Mastering CSRD Reporting Requirements

Karel Maly

August 22, 2025

The Corporate Sustainability Reporting Directive (CSRD) is here, and it’s a game-changer. It requires companies to publish detailed, audited reports on their environmental, social, and governance (ESG) impacts. These aren’t just suggestions; the CSRD reporting requirements are designed to make sustainability data as solid and comparable as the financial numbers you see in an annual report. We're moving away from optional disclosures and into a world of legally mandated transparency.

Unpacking the Shift to Mandatory Sustainability Reporting

The arrival of the CSRD marks a major turning point in corporate accountability. This isn't happening in a vacuum—investors, customers, and regulators have been demanding better, more reliable sustainability information for years. The CSRD isn't just another acronym to memorise; it's a significant upgrade from its predecessor, the Non-Financial Reporting Directive (NFRD).

To put it simply, the NFRD was like a grainy, black-and-white photo of a company’s ESG performance. It gave you a general idea, but the details were fuzzy, and you couldn't easily compare one company's photo to another.

The CSRD, on the other hand, is like a high-definition, 360-degree video. It offers a complete, dynamic, and verifiable picture of how a company’s business impacts the planet and its people—and just as importantly, how sustainability issues impact the company’s bottom line. This two-way view is a cornerstone of the directive, known as double materiality. We’ll dig into that a bit later.

Why This Matters Now

The directive’s ultimate goal is to standardise sustainability data across the EU. The idea is that everyone—from a major investment fund to an everyday consumer—can make decisions based on information they can actually trust. For most businesses, this means it's time to seriously rethink how they gather, manage, and report their ESG data.

This isn’t some far-off deadline, either. The transition is happening now and has real legal teeth. In the Czech Republic, for example, an estimated 1,900 companies need to start collecting data to comply from 1 January 2025. Yet, recent studies show about half of them haven't even started preparing. That's a huge risk, especially when you consider that putting together a compliant report can easily take six months.

The consequences for inaction are steep. Penalties for non-compliance can reach as high as 3% of a company’s total assets. The EU is rolling this out in phases, starting with the biggest companies, which shows just how serious they are about embedding sustainability into the fabric of corporate governance. For a closer look, you can find more details about the Czech companies ignoring sustainability data requirements.

The whole point of the CSRD is to put sustainability reporting on the same footing as financial reporting. ESG information is no longer a side note; it's a core component of the management report, audited and held to incredibly high standards.

This directive creates a new baseline for what it means to be a responsible business. By enforcing a common set of rules—the European Sustainability Reporting Standards (ESRS)—the CSRD ensures that when a company claims to be "green" or "ethical," it has the audited data to prove it. This forces sustainability out of the marketing department and into the boardroom, where it belongs.

Which Companies Must Comply with CSRD

Figuring out if the CSRD reporting requirements apply to your business can feel like trying to solve a tricky puzzle. The directive dramatically widens the net, pulling in far more companies than the old Non-Financial Reporting Directive (NFRD) ever did. We're moving away from a narrow focus on public-interest entities to something much more inclusive, meaning thousands of new businesses now have to get on board.

It helps to think of it as a phased rollout. The plan is to gradually weave sustainability reporting into the fabric of the European economy. The first wave hits the biggest and most influential companies, with others to follow in the coming years. This makes perfect sense—make the businesses with the largest footprint accountable first, and they'll set the standard for everyone else.

The Criteria for Large Companies

So, how do you know if your company is caught in this first wave? A "large" company is defined as one that meets at least two of the following three criteria:

- An average of more than 250 employees during the financial year.

- A balance sheet totalling more than €25 million.

- A net turnover of more than €50 million.

These thresholds are the main gatekeepers for CSRD compliance. If your organisation ticks two of those boxes, you're officially in scope and need to start getting ready. And this isn't just for listed corporations; many large private limited companies will find themselves on the hook as well.

For businesses here in the Czech Republic, these rules are now a local reality. The CSRD directly affects large Czech firms that meet at least two of the thresholds: a net turnover of €50 million or more, over 250 employees, and balance sheet assets exceeding €25 million. The year 2025 is a major turning point, as this group will be preparing its first detailed sustainability reports. It’s a move that will set the benchmark for how all businesses integrate ESG into their core operations. You can learn more about how Czech companies are adapting to these new sustainability rules.

