Effective Carbon Pricing Strategies for Businesses

Karel Maly

September 20, 2025

For any forward-thinking business, carbon pricing strategies are no longer a distant concern—they're a fundamental piece of financial planning and risk management, right up there with currency fluctuations and supply chain costs.

It’s helpful to think of carbon pricing as a disposal fee for pollution. It puts a direct, monetary cost on greenhouse gas emissions, taking something that was once an abstract environmental problem and turning it into a concrete operational expense.

Why Carbon Pricing Is Now a Business Imperative

The idea of paying for emissions might sound like another layer of red tape, but its real-world impact is far more profound. For businesses here in the Czech Republic and across Europe, carbon pricing directly affects the bottom line, influencing everything from electricity bills to the cost of raw materials. Ignoring it is like ignoring any other major market force—a gamble most businesses can’t afford to take.

This isn't just a theoretical pressure. The financial sting is already being felt. In May 2025, for example, the price of coal shot up by a staggering 56.35% (CZK 413.30 per 100 kg), while natural gas jumped 14.47% (CZK 285.00 per MWh). These spikes were driven, in part, by the rising cost of ETS certificates. These are real costs that companies either have to absorb, hitting their margins, or pass on to their customers. You can read more on this from the Czech National Bank's blog.

Turning Risk into Strategic Advantage

This is where the opportunity lies. When you actively engage with carbon pricing, it stops being a threat and becomes a powerful strategic tool. Getting ahead of these costs gives your organisation a real competitive advantage.

By mastering this landscape, you can:

- De-risk future investments by assessing new projects with a clear view of their potential carbon costs.

- Boost operational efficiency by pinpointing and tackling the biggest sources of emissions in your operations.

- Innovate and create low-carbon products that stand out in a market with increasingly eco-conscious customers.

- Build a stronger brand reputation by showing tangible proof of your commitment to climate action.

At its core, a smart carbon pricing strategy creates a clear financial reason to go green. It aligns your sustainability efforts with your economic performance, proving that what’s good for the planet can also be great for your bottom line.

By integrating a price on carbon into financial planning, companies can make smarter, more resilient decisions that prepare them for an increasingly carbon-constrained world. It’s about future-proofing your business model.

The First Step Towards Mastery

The whole journey starts with one crucial step: understanding your own emissions. You can’t manage what you don’t measure. Calculating your company's carbon footprint is the essential first move, giving you the hard data needed to see where you’re exposed to external carbon prices and how to build an effective internal plan. A thorough analysis is key to understanding the ROI of carbon footprint tracking for your business.

Once you have that baseline, you can start exploring specific tools like Emissions Trading Systems (ETS), carbon taxes, or internal "shadow prices" to guide your decisions. Each of these mechanisms translates emissions into a language the entire organisation understands: money. This guide will walk you through these strategies, helping you shift from simply reacting to regulations to proactively managing your carbon future.

Navigating External Carbon Pricing Mechanisms

When governments decide to put a price on carbon, they generally head down one of two main paths. For any business, getting to grips with the differences between these government-led, or external, carbon pricing mechanisms isn't just a theoretical exercise—it directly impacts your operational costs, compliance duties, and long-term investment plans.

The two most common approaches are Emissions Trading Systems (ETS) and Carbon Taxes. While both are designed to cut greenhouse gas emissions, they work in completely different ways. One creates a bustling market for pollution permits, while the other simply applies a fixed cost to emissions.

