Carbon Accounting in Construction & Real Estate: A Practical Guide

Karel Maly

August 21, 2025

Carbon accounting in the world of construction and real estate is all about tracking, managing, and reporting the greenhouse gas emissions tied to a building's entire life. This isn't just about one thing; it covers everything from the emissions created when manufacturing materials and during the actual construction—what we call embodied carbon—all the way to the energy a building uses for heating, cooling, and lighting once it's up and running, known as operational carbon. It's the bedrock practice for hitting sustainability targets in the built environment.

Why Carbon Accounting Is Your New Blueprint

Think of it like an environmental balance sheet for your project. Instead of just tracking pounds and pence, you're logging every single emission "transaction." This means accounting for the carbon footprint of the concrete, the steel, the transport of materials, and the energy the building will consume for the next 50 years. What was once a niche concern for a few is quickly becoming a core part of the business.

Getting a handle on carbon accounting isn’t just a "nice-to-have" anymore; it’s essential for future-proofing your business. A few powerful forces are making this an undeniable reality:

- Tighter EU Regulations: Governments are rolling out stricter emission caps and mandatory reporting for both new builds and existing properties. Compliance is non-negotiable.

- Investor Demand for ESG: Environmental, Social, and Governance (ESG) metrics are now a huge deal for investors. They see sustainable properties as safer, more valuable long-term assets.

- A Clear Market Advantage: A building with a verified low-carbon footprint isn't just good for the planet. It can command higher rents, attract top-tier, eco-conscious tenants, and build a powerful brand reputation.

The Foundation of Sustainable Building

To really get why carbon accounting is the new blueprint, you have to understand the bigger picture of sustainable building principles. These ideas push architects, developers, and property managers to create buildings that are not just energy-efficient but are also made with materials and methods that cause minimal environmental damage. Carbon accounting is what provides the hard data to prove you're actually doing it.

By putting a number on emissions at every single stage—from digging raw materials out of the ground to the building's eventual demolition—carbon accounting turns vague sustainability goals into concrete, measurable targets. It gives you the clear, verifiable data needed to make smarter design choices, report accurately, and prove your environmental credentials.

This guide will serve as your practical roadmap. We’ll walk through the complex concepts and get you to a place of confident action, showing you how tracking emissions in detail can unlock major wins for both the environment and your bottom line.

Decoding Your Building's Carbon Footprint

To get carbon accounting right in construction and real estate, you first need to know where the emissions are actually coming from. Every single building tells two very different carbon stories over its lifetime, and understanding both is the only way to get a true picture of its environmental impact.

The first story is all about embodied carbon. Think of it as the building's carbon "birth certificate"—a one-time hit that includes every emission released before the doors even open. This covers everything from mining the raw materials and manufacturing the steel and concrete to shipping it all to the building site.

Then there's operational carbon, which is the story of the building’s day-to-day life. These are the emissions that come from heating, cooling, lighting, and running all the equipment inside. While embodied carbon is a fixed cost, operational carbon just keeps adding up, year after year, for decades.