A Practical Example: Prague Precision Engineering

Let's bring this to life with a hypothetical Czech company—we'll call them 'Prague Precision Engineering s.r.o.'. Imagine their financial records from last year looked like this:

- Employees: 310

- Net Turnover: €48 million

- Total Assets: €28 million

Prague Precision Engineering meets two of the three criteria: employees and total assets. Even though their turnover is a little under the threshold, they are squarely within the CSRD's scope. This means their team must start collecting sustainability data for the 2025 financial year to publish their first report in 2026.

This simple check is the first, most critical step for any business leader. It turns the abstract rules of the CSRD into a clear 'yes' or 'no' and tells you exactly how urgently you need to act.

Beyond Large EU Companies

But the directive's reach doesn't stop with large EU companies. The compliance timeline is staggered to bring other types of businesses into the fold over the next few years, creating a much more comprehensive reporting landscape.

- Listed SMEs: Small and medium-sized enterprises listed on regulated EU markets will need to start reporting for the 2026 financial year.

- Non-EU Parent Companies: From 2028, the rules will also apply to non-EU companies that have a major presence in the EU. This includes those generating over €150 million in net turnover within the Union and having at least one large or listed subsidiary or branch here.

This phased approach shows a clear long-term vision. The CSRD is designed to level the playing field, making sustainability transparency a standard business practice for any major player in the EU market, no matter where their headquarters might be.

Getting to Grips with the European Sustainability Reporting Standards

The new CSRD reporting requirements aren't just a simple checkbox exercise. They introduce a whole new language for sustainability called the European Sustainability Reporting Standards (ESRS). Think of the ESRS as the official rulebook, ensuring that when a company talks about its environmental or social impact, it’s speaking the same, verifiable language as everyone else.

This isn’t a static set of rules, either. They are constantly being refined to reflect the evolving European Commission demands for genuine corporate accountability. The goal is to make sustainability information just as reliable and consistent as the financial figures in an annual report. It’s about moving away from glossy, feel-good stories to hard, comparable data.

The Heart of CSRD Reporting: The Double Materiality Principle

Before we get into the nitty-gritty of the specific standards, we need to talk about the core concept that underpins the entire CSRD: double materiality. This isn't just jargon; it’s a fundamental shift in how businesses are expected to view their place in the world. It forces you to look at sustainability through two lenses at the same time.

Picture a busy two-way street.

-

Your Impact on the World (Impact Materiality): This is the traffic flowing out from your company. It covers all the effects, both good and bad, that your operations have on people and the planet. We're talking about everything from the carbon emissions your factories produce to the working conditions within your supply chain.

-

The World's Impact on Your Business (Financial Materiality): This is the traffic coming towards you. It represents how major sustainability trends and events could create real financial risks or opportunities for your company. For instance, could rising sea levels disrupt your coastal operations? Could a consumer shift towards eco-friendly products boost your sales?

Under the CSRD, you’re required to report on what’s happening in both lanes. It’s no longer enough to simply publish a corporate social responsibility report. You now have to clearly disclose how these big-picture ESG issues could realistically affect your bottom line, for better or worse.

Double materiality creates a direct link between a company's sustainability efforts and its financial health. It pulls sustainability out of its silo and places it firmly on the agenda for the CFO and the entire board, making it a central part of corporate strategy.

A Closer Look at the Three Pillars of ESRS

The ESRS framework is built around the familiar ESG (Environmental, Social, and Governance) pillars, but it demands a level of detail that many companies won't be used to. Your double materiality assessment will determine exactly which of these disclosures are relevant to your business.

1. Environmental Disclosures

This pillar is all about your company’s relationship with the natural world. It goes way beyond surface-level green initiatives and demands hard data on your true footprint. Key areas include:

- Climate Change: You’ll need to report on your Scope 1, 2, and 3 greenhouse gas (GHG) emissions and show a clear transition plan for aligning with the Paris Agreement.