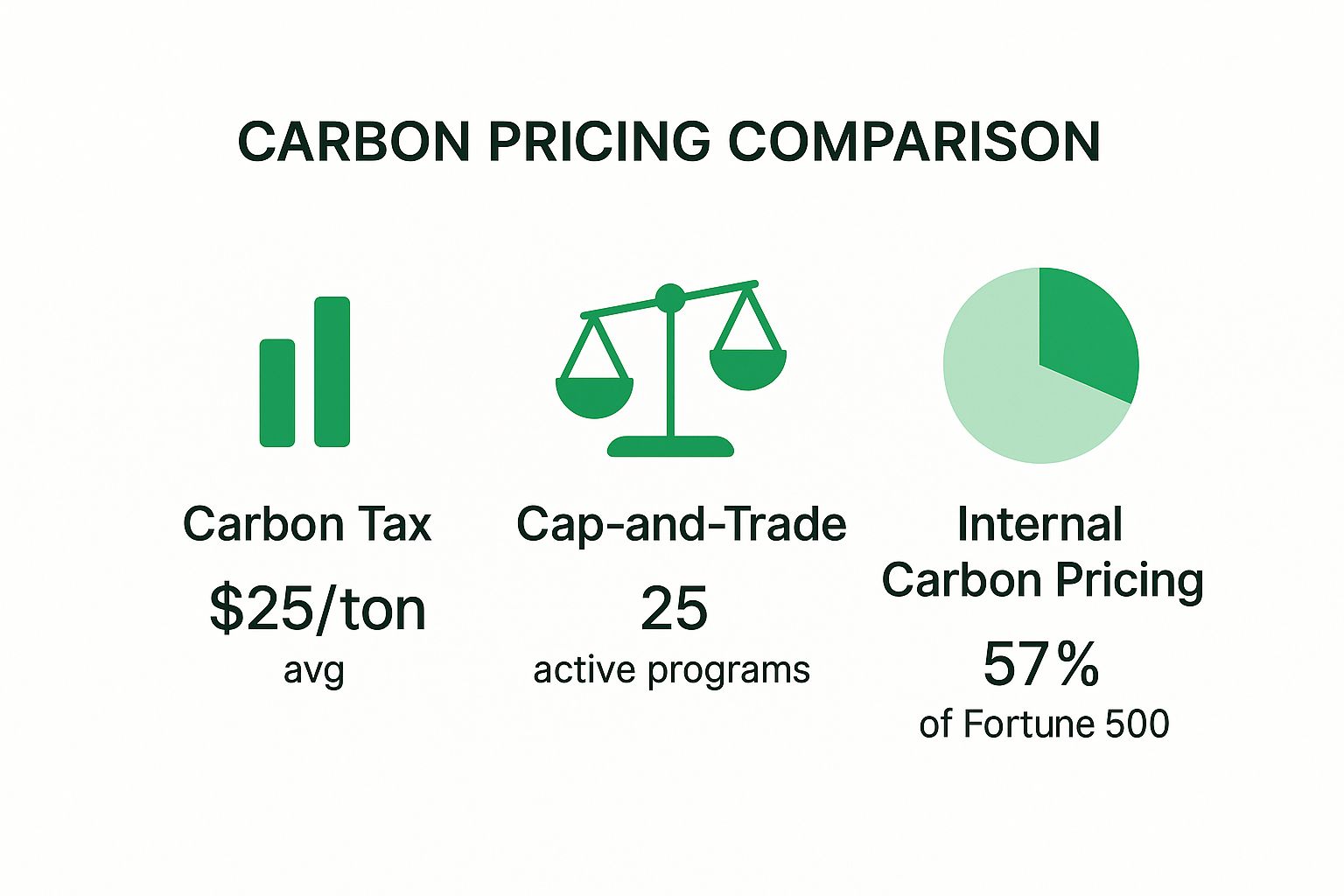

This snapshot of key carbon pricing strategies shows just how widely they're used across the globe and their typical price points, offering a quick comparison for business leaders.

The data makes it clear: while carbon taxes are a popular starting point, market-based systems like cap-and-trade and proactive internal pricing by major corporations are also widespread and powerful strategies.

Understanding Emissions Trading Systems

An Emissions Trading System, often just called a "cap-and-trade" system, essentially works like a stock market for emissions. First, a government authority sets a firm limit—the cap—on the total amount of greenhouse gases that certain industries can emit over a specific period.

This total emissions budget is then divided into individual permits, or allowances, where each one gives the holder the right to emit one tonne of CO₂. These allowances are then handed out to companies, either for free or through auctions.

Now, here’s the clever part. The cap is designed to shrink over time. This makes the allowances increasingly scarce and, as a result, more valuable. This scarcity creates a market where companies that manage to slash their emissions can sell their leftover allowances to businesses that are finding it harder to meet their targets.