The Three Scopes of Emissions

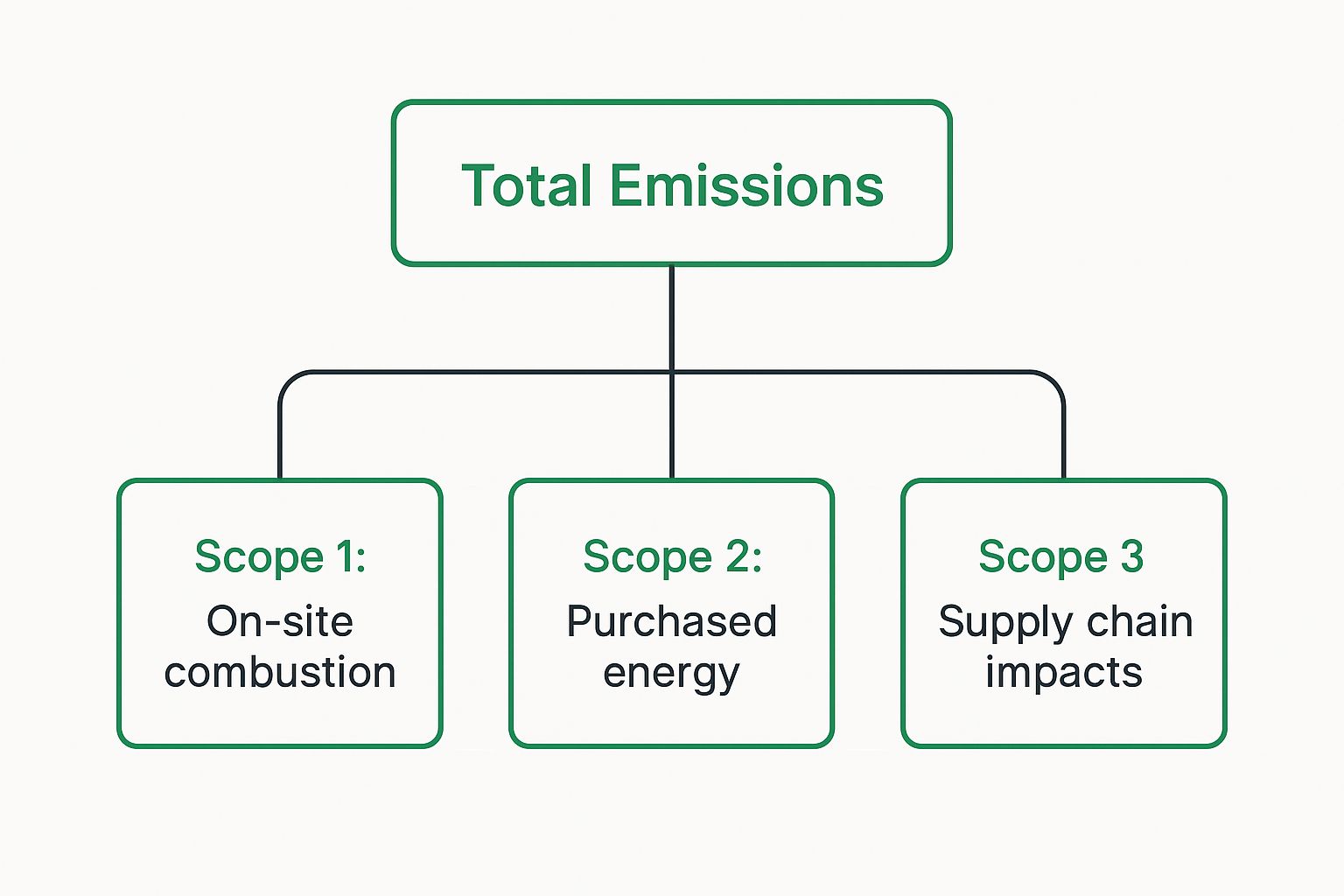

To keep things organised, the globally accepted Greenhouse Gas (GHG) Protocol sorts these emissions into three "scopes". If you're serious about carbon accounting, you need to know these inside and out.

-

Scope 1: Direct Emissions These are the emissions you create yourself, from sources you own or control. For a construction company, that means the fuel you burn in your trucks, site generators, and heavy machinery. It's the stuff coming straight from your own exhaust pipes.

-

Scope 2: Indirect Emissions from Purchased Energy This one is pretty straightforward. It’s the carbon footprint of the electricity you buy from the grid to power your offices and construction sites. You don't produce these emissions on-site, but you're responsible for them because you're the one using the power.

-

Scope 3: The Rest of the Value Chain Here's where it gets complicated. Scope 3 covers all the other indirect emissions linked to your business. We're talking about the embodied carbon in the materials you buy, emissions from third-party delivery trucks, your employees' daily commutes, and even the energy your tenants use once they move in. It’s a huge category.