- Pollution: This requires detailed disclosures on air, water, and soil pollutants your business generates.

- Water and Marine Resources: Companies must report on their water usage and their impact on marine ecosystems.

- Biodiversity and Ecosystems: You need to detail how your operations affect biodiversity and outline any plans to protect or restore natural habitats.

- Resource Use and Circular Economy: This involves tracking materials from start to finish and explaining your strategies for reducing waste and embracing circular business models.

2. Social Disclosures

The ‘S’ in ESG is about people. This pillar looks at how your company impacts everyone it touches, from employees to the wider community. It requires you to look at:

- Own Workforce: This covers everything from working conditions and health and safety to diversity, inclusion, and equal pay metrics.

- Value Chain Workers: Your responsibility doesn't end at your own front door. You must also report on the labour rights and conditions of workers in your supply chain.

- Affected Communities: Companies have to report on their impact on the local communities where they operate.

- Consumers and End-Users: This includes reporting on product safety, how you protect customer data, and your approach to responsible marketing.

3. Governance Disclosures

The governance pillar is the foundation that holds everything else together. It’s about the internal systems and controls you have in place to manage your company responsibly and transparently. Key topics include:

- Business Conduct: You must disclose your policies on critical issues like anti-corruption, bribery, and corporate lobbying.

- Risk Management and Internal Controls: This requires a clear explanation of how you identify, assess, and manage sustainability-related risks and opportunities.

- Board Oversight: You need to provide details on the board's role in overseeing the company's sustainability strategy and performance.

Navigating the Legal Landscape in the Czech Republic

The Corporate Sustainability Reporting Directive might have started as an EU-level mandate, but don't mistake it for a distant suggestion from Brussels. Here in the Czech Republic, the CSRD is being woven directly into our national laws, giving it real teeth and serious consequences for companies that fall behind.

This transition from directive to domestic law is happening through a major overhaul of Czech legislation. The key piece of the puzzle is the new Accounting Act, which is slated to come into force on 1 January 2025.

Essentially, this new act scraps the old, much looser rules that were put in place for the previous Non-Financial Reporting Directive (NFRD). For your legal and compliance teams, it means the old playbook is out, and a far more detailed and demanding one is taking its place.

The New Accounting Act as the Primary Legal Tool

You can think of the new Accounting Act as the official vehicle driving CSRD requirements onto Czech roads. It lays down the specific legal framework that makes sustainability reporting a non-negotiable part of a company's annual disclosures, right alongside its financial statements. The whole process is being steered by the Czech Ministry of Finance, which is tasked with making sure our national laws are perfectly in sync with the directive's goals.

This legal integration is moving fast. The adoption of CSRD in the Czech Republic is pushing forward through the new Accounting Act, which will be the main legislative instrument for making these obligations a domestic reality. This shift brings with it a massive jump in the number of Czech companies that will have to report—we're going from just a handful of companies to an estimated 1,500 to 1,900 by 2025. It’s a fundamental change in Czech corporate governance, embedding EU sustainability targets firmly into local business practices. You can learn more about the new ESG reporting landscape across CEE to get a broader perspective.

Understanding Local Enforcement and Penalties

With the CSRD becoming part of Czech law, compliance is no longer an abstract concept; it’s a tangible, local issue with specific national enforcement. This isn't about pleasing a regulator in another country; it's about following Czech law. And with that legal backing comes the very real risk of penalties.

The new Czech legal framework will introduce concrete penalties for companies that fail to meet their CSRD obligations. This underscores the real-world costs of inaction and elevates sustainability reporting from a 'nice-to-have' to a critical business function.

Failing to report, providing incomplete data, or skipping the mandatory third-party assurance could lead to significant fines and other sanctions under the updated national laws. This reality means businesses must approach their CSRD preparations with the same level of seriousness they give their financial accounting. For a deeper dive, check out our guide on regulatory compliance and carbon tracking for the Czech Republic. Czech lawmakers are sending a clear message: sustainability reporting is now a core, non-negotiable part of doing business here.