This market-based approach gives businesses flexibility. They can decide which path is cheaper for them: invest in cleaner technology to cut their own emissions, or simply buy more allowances on the open market. The trade-off, however, is price volatility. Allowance costs can swing up and down based on supply, demand, and the wider economic climate.

An ETS is powerful because it guarantees a specific environmental outcome—total emissions can't go over the cap. For businesses, though, it adds a new layer of market risk and administrative work, as managing allowances becomes an active part of operations.

The EU ETS is the world's largest and oldest system of its kind, and it’s a classic example of this model in action. Its influence is felt far beyond its direct participants, especially with new rules like the Carbon Border Adjustment Mechanism (CBAM) affecting global supply chains. You can get more details in our essential guide to achieving EU CBAM compliance.

The Straightforward Approach of a Carbon Tax

A Carbon Tax, on the other hand, is a much more direct tool. It’s a simple fee imposed by the government on every tonne of greenhouse gas emissions a company produces. You can think of it like the excise duties on fuel or tobacco, but applied directly to the carbon content of fossil fuels.

So, when a company burns coal, natural gas, or oil, it pays a tax based on the emissions created. This instantly makes carbon-heavy activities more expensive, creating a clear financial reason for businesses and consumers to find cleaner alternatives and become more energy-efficient.

The biggest benefit of a carbon tax for businesses is predictability. The price per tonne is set by the government, which makes it much easier to build into financial forecasts and investment plans. You know exactly what your carbon costs will be for any given level of activity.

The flip side, however, is that there’s no guarantee on the environmental outcome. While the tax definitely encourages emission cuts, the total reduction depends entirely on how businesses and consumers react to the price. If the tax is set too low, it might not be enough to drive real change.

To make it clearer, here’s a breakdown of how the two systems stack up against each other.

Comparing ETS and Carbon Tax Mechanisms

This table offers a side-by-side comparison of the two main external carbon pricing mechanisms to help businesses understand their core differences.

| Feature | Emissions Trading System (ETS) | Carbon Tax |

|---|---|---|

| Price Mechanism | Variable price, determined by market supply and demand. | Fixed price per tonne of CO₂, set by the government. |

| Environmental Outcome | Certain. The "cap" guarantees total emissions won't be exceeded. | Uncertain. The level of reduction depends on the response to the tax. |

| Business Certainty | Price uncertainty makes long-term planning more complex. | Cost certainty makes it easier to budget and plan investments. |

| Administrative Load | Higher. Requires monitoring, reporting, and trading of allowances. | Lower. Often integrated into existing tax collection systems. |

| Flexibility | High. Companies can choose to reduce emissions or buy allowances. | Lower. The primary option is to reduce emissions to avoid the tax. |

In short, an ETS provides environmental certainty with price volatility, while a carbon tax offers cost predictability but with less certainty about the final emissions reduction.

How These Systems Impact Your Business

Looking at these two primary carbon pricing strategies for businesses, you can see they create very different operational realities:

- Cost Management: With an ETS, costs are dynamic and demand active market engagement. A carbon tax creates predictable costs that can be managed through straightforward budgeting.

- Administrative Burden: ETS compliance is a bigger job, involving monitoring, reporting, and trading. A carbon tax is usually simpler, often piggybacking on existing systems like fuel levies.

- Incentive for Innovation: Both systems spur innovation. An ETS rewards companies that can cut emissions for less than the market price of an allowance. A carbon tax incentivises any reduction that costs less than the tax itself.

In many places, including the Czech Republic, businesses often have to navigate a hybrid model. Recent data shows that 74.6% of the country's total GHG emissions are covered by some form of carbon price. The EU ETS covers 47.1% of these emissions, but additional fuel excise taxes cover another 31.2%. This shows how different mechanisms can work side-by-side, meaning businesses need to be skilled at handling both market-based systems and direct taxes.