To get a complete picture of your environmental impact, you have to look beyond your own direct actions. For most real estate companies, Scope 3 emissions are the biggest piece of the pie, making them the most critical area to tackle for real change.

This detailed perspective is particularly important in places like the Czech Republic. The country's GHG emissions have changed a lot over the years, and the built environment is now a key focus for decarbonisation. While total national emissions dropped by about 35% between 1990 and 2017, buildings were still responsible for around 12.7 MtCO2e in 2017 from their operations alone. That number shows just how big the challenge is.

From Measurement to Action

Once you’ve broken down your building's footprint—separating embodied from operational carbon and sorting it all into Scopes 1, 2, and 3—it's time to do something about it. To move from numbers on a page to real-world reductions, start with the low-hanging fruit of operational energy.

You can find a great starting point with these practical strategies for reducing energy consumption. This helps you turn your data into a clear action plan to lower your building’s impact over the long haul. To dig deeper into the whole process, you can learn more about getting a full picture of your https://www.carbonpunk.ai/en/carbon-footprint.

Mapping the Entire Carbon Lifecycle of a Building

If you only look at a building's energy bills to gauge its carbon impact, you're missing most of the story. It's like reading just one chapter of a very long book. To get the full picture, we need to conduct a Whole-Life Carbon (WLC) assessment. This approach tracks emissions right from the very beginning—when raw materials are pulled from the earth—all the way through to the day the building is demolished.

This complete view is the bedrock of effective carbon accounting in construction and real estate. By mapping out every stage, we can finally see where the biggest emission hotspots are and, more importantly, where we can make the most meaningful cuts. It’s about shifting from a narrow focus on operations to a full, lifecycle perspective that tells the true environmental story of a project.

From Cradle to Grave: The Building Lifecycle Stages

So, what does this journey actually look like? The whole process is broken down into clear, distinct stages, or modules, which helps us organise the complex flow of emissions. Think of it as a timeline for a building's carbon footprint.

Here’s a breakdown of the key stages and where their carbon impact comes from.

Building Lifecycle Stages and Carbon Impact

| Lifecycle Stage (Module) | Description | Key Emission Sources |

|---|---|---|

| A1-A3: Product Stage | Often called "cradle-to-gate," this covers everything needed to create building materials before they even reach the site. | Extracting raw materials (e.g., mining iron ore for steel), transport to factories, and the energy-intensive manufacturing of products like concrete, steel, and glass. |

| A4-A5: Construction | This phase includes getting all the finished materials to the site and assembling the building. | Fuel for trucks and ships delivering materials, plus the electricity and fuel used by machinery (cranes, excavators) on the construction site itself. |

| B1-B7: Use Stage | This is the longest part of the building's life, covering all emissions generated while it's occupied and operational. | Energy for heating, cooling, and lighting; emissions from maintenance, repairs, and replacing components like windows or roofing over the decades. |

| C1-C4: End-of-Life | This is the final chapter, covering the building's deconstruction and what happens to the materials afterwards. | Energy used for demolition, transport of waste materials, and the processes for recycling, landfilling, or incineration. |

Each of these stages contributes to the total carbon footprint, making it essential to consider them all, not just the operational (Use Stage) part that we tend to focus on.

This diagram helps visualise how a building's total emissions are split across the three main scopes.

As you can see, while on-site emissions (Scope 1) and purchased energy (Scope 2) are important, it's the supply chain impacts (Scope 3) that often represent the largest and most complex piece of the carbon puzzle.

The Hidden Power of Early Decisions

This lifecycle approach shines a light on a crucial truth: decisions made in the design phase have a massive, lasting impact. Choosing mass timber over traditional concrete, for example, isn't just a design choice; it's a decision that can lock in huge carbon savings for the next 50 or 100 years.

This "upfront" carbon, known as embodied carbon, is a one-time cost. Once the building is constructed, you can't go back and reduce it.