Your Step-by-Step Roadmap to CSRD Compliance

Getting your head around the CSRD’s scope and standards is one thing, but actually putting them into practice is a whole different ball game. To get from theory to action, you need a clear, structured plan. This roadmap breaks the journey down into five manageable stages, turning the tangled web of CSRD reporting requirements into a logical sequence your team can actually follow.

Think of this less like a sprint and more like building a new, solid piece of business infrastructure. Each step lays the foundation for the next, making sure your final report isn't just compliant but is also a genuine strategic asset. If you rush any of these stages, you're setting yourself up for inaccurate data, failed audits, and wasted resources down the line.

For a broader perspective on establishing a compliance framework from scratch, this comprehensive compliance guide offers some excellent high-level insights.

Stage 1: Conduct a Double Materiality Assessment

This is where it all begins, and it’s arguably the most critical step. A double materiality assessment is how you pinpoint which specific sustainability topics are truly relevant to your business. It’s where you apply that "two-way street" principle, figuring out both your company’s impact on the world and how ESG issues affect your bottom line.

This assessment literally defines the scope of your report. Without it, you're just reporting on everything under the sun, which is inefficient and misses the entire point of the ESRS. The goal here is to zero in on what really matters—to your organisation and to your stakeholders.

Stage 2: Perform a Data Gap Analysis

Once you know what to report on, the next question is obvious: what information do you already have? A gap analysis is simply a methodical review of your current data sources, systems, and processes, measured against the specific data points the ESRS demands for your material topics.

You’re bound to find some surprises here. You might discover your HR team already tracks fantastic diversity metrics, or that the operations crew has detailed energy consumption logs going back years. But you'll also find the gaps—areas where you’re collecting no data at all, especially when it comes to tricky things like Scope 3 emissions or labour practices deep in your supply chain.

This stage gives you a clear action plan, showing you exactly where you need to build new data collection processes.

A thorough gap analysis is your best defence against last-minute panic. It tells you where your blind spots are early in the process, giving you the time needed to build the systems to fill them before reporting deadlines loom.

Stage 3: Design Robust Data Collection Processes

With your data gaps mapped out, it's time to build the machinery for gathering, validating, and managing all this ESG information. This usually means creating new workflows and giving people clear responsibilities across different departments—from finance and logistics to HR and procurement. Let's be honest, trying to do this with manual spreadsheets just isn't sustainable at the scale CSRD requires.

