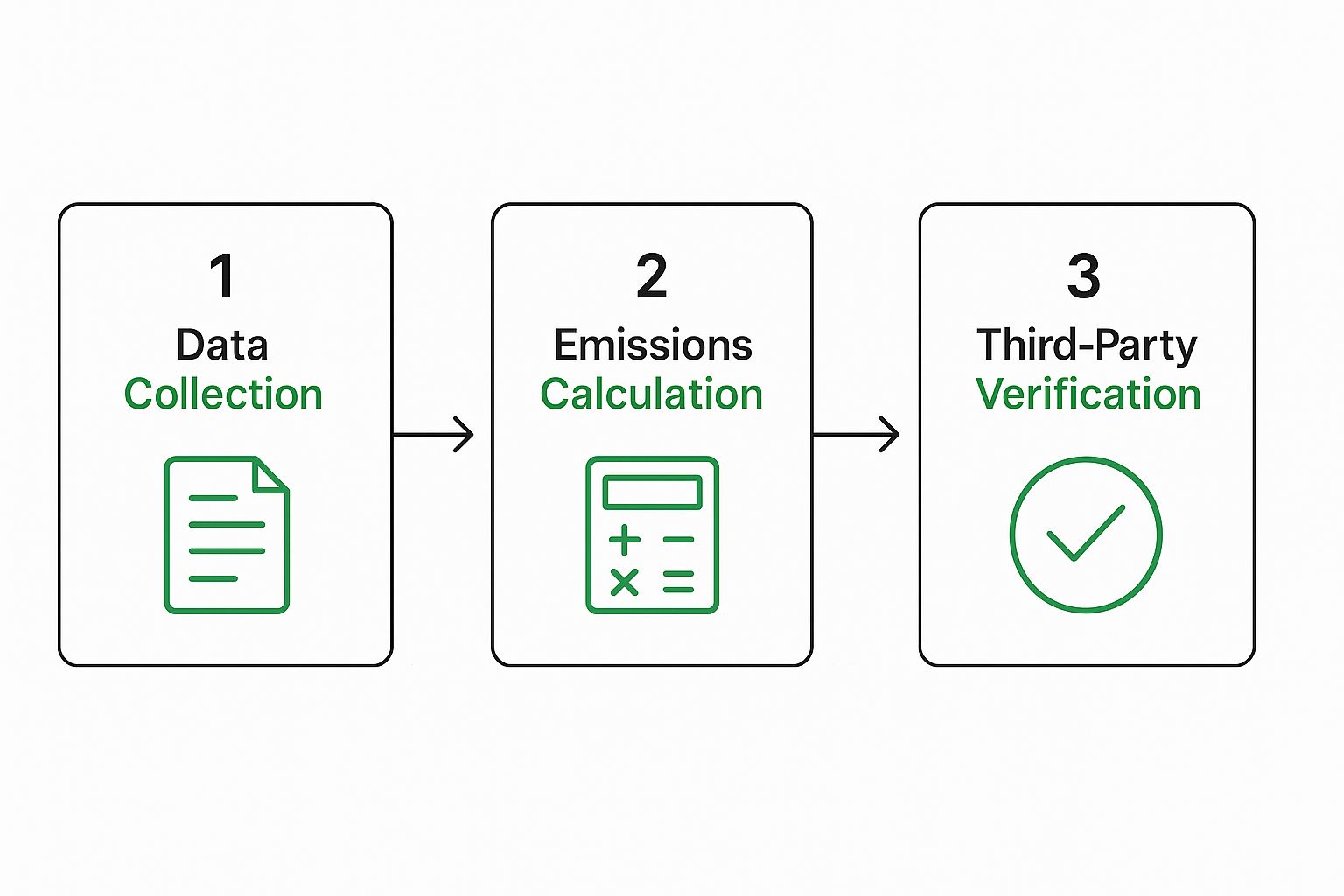

This image gives a great high-level view of the whole reporting workflow, from gathering the initial data to getting it all verified.

As you can see, a successful submission is the end of a very structured road. Getting your calculations and verifications right from the start is absolutely non-negotiable for compliance.

What Goes into Your Quarterly Report?

Getting around the registry for the first time demands a sharp eye for detail. The system is built for precision, and even small mistakes can get your report rejected or put you under a microscope later on.

Your report has to break down the following for each product type and its country of origin:

- Quantity of Imported Goods: This has to be precise—megawatt-hours for electricity and tonnes for everything else, like steel or cement.

- Embedded Emissions: You need to declare the total direct and indirect greenhouse gas emissions, and they must be calculated using the EU's specific methodologies.

- Carbon Price Due: If a carbon price was already paid in the country of origin, you have to include this. It will be crucial for claiming deductions when the permanent system kicks in from 2026.