Building Your Internal Carbon Pricing Strategy

While dealing with systems like the EU ETS is mostly about compliance, the truly forward-thinking companies are taking matters into their own hands by setting an internal carbon price. This isn't about paying a tax to someone else. It's about voluntarily putting a price tag on your own company's emissions to make smarter, sharper business decisions.

Imagine adding a "carbon cost" line item to every new project proposal or investment plan. It’s a simple but powerful shift that turns carbon management from a reactive, box-ticking exercise into a proactive engine for innovation and long-term resilience.

By putting one of these carbon pricing strategies for businesses in place, you start to see around corners. You can get ahead of future regulations, spot hidden financial risks tied to climate change, and steer your investments towards cleaner tech long before your competitors even know what’s happening.

Choosing Your Internal Pricing Model

When it comes to internal carbon pricing, there are three main flavours. Each one serves a different purpose, and it's not uncommon for businesses to mix and match them to meet different goals.

-

Shadow Price: This is the most popular place to start. A shadow price is a theoretical, "what-if" cost you apply to each tonne of CO₂. No actual cash changes hands. Instead, this imaginary cost gets plugged into the financial models for new investments. It helps you answer critical questions like, "Would this new factory still be a good investment if a carbon tax of €80 per tonne came into force?"

-

Internal Carbon Fee: This model has real teeth. Here, individual business units are actually charged a fee based on the emissions they produce. The money collected is typically ring-fenced into a central fund used to pay for sustainability projects, like energy-efficiency upgrades or switching to renewable energy. It creates a very direct and powerful incentive for managers to slash their department's carbon footprint.

-

Implicit Price: This one is more of a look-back calculation. You figure out your implicit price by looking at what you've already spent on cutting emissions and dividing that cost by the tonnes of CO₂ you saved. For example, if you spent €1 million on new machinery that cut emissions by 20,000 tonnes, your implicit carbon price for that project was €50 per tonne. It’s a great way to see how cost-effective your past decarbonisation efforts have been.

An internal carbon price forces you to view emissions through a financial lens. It embeds the cost of pollution directly into your business case, making the argument for sustainable investments clearer and more compelling for everyone from project managers to the board.

Setting the Right Price for Your Business

Figuring out what price to set is probably the most crucial step. Go too low, and it won't be enough to change behaviour. Go too high, and you could accidentally kill off perfectly good projects. There’s no magic number, but a few key factors can help guide you to the right place.

The trick is to balance your own internal ambitions with what's happening in the outside world. That way, the price you land on is high enough to make a difference but realistic enough to be used in day-to-day operations.

Key Considerations for Price Setting

- External Benchmarks: Keep a close eye on existing carbon taxes and ETS prices, like the one for the EU ETS. Aligning your internal price with these real-world market signals makes sure it reflects actual regulatory risks.

- Decarbonisation Goals: Your price needs to be high enough to make the low-carbon option the financially smart option. If you want to switch your vehicle fleet to electric, the carbon price should help bridge the cost gap, making an EV’s total cost of ownership look much better than a petrol car's.

- Peer Benchmarking: See what others in your industry are doing. Researching the internal carbon prices of your peers gives you a valuable reference point and helps you stay competitive.

- Social Cost of Carbon: For those looking to be leaders, some companies set their price based on the estimated societal damage caused by a tonne of CO₂. These figures can range anywhere from $50 to over $200.

Integrating the Price into Business Decisions

Just having a price isn't enough—it needs to be woven into the very fabric of how your company makes decisions. The ultimate goal is to make thinking about carbon costs as normal as thinking about labour or material costs.

To get there, you need to embed your internal carbon price into the core functions of the business. This is where your strategy moves from a nice idea on a slide deck to a practical, everyday tool.

- Capital Expenditure (CapEx): Every major investment proposal should have to calculate its lifetime carbon costs using your internal price. This immediately helps you prioritise projects with a smaller carbon footprint.

- Mergers and Acquisitions (M&A): A shadow price can be used to assess the carbon liability of a company you’re thinking of buying, uncovering risks that would never show up on a traditional balance sheet.

- Research and Development (R&D): Guide your innovation pipeline. By applying the carbon price to new product development, you’ll naturally favour designs that are more energy-efficient or use greener materials.