Thinking in terms of the whole lifecycle shows that every stage is connected. You can't just optimise for operational efficiency and ignore the embodied carbon in materials and construction—that's missing half the equation. Real carbon reduction demands a strategy that tackles the entire journey from start to finish.

Understanding the concept of Whole Life Carbon Costs is the key to this comprehensive mapping. It’s the framework that allows us to add up the total carbon footprint, from the architect's first sketch to the final recycling of materials. This is fast becoming the gold standard for any serious sustainability assessment.

Here in Czechia, the construction sector's footprint is enormous. The industry is responsible for around 50% of all material extraction and creates a third of the nation's total waste. This shows just how heavily the sector’s choices influence a building's lifecycle emissions. Even a renovation aimed at saving energy can accidentally increase embodied carbon if the new materials and processes aren't chosen carefully.

Choosing Your Carbon Accounting Framework

Diving into carbon accounting can feel a bit like learning a new language, with its own set of acronyms and standards. But picking the right framework isn't just a box-ticking exercise. It's about choosing the right rulebook for what you want to achieve, whether that’s reporting your entire company's emissions or assessing the lifecycle impact of a single building. These frameworks give you the structure to measure your carbon footprint consistently and credibly.

Think of it like choosing a measuring tape. You wouldn't use a tailor's tape to measure a motorway, right? Similarly, the standard for corporate reporting won't work for calculating the embodied carbon of a new office block. Each framework serves a specific purpose, designed to answer very different questions about your environmental impact.

For any business in the construction and real estate sector, especially in the EU, a few key frameworks really matter. They lay the groundwork for solid carbon accounting in construction and real estate, making sure your data is accurate, comparable, and trusted by everyone from investors to tenants.

Corporate Reporting with the GHG Protocol

When it comes to corporate-level emissions, the Greenhouse Gas (GHG) Protocol is the most recognised and widely used tool on the planet. It’s essentially the international gold standard for a company looking to understand its overall carbon footprint, breaking emissions down into the three scopes we covered earlier.

- Its Purpose: To help a company measure and manage the emissions from all its operations.

- When to Use It: This is your go-to for annual corporate sustainability reports, investor disclosures, and setting company-wide climate targets.

- Key Takeaway: The GHG Protocol is about your organisation's total footprint, not the specific lifecycle of one building.

Building-Specific Whole-Life Carbon Assessment

But what happens when you need to shift focus from the company to the asset itself? That's where you need a more specialised set of tools. Frameworks designed for Whole-Life Carbon (WLC) assessment step in here. In Europe, the professional statement from RICS (Royal Institution of Chartered Surveyors) is hugely influential.

These standards provide detailed, step-by-step methods for calculating both embodied and operational carbon across a building's entire life—from the A1 stage (sourcing raw materials) right through to C4 (demolition and disposal). This granular view is absolutely critical for making smart design choices and accurately reporting a project's true environmental cost.

While the GHG Protocol gives you the 30,000-foot view of your company's emissions, WLC standards like those from RICS get you on the ground, providing a cradle-to-grave analysis of a specific building. You need both, but they answer different questions.

Navigating EU Taxonomy and Local Standards

The regulatory landscape is, of course, a huge piece of the puzzle. The EU Taxonomy is a classification system that establishes what can be officially labelled as an environmentally sustainable economic activity. If you want your project to be "taxonomy-aligned" to attract green investment, you need robust carbon data to back it up. High-quality carbon accounting is your ticket to proving compliance and unlocking that capital.

Here in the Czech Republic, this alignment is becoming more and more important. The largest construction firms are already weaving global frameworks into their reports to meet growing ESG demands from the market. Interestingly, subsidiaries of international firms often lead the way, adopting standards like the GHG Protocol more readily, which in turn pushes the entire industry toward more transparent and standardised accounting. You can read more about the findings on GHG reporting practices in Czechia.

At the end of the day, it's vital to distinguish between voluntary frameworks like the GHG Protocol and mandatory reporting tied to regulations like the EU Taxonomy. A smart strategy uses both. You build a credible data foundation with established standards, which in turn helps you satisfy the demands of regulators, investors, and clients alike.