A classic mistake is misclassifying emissions. For example, if you only declare direct emissions for a product that also requires reporting indirect emissions from its electricity use, your report will be inaccurate and non-compliant. Always double-check the specific rules for each CN code.

Making Sense of the Transitional Registry

The CBAM Transitional Registry is the only official way to submit your compliance data. To even get in, your company’s designated CBAM declarant first needs access from the National Competent Authority in your member state. Once you’re in, you’re either entering data by hand or uploading a pre-formatted file.

I’ve seen many businesses completely underestimate how long that first submission takes. The registry’s interface demands very specific data entry for every single product, from every single supplier. My advice? Do a dry run long before the deadline. Try uploading a small batch of data to see what formatting problems or information gaps pop up.

As you get deeper into your data strategy, looking into things like Robotic Process Automation for regulatory reporting can be a game-changer. Automating these repetitive data entry tasks frees your team from drudgery so they can focus on what really matters: improving data quality and working with your suppliers.

Sidestepping Common Reporting Pitfalls

Accurate reporting is the foundation of EU Carbon Border Adjustment Mechanism (CBAM) compliance. A few common, recurring errors can easily undo all your hard work and lead to penalties.

One of the issues I see most often is incorrect unit conversion. A supplier might give you energy consumption data in gigajoules (GJ), but the registry demands megawatt-hours (MWh). If you don't convert that correctly, your entire emissions calculation is thrown off.

Another red flag for auditors is wildly inconsistent data between quarters. If your reported emissions for the same product from the same supplier jump all over the place without a good reason, expect questions. Keeping detailed records of any production changes is your best defence to explain these variations.

This is where platforms like Carbonpunk are incredibly helpful. They can automatically flag these kinds of anomalies and enforce data consistency over time, keeping you ready for any audit. For any company looking to get ahead of this, exploring a platform that can generate automated sustainability reports for ESG compliance is the logical next move.

Getting Ready for the Financial Squeeze in 2026

Think of the current transitional period as a dress rehearsal. It’s all about reporting. But come 2026, the main performance begins, and the EU Carbon Border Adjustment Mechanism (CBAM) will shift from a data-gathering exercise to a very real financial obligation.

This is the moment when the carbon embedded in your imports hits the balance sheet. For businesses in the Czech Republic and right across the EU, this means you'll have to buy and surrender CBAM certificates for every tonne of CO₂e you bring in. Carbon is about to become a direct, tangible cost that will reshape how you think about procurement and pricing.

The Shift to Financial Compliance

Mark your calendar for 1 January 2026. This is when CBAM enters its definitive phase, and everything changes for importers. If your Czech business imports goods covered by CBAM, you'll need to be registered as an authorised declarant and start buying certificates to match the emissions embedded in those goods.

The price tag? It's directly tied to the weekly average auction price of allowances under the EU Emissions Trading System (ETS). This creates a direct financial link between what you import and the EU’s carbon market. It’s worth reading up on how these carbon tariffs are designed to mitigate climate change to get the bigger picture.

The whole point is to level the playing field, making sure a product’s carbon cost is the same whether it’s made in the EU or outside. It’s a direct shot at "carbon leakage," stopping companies from simply moving production to places with looser environmental rules.

Becoming an Authorised CBAM Declarant

Before you can even think about paying, you have to get official status as an "Authorised CBAM Declarant." This isn’t something that happens automatically. You have to formally apply to your national authority, and they will be looking closely at your application.

They’ll want to see a clean compliance history and be confident that you have the systems in place to handle these new responsibilities. Getting this authorisation is a crucial step—without it, you legally cannot import CBAM-covered goods into the EU from 2026. Don’t leave this to the last minute; start the process early to avoid serious disruptions to your supply chain.

Claiming Reductions for Carbon Prices Paid Abroad

There's a key detail in the CBAM rules designed to prevent carbon from being priced twice. If a carbon price was already paid on your goods in their country of origin, you can claim a deduction on your CBAM bill.

But be warned: this is no simple tick-box affair. To get this deduction, you need solid, verifiable proof from your non-EU suppliers. This documentation has to clearly show:

- How much carbon price was paid.

- The exact quantity of emissions that payment covered.

- Proof that the payment was part of an official scheme, like a carbon tax or a local ETS.

This is where your supplier relationships become absolutely critical. You must work with them now to ensure they can provide this detailed documentation. Waiting until 2026 will be too late. The burden of proof is on you, the importer, and without it, you will pay the full CBAM cost regardless of any taxes paid at origin.