- Supply Chain Management: Start judging your suppliers on more than just price and quality. Use your internal price to put a real number on the cost of having a high-emission supply chain.

By making your internal carbon price a standard part of these key processes, you create a powerful cycle of continuous improvement. It becomes a fundamental tool for building a more resilient, efficient, and future-proof business.

Your Step-By-Step Implementation Roadmap

So, you understand what internal carbon pricing is. The next big question is, how do you actually do it? Moving from theory to practice requires a clear, structured plan.

Think of it as a roadmap. We’ll break down the entire process into five manageable steps. This isn't just about ticking a box; it's about weaving this powerful concept into the fabric of your business operations. Following this plan will help you build a robust framework that prepares you for regulations, drives real efficiency, and uncovers new opportunities for innovation.

Let’s get started.

Step 1: Measure Your Complete Carbon Footprint

You can't manage what you don't measure. It’s an old saying, but it’s the absolute truth here. The very first step is to get a complete, honest picture of your company's greenhouse gas (GHG) inventory.

This goes beyond just the obvious stuff, like emissions from your factory chimneys (Scope 1) or the electricity you buy (Scope 2). The real challenge, and where the most significant insights often lie, is in mapping your Scope 3 emissions. This covers everything else in your value chain—from the raw materials you source to how your customers use and dispose of your products.

A full footprint analysis is non-negotiable. It shows you exactly where your emissions "hotspots" are, so you can focus your energy where it will make the biggest difference. Trying to set a carbon price without this data is like navigating without a map.

Your carbon footprint is the bedrock of your entire strategy. An accurate, complete measurement across all three scopes is the only way to create an internal price that reflects your true climate impact and risk.

If you’re wondering how to tackle this, our guide to choosing a carbon analysis tool for companies breaks down how modern platforms can make this critical first step much simpler.

Step 2: Assess Your Regulatory and Market Exposure

Once you know your own emissions, you need to look outside. What external pressures is your business facing? This means digging into the carbon pricing regulations in every region you operate in, both current and on the horizon.

Are you already covered by a system like the EU ETS? Is there a carbon tax being debated in a key market? Knowing your compliance obligations is the first piece of the puzzle.

Your homework here should include:

- Direct Costs: What’s the potential financial hit from mandatory carbon prices on your Scope 1 and Scope 2 emissions?

- Indirect Costs: How could carbon pricing ripple through your supply chain? Think higher prices for materials, transport, and other services.

- Market Trends: Pay attention to your customers, investors, and even your competitors. Are they making moves? Understanding their expectations can reveal both risks and competitive advantages.

This whole assessment helps you establish a realistic "floor" for your internal carbon price. At a bare minimum, it should reflect the real-world costs you're likely to face sooner or later.

Step 3: Select and Design Your Internal Pricing Model

With a clear view of your footprint and your external risks, it's time to choose the right tool for the job. Which internal carbon pricing model fits your company's culture, goals, and maturity level? As we've covered, your main choices are a shadow price, an internal fee, or an implicit price.

This isn't a random choice; it's a strategic one.

- A shadow price is a great starting point for companies new to this. It’s a low-risk way to factor carbon costs into big decisions for the future, without messing with today's budgets.

- An internal carbon fee is a bolder move. This is for organisations ready to create real financial carrots and sticks to drive decarbonisation, often using the collected funds for green projects.

- An implicit price is more of an analytical tool. It’s often used alongside another model to figure out how cost-effective your past reduction efforts were, helping you make smarter choices going forward.

Once you’ve picked your model, you have to set the actual price. This figure should be informed by your risk assessment, your own decarbonisation targets, and what’s happening in the market. Start with a price that’s meaningful but manageable, and build in a clear plan to review and raise it over time.

Step 4: Embed the Price into Core Business Processes

An internal carbon price sitting in a report on a shelf is useless. For it to work, it has to be part of the daily grind of your business. This is where your strategy hits the ground and becomes a reality for your teams.

Think about the key decision points in your company:

- Capital Investments: Every major project proposal should now include an analysis of its lifetime emissions, with a cost calculated using your internal carbon price. This instantly makes low-carbon projects look more attractive financially.