Putting Carbon Accounting Into Practice

Understanding the theories and standards is a great start, but the real test is putting them to work in your business. This is where carbon accounting stops being an abstract idea and becomes a practical tool for making smarter decisions. It’s all about building a clear, repeatable process to turn raw operational data into a genuine roadmap for cutting your environmental impact.

The whole process can feel a bit daunting at first, but it follows a pretty logical path. A good way to think about it is like building a financial report. But instead of tracking pounds or euros, you're tracking kilograms of CO₂. You start with the basic data points from your daily operations, apply the right calculations, and end up with an emissions inventory you can actually act on.

Kicking Off Your Data Collection

First things first: you need to gather your activity data. This is the raw, real-world information that reflects your operations—the fuel you use, the electricity you buy, the materials you order. Without good data, your carbon calculations are just guesswork.

Start with the information that’s easiest to get your hands on. For most construction and real estate firms, this usually includes:

- Utility Bills: Round up all the electricity, natural gas, and water bills for your offices, properties, and active construction sites. This is your direct line into calculating Scope 2 emissions.

- Fuel Records: Get a handle on every litre of diesel and petrol your company vehicles and on-site machinery burn through. This information is the backbone of your Scope 1 emissions.

- Material Quantities: Dig into your purchase orders and invoices to find out the total tonnage of major materials like concrete, steel, and insulation brought onto your projects.

With that data in hand, you need the other half of the equation: the emission factor. This is simply a standardised multiplier that converts your activity data (like litres of fuel or kWh of electricity) into its carbon dioxide equivalent (CO₂e). For instance, an emission factor tells you exactly how many kilograms of CO₂ are released for every tonne of steel produced or every kilowatt-hour of electricity your site consumes.

From Spreadsheets to Software Solutions

When you’re just starting out, a spreadsheet often seems like the go-to tool. It’s a familiar way to organise data and run some basic calculations. But let's be honest—as soon as you start getting serious about carbon accounting in construction and real estate, especially when you wade into the complexities of Scope 3, spreadsheets can quickly turn into a liability. They become clumsy, time-consuming, and dangerously prone to error.

This is exactly why specialised carbon accounting software was developed. Modern platforms are built to automate the heavy lifting, transforming what could be a chaotic mess of data into a smooth and reliable system.

These tools can link directly to your utility accounts, pull in procurement data, and automatically apply the correct, up-to-date emission factors. This doesn’t just save an incredible amount of time; it ensures your reports are accurate, audit-ready, and fully compliant with standards like the GHG Protocol.

The biggest headache for most companies is chasing down solid data for Scope 3 emissions, especially the embodied carbon locked into the supply chain. This means you need to work with your suppliers to get Environmental Product Declarations (EPDs) or, when that’s not possible, rely on industry-average data. Good software platforms solve this by coming pre-loaded with huge databases of these emission factors, making one of the toughest parts of the job much simpler.

Ultimately, the aim isn't to create a one-off report you can file away. It's about building a continuous cycle of measuring, analysing, and reducing your emissions. With a clear process and the right tools, you can go beyond just ticking a compliance box. You can start using your carbon data to find cost savings, drive strategy, and build a more resilient business. To see how these concepts work on a smaller scale, you can use a carbon footprint calculator to reduce your impact and watch the principles come to life.

The Business Case for Counting Carbon

Let's be clear: treating carbon accounting in construction and real estate as just another box to tick for compliance is a massive missed opportunity. If you see it as a chore, you're looking at it all wrong. Think of it instead as a powerful lens, one that brings hidden financial risks and new commercial opportunities into sharp focus. It’s how you turn sustainability from a cost centre into a genuine value driver.

Having transparent carbon data is no longer just a nice-to-have for the annual ESG report. It’s now a fundamental tool for building a more resilient, competitive business. This shift is actively changing how the market defines value, and the companies that get ahead of it are already seeing tangible returns.