Weaving Carbon Costs into Your Business Model

With CBAM certificates, carbon stops being a line item in a sustainability report and becomes a direct cost, just like raw materials or transport. The smartest businesses are already running the numbers to see what this will look like. For many, it's a wake-up call to reduce emissions across the board, even in areas like corporate travel. For practical ideas, check out our guide on how to go about shrinking your carbon footprint for business travel.

Here are the strategic moves you should be making right now:

- Financial Forecasting: Use the emissions data you’re gathering now to project your future CBAM costs. Run a few scenarios with different EU ETS prices to understand your potential financial risk.

- Rethink Procurement: Take a hard look at your suppliers. Soon, their carbon intensity will directly affect your bottom line. It might be time to favour suppliers in countries with cleaner energy or those who have invested in decarbonisation.

- Pricing Strategy: How will you handle these new costs? Will you absorb them, or will you need to adjust your prices? This requires a sharp analysis of your market and where you stand against competitors.

Ultimately, preparing for 2026 is about moving EU Carbon Border Adjustment Mechanism (CBAM) compliance from a back-office reporting task to a core part of your financial and strategic planning.

Answering Your Top CBAM Compliance Questions

Getting to grips with the EU Carbon Border Adjustment Mechanism (CBAM) throws up a lot of practical questions. As businesses like yours navigate these new rules, we’ve noticed the same concerns cropping up again and again. Here are some clear, straightforward answers to the most common queries we hear from the field.

What Happens if I Miss a CBAM Reporting Deadline?

Let's be clear: missing a CBAM reporting deadline, even during this transitional phase, has real consequences. The national competent authorities in each EU member state are empowered to issue penalties for non-compliance, and they’re designed to make sure businesses take this seriously.

Fines can range from €10 to €50 per tonne of unreported emissions. The final amount isn't arbitrary; it depends on factors like how long the delay is, the volume of unreported emissions, and if it's a repeat offence. Consistent failure here will undoubtedly lead to higher fines and a lot more regulatory scrutiny.

The only way to avoid these penalties is by building a solid internal process. You need a reliable system for tracking deadlines, gathering data from your suppliers, and making sure every quarterly submission is accurate and on time.

Do I Still Need to Report Emissions if a Carbon Price Was Paid Abroad?

Yes, you absolutely do. This is a point of confusion for many, but the reporting obligation is completely separate from any financial payments. You must report all embedded emissions in your quarterly CBAM report, regardless of whether a carbon price was paid in the country of origin.

During this transitional period, the game is all about data collection. The EU wants a transparent view of the carbon footprint of imported goods. Your report needs to show the total direct and indirect emissions associated with your products. It’s non-negotiable.

The ability to deduct a carbon price paid abroad only becomes relevant from 2026, when the financial phase kicks in. At that stage, you’ll need solid proof of payment to lower the number of CBAM certificates you have to purchase. For now, just focus on reporting everything.

How Can Small Businesses Handle the Administrative Burden?

For Small and Medium-sized Enterprises (SMEs), the paperwork and data chasing for CBAM can feel like a mountain to climb. But with a structured approach, it’s far from impossible. The worst thing you can do is let the complexity paralyse you.

Here’s a practical game plan:

- Confirm You're in Scope: First things first, check the official Combined Nomenclature (CN) codes. You might discover that only a fraction of your imports are actually covered by CBAM.

- Start the Supplier Conversation: Don't put off talking to your non-EU suppliers. The EU provides communication templates to help you clearly explain what data you need. Frame it as a critical step for your continued partnership.

- Get Expert Help: When it comes to the technical emissions calculations, don't try to go it alone. Specialised software or consulting services can automate this and ensure your numbers align with EU methodologies, saving you immense time and stress.

- Team Up with Your Peers: Industry associations can be a goldmine. They offer shared resources, workshops, and best practices. Remember, you’re not the only one navigating this.

Can I Just Use Default Values for All My Reporting?

You can, but you really shouldn't. While the EU provides default emissions values as a fallback, relying on them as your main strategy is a costly mistake in the long run.

These default values are deliberately set at a high, conservative level. Why? To push importers to get actual data from their suppliers.

Using them means you'll almost certainly be over-reporting your emissions. It might not seem like a big deal now, but this habit will directly hurt your bottom line starting in 2026. That's when over-reporting translates into over-paying for CBAM certificates.

Think of default values as a temporary safety net for when you absolutely can't get real data. Your primary goal must be to get actual, verified data from your producers as soon as possible. It’s the only way to ensure both accuracy and cost-efficiency.

Managing the complexities of CBAM reporting requires a powerful, automated solution. Carbonpunk streamlines data collection, validates emissions with over 95% accuracy, and generates audit-ready reports, turning your compliance burden into a competitive advantage. Discover how our AI-driven platform can secure your supply chain's future at https://www.carbonpunk.ai/en.