- Operational Budgeting: If you're using an internal fee, department budgets need to account for the cost of their emissions. This gives managers a direct financial reason to find efficiencies.

- Procurement: Start using the carbon price to evaluate your suppliers. It’s a powerful way to quantify the benefit of switching to a partner with a smaller carbon footprint.

- R&D: Let the carbon price guide your innovation. Apply it during new product development to encourage designs that are sustainable from the ground up.

Making this happen takes more than just an email memo. It requires clear communication, training, and the right tools to make it easy for everyone, from engineers to finance managers, to apply the price correctly.

Step 5: Monitor, Report, and Adjust Your Strategy

Finally, remember that this isn't a "set it and forget it" task. Your carbon pricing strategy has to live and breathe with your business. The regulatory world will change, markets will shift, and your own priorities will evolve.

You need a solid system for keeping score. Track key metrics like how much you've reduced emissions, the financial impact of the price, and how many low-carbon projects got the green light. Regular reports to senior leadership and other key stakeholders keep the momentum going and ensure everyone stays bought in.

Most importantly, schedule a review of your carbon price at least once a year. Does it still make sense? Is it high enough to drive change? Be ready to tweak the price—or even the entire model—as you learn and as your climate strategy matures. This iterative loop is what turns a good idea into a lasting, effective tool for decarbonisation.

Turning Regulatory Challenges Into Opportunities

Let's be realistic: getting to grips with carbon pricing isn't always a smooth ride. It can introduce some genuine operational headaches that, at first glance, look like nothing but extra costs. But seeing it that way means you’re missing the bigger picture. A smart approach reframes these regulatory pressures, turning what seems like a risk into a serious competitive advantage and a launchpad for sustainable growth.

The hurdles are real. Businesses often get bogged down in the sheer complexity of collecting emissions data, especially when it’s scattered across a sprawling supply chain. Then there’s the financial whiplash from fluctuating prices in Emissions Trading Systems and the nagging risk of ‘carbon leakage’—where production simply shifts to countries with looser rules. These are all valid concerns, but they’re problems with solutions.

Navigating Common Hurdles

Building a resilient strategy starts with knowing what you’re up against. Understanding these common pain points is the first step to overcoming them.

- Complex Emissions Data: Accurately measuring Scope 1, 2, and especially Scope 3 emissions is a huge job. The data is often fragmented, living in different systems, with various suppliers, and across multiple departments. Pulling it all together for a clear carbon footprint is a major challenge.

- Market Volatility: For any company in the EU ETS, the see-sawing price of carbon allowances creates financial uncertainty. It makes long-term budgeting for compliance costs a moving target and complicates decisions about investing in decarbonisation.

- Carbon Leakage Risk: In globally competitive industries, there's a genuine fear that higher carbon costs will put you at a disadvantage against rivals in regions without similar pricing. This can create pressure to hit pause on green investments or even think about relocating.

For businesses in Czechia, these universal challenges are compounded by a layer of local policy uncertainty. The country’s ranking of 49th in the 2025 Climate Change Performance Index highlights an urgent need for the government to set clearer, more decisive emission reduction targets. This kind of environment makes it tough for companies to plan long-term investments in low-carbon technology while they wait for stronger signals on the future of national carbon pricing. You can discover more insights about the Czech Republic's climate policy performance and what it means for businesses.

The Powerful Upside of Proactive Engagement

While the challenges are undeniable, the opportunities that come from tackling them head-on are far more significant. A well-executed carbon pricing strategy does more than just tick a compliance box; it builds a stronger, more future-proof business from the inside out.

By treating carbon as a strategic financial metric, companies transform a compliance burden into a driver of efficiency, innovation, and long-term value. It’s about playing offence, not just defence.

This shift in mindset unlocks several key benefits that directly impact your bottom line and market standing.

Driving Innovation and Efficiency

The moment you put a price on carbon, you create a powerful internal motivator for innovation. It pushes teams across the entire organisation to find smarter, leaner ways to operate.