Unlocking Financial and Reputational Gains

A well-documented, low-carbon footprint is fast becoming one of the most valuable assets a building can possess. Investors and lenders are now actively hunting for projects with solid green credentials. They're often willing to offer better "green financing" terms for developments that can actually prove their sustainability performance, opening up new streams of capital and potentially lowering the cost of borrowing.

But it goes well beyond just securing funding. A low-carbon profile has a direct, positive impact on a property's market appeal and its bottom line.

- Increased Property Values: Buildings with lower operational and embodied carbon are simply seen as premium assets. They're better protected from future carbon taxes and unpredictable energy prices, making them a much smarter long-term bet.

- Higher Rental Premiums: Top-tier corporate tenants are increasingly willing to pay more for office spaces that align with their own sustainability commitments. A certified low-carbon building acts like a magnet for attracting and keeping these high-quality occupants.

- Enhanced Brand Reputation: When you can show a real, data-backed commitment to decarbonisation, you build trust. It sets your brand apart in a very crowded market, resonating with clients, partners, and the public.

Driving Efficiency and Cost Savings

The ripple effect of good carbon accounting touches your operational efficiency, too. The process of gathering detailed data often shines a light on significant waste and inefficiencies that were flying under the radar. For instance, tracking energy use across different sites might flag an underperforming HVAC system, pointing you toward an upgrade that will slash your utility bills.

Proactive carbon management is not a niche activity for eco-warriors. It is a cornerstone of financial prudence and long-term success in the modern built environment.

The same logic applies to logistics. Analysing the emissions from transporting materials can reveal smarter ways to plan routes and cut down on fuel costs. This is a central piece of the puzzle, and for anyone wanting to get into the details, our guide on carbon accounting for supply chains explained is a great resource.

At the end of the day, almost every tonne of carbon you save is linked to reducing waste, lowering energy consumption, and using materials more intelligently. The business case isn't just there; it's compelling.

Answering Your Questions

Getting to grips with carbon accounting in construction and real estate naturally brings up a few questions. Let's tackle some of the most common ones to help you feel more confident about putting these principles into practice.

What's the Toughest Nut to Crack in Construction Carbon Accounting?

Without a doubt, the biggest headache is calculating Scope 3 emissions. Think of these as the indirect emissions tied to your entire value chain—everything from the embodied carbon in the steel and concrete you buy to the fuel used by third-party delivery trucks and the waste hauled away from your site.

Pulling together reliable data from dozens, sometimes hundreds, of suppliers and subcontractors is a massive coordination effort. But it’s absolutely essential if you want an honest, complete picture of your project's carbon footprint.

Is This Really Feasible for a Small Construction Firm?

Yes, it absolutely is. It might look daunting from the outside, but smaller companies can get started by focusing on the low-hanging fruit. That usually means tackling your direct fuel use (Scope 1) and the electricity you purchase (Scope 2), simply because you already have that data in your bills.

The secret is just to start measuring. It won't be perfect on day one. Begin with industry-average emission factors for a few key materials to build a baseline. You can then work on improving the quality and detail of your data over time.

How Does All This Carbon Talk Actually Affect Property Value?

It's already having a major impact. A building's carbon performance is quickly becoming a key factor in its market valuation. Properties with low operational and embodied carbon are simply more appealing to investors and tenants who are serious about their ESG goals.

These greener, more efficient buildings tend to see real financial benefits:

- Higher rents, as environmentally-conscious corporate tenants are willing to pay more.

- Lower operating costs over the long haul, thanks to better energy efficiency.

- Less exposure to risk from potential carbon taxes or stricter regulations down the road.

This advantage has a name: the "green premium." It creates a direct line between solid carbon accounting and higher asset values, making sustainability a smart financial move.

Ready to ditch the spreadsheets and get a real handle on your carbon management? The AI-powered platform from Carbonpunk delivers the precision and insight you need to master your supply chain emissions and hit your sustainability targets. Find out how we can help you at https://www.carbonpunk.ai/en.