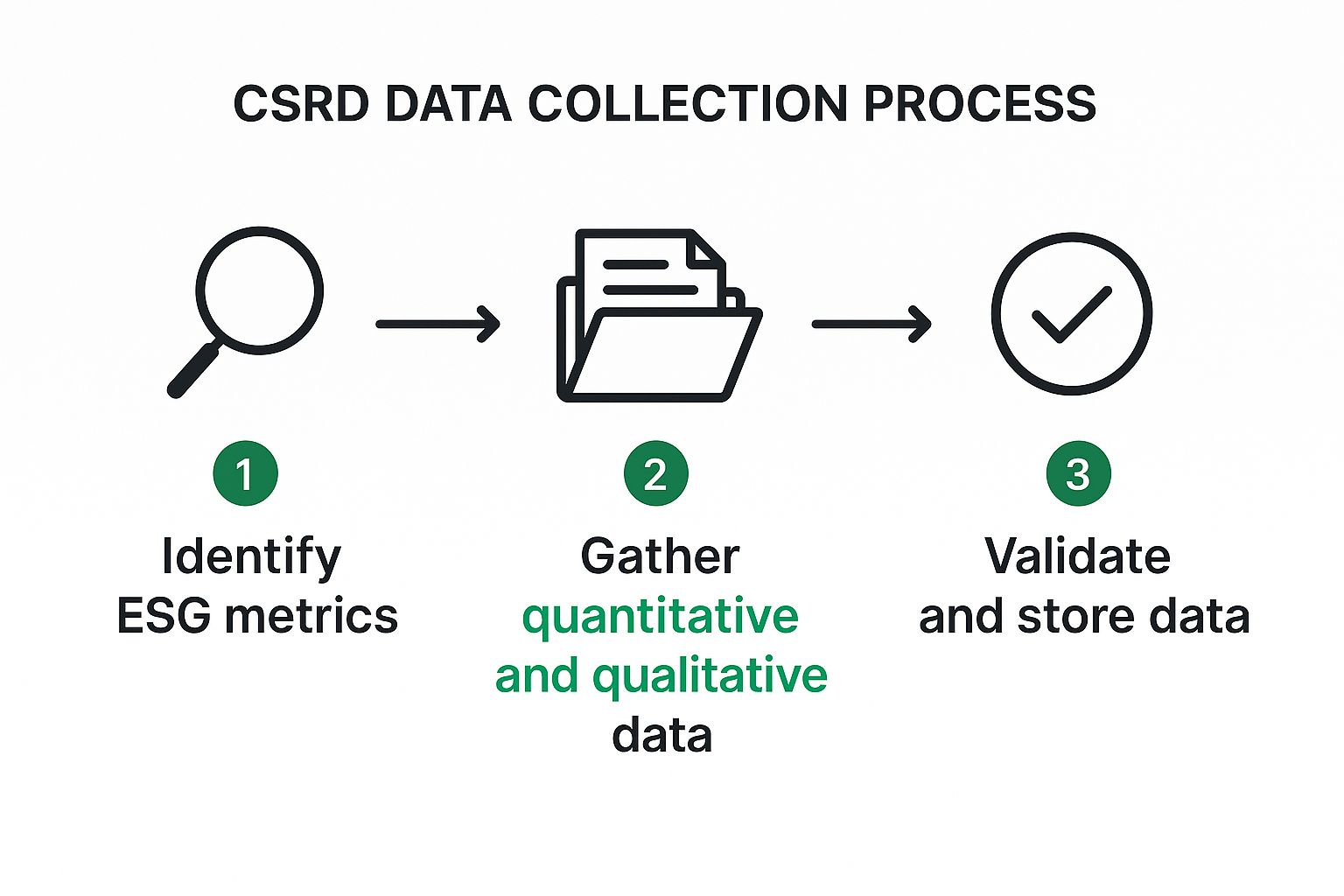

This infographic shows the basic flow of a smart data collection strategy, from identifying what you need to final validation.

As you can see, it's a clear, linear process. The idea is to ensure data isn't just collected, but that it's also accurate and fit for purpose before it ever gets stored for reporting and auditing.

Stage 4: Implement the Right Technology

Trying to manage this flood of new data without the right tools is a recipe for disaster. Modern sustainability platforms, especially those using AI, can do a lot of the heavy lifting for you. These tools are designed to:

- Aggregate data automatically from all sorts of places, like utility bills, ERP systems, and supplier surveys.

- Map data points directly to the relevant ESRS disclosure requirements, making sure nothing falls through the cracks.

- Ensure data quality by flagging weird anomalies and creating a crystal-clear, auditable trail.

Investing in the right software changes compliance from a painful manual chore into a much more efficient, data-driven process. For any business serious about getting this right, looking into automated sustainability reports for ESG compliance is a non-negotiable next step.

Stage 5: Prepare for Third-Party Assurance

Finally, never forget that your CSRD report will be audited. From day one, you need to operate with the mindset that an independent third party is going to scrutinise every single number and claim you make. This means keeping meticulous records of your data sources, how you made your calculations, and your internal controls.

You can't just create an audit trail at the last minute. By embedding this principle into your processes from the very start, you turn the final assurance stage into a smooth validation exercise instead of a frantic, stressful scramble.

How to Use Technology for Smart CSRD Reporting

Trying to meet the new CSRD reporting requirements with old tools is a recipe for disaster. It’s like trying to build a modern skyscraper with just a hammer and nails. Spreadsheets might have been fine for tracking a few numbers in the past, but they simply can’t handle the sheer volume and complexity of data the European Sustainability Reporting Standards (ESRS) now demand.

Manually collecting all this information is painfully slow and full of opportunities for human error. Worse, it often leads to data being trapped in different departments, creating messy, disconnected silos. This makes the mandatory third-party audit an absolute nightmare, as auditors will have a tough time verifying data that doesn’t have a clear, traceable history.