This naturally leads to:

- Process Optimisation: You start identifying and cutting out energy waste in manufacturing processes that were previously just accepted as "the cost of doing business."

- Product Redesign: It sparks ideas for new products that are more energy-efficient or made from low-carbon materials, which can open up entirely new markets.

- Technological Adoption: Suddenly, the business case for investing in cleaner technologies—from on-site renewable energy to electric vehicle fleets—becomes crystal clear.

Boosting Brand Reputation and Attracting Investment

In today’s market, a genuine commitment to sustainability is a powerful differentiator. Customers, business partners, and the best talent are all drawn to companies with solid environmental credentials.

What’s more, the financial world is watching closely. Investors and lenders are increasingly using ESG (Environmental, Social, and Governance) criteria to assess risk and decide where to put their money. A robust internal carbon pricing strategy sends a clear signal that your company is proactively managing climate-related financial risks, making you a more attractive, less risky investment. This can mean better access to capital and more favourable loan terms.

By embracing the complexities of carbon pricing, you’re not just complying with rules. You're building a more resilient and competitive organisation, positioning yourself as a leader ready to thrive in the low-carbon economy.

Common Questions About Business Carbon Pricing

Diving into carbon pricing can feel a bit overwhelming, and it’s natural for business leaders to have a lot of questions. While the ideas might seem complex at first, they’re designed to be practical tools. Let’s tackle some of the most common queries head-on to help you build a solid strategy.

Think of this as your quick-reference guide. Getting these fundamentals straight will give you the confidence to move forward.

How Do We Choose the Right Internal Carbon Price?

This is a big one. Finding the right price is less about finding a single "correct" number and more about setting a meaningful one based on solid data. It's a blend of art and science.

To get started, look at what’s happening outside your own walls.

- Look at Regulatory Prices: What are the going rates in mandatory schemes like the EU ETS? Your internal price should, at a minimum, reflect the real-world compliance costs you might face.

- Check on Your Peers: What prices have other companies in your sector shared publicly? Knowing this helps you gauge if your strategy is in line with the industry and keeps you competitive.

- Align with Your Goals: This is crucial. Your price needs to be high enough to actually make a difference. If a low-carbon option still looks too expensive after applying your internal carbon fee, your price is too low to drive real change.

A popular strategy is to begin with a price that mirrors current regulatory markets and then map out a plan to increase it over the years. This gives your organisation a chance to adjust without stalling your progress toward decarbonisation.

Will Carbon Pricing Hurt Our Competitiveness?

It’s a fair question, especially for businesses in energy-hungry sectors that trade globally. The core fear is simple: if you’re paying for carbon and your international competitors aren’t, you could be priced out of the market. This risk is known as carbon leakage.

But here's the other side of the coin. Getting ahead of the curve with internal carbon pricing can actually make you more competitive over the long haul. It forces you to innovate and become more efficient, building resilience against the regulations that are inevitably coming. Plus, with new rules like the EU's Carbon Border Adjustment Mechanism (CBAM), the global playing field is already starting to level out.

Don’t just see it as a cost. Think of internal carbon pricing as an investment in a smarter, more resilient, and future-ready business. It’s about preparing for where the economy is headed.

What Is the Difference Between a Carbon Tax and an ETS?

Both systems put a price on carbon, but they get there from opposite directions.

- A carbon tax is straightforward: it sets a fixed price for every tonne of carbon emitted. This gives businesses certainty about the cost, but the total amount of emissions reduced is less predictable. It all depends on how businesses react to the price.

- An Emissions Trading System (ETS) does the reverse. It sets a firm limit (a cap) on the total volume of emissions allowed. This guarantees a specific environmental outcome. The price, however, floats based on supply and demand for emission allowances, which can create cost uncertainty.

Here’s a simple way to remember it: a tax fixes the price and lets the emissions quantity vary, while an ETS fixes the quantity and lets the price vary.

Ready to turn complex carbon data into a clear strategic advantage? Carbonpunk's AI-driven platform automates emissions tracking across your entire supply chain, providing the high-accuracy data you need to build effective carbon pricing strategies and drive measurable reductions. Learn how you can get started.