Why Manual Spreadsheets Just Won't Cut It Anymore

The ESRS isn't just asking for a few data points; it requires a complete, interconnected picture of your company's sustainability impact. You need to pull information from a huge range of sources – think utility bills for energy use, HR systems for employee data, and even complex datasets from hundreds of suppliers to calculate your Scope 3 emissions.

Doing this by hand isn't just inefficient; it's a massive compliance risk waiting to happen. Specialised software isn't a luxury anymore; it's essential for getting your CSRD reporting right.

Think of these platforms as the central nervous system for all your sustainability data, giving you a single source of truth. They're built to:

- Automate Data Collection: They can connect directly to your different systems and pull the information automatically, which means no more manual data entry and far fewer mistakes.

- Keep Data Accurate and Consistent: These tools standardise your data and can flag anything that looks out of place, ensuring your information is reliable enough for an audit.

- Link Data to ESRS Rules: They automatically map your data to the specific ESRS disclosure requirements, so you don’t miss anything important.

Technology turns CSRD compliance from a frantic data-hunting mess into a structured, manageable workflow. It gives you the solid, auditable foundation you need to meet the directive's tough standards for transparency.

The Power of AI-Driven Platforms

The best platforms, especially those using Artificial Intelligence, do much more than just collect data. AI can sift through massive amounts of information to spot patterns, risks, and opportunities that a human team would almost certainly miss.

For instance, an AI tool could analyse your logistics data and suggest more efficient shipping routes. This simple change could lead to real cost savings and a drop in your greenhouse gas emissions. That’s exactly the kind of credible, data-backed action you need for your transition plan. Digging into https://www.carbonpunk.ai/en/blog/ai-for-sustainability-reporting-essential-strategic-insights will give you a better idea of how powerful this can be.

Building a Data Trail Auditors Will Love

One of the biggest wins from using dedicated software is the creation of a clean, unchangeable audit trail. Every single data point, calculation, and correction is tracked and logged. This gives third-party auditors the transparent evidence they need to confidently sign off on your report.

To keep all this information organised, consider creating a robust internal knowledge base. This can act as a central library for all your sustainability data, processes, and reports, ensuring everyone from the C-suite to the sustainability team is on the same page. In the end, investing in the right technology isn't just another expense—it's a smart investment in efficiency, accuracy, and your company's future compliance.

Got Questions About CSRD? We’ve Got Answers

Stepping into the world of CSRD reporting can feel like learning a new language. As businesses start to get their heads around the new rules, a few key questions pop up again and again. Getting these sorted is the best first step you can take towards a clear compliance plan.

Think of this section as your cheat sheet. We'll cut through the jargon, compare the new with the old, and give you some practical first moves.

So, How Is CSRD Different From a Regular ESG Report?

This is a big one. While both deal with sustainability, comparing CSRD to a standard ESG report is like comparing a legally binding contract to a friendly handshake.

Most ESG reports have been voluntary, meaning companies could pick and choose what to include. The format, depth, and reliability were all over the map. CSRD changes the game entirely. It’s a legally binding directive that mandates a strict reporting format—the European Sustainability Reporting Standards (ESRS). Plus, and this is crucial, it demands a mandatory third-party audit, giving it the same weight as your financial statements.

What Does "Double Materiality" Actually Look Like?

The term 'double materiality' sounds a bit academic, but the idea behind it is pretty simple. It just means looking at risk and impact from two sides.

Let’s take a fictional Czech furniture maker. Under double materiality, they need to report on:

- Their impact on the world: How does sourcing wood contribute to deforestation? This is the 'inside-out' view.

- The world's impact on them: What happens if new anti-deforestation laws pass? This could jack up their material costs and disrupt their entire supply chain, hitting their bottom line. That's the 'outside-in' view.

Do We Need to Hire a Consultant?

It’s a common question: should we bring in outside help for this? While there’s no rule saying you must, tapping into external expertise can be a massive help, especially if your company is just starting its sustainability reporting journey.

The smartest approach is often a hybrid one. Build a dedicated team internally, use smart tech platforms to handle the heavy lifting of data collection, and call in the experts for tricky, high-stakes tasks like your first big materiality assessment.

By mixing internal ownership with specialised external support, you build your own long-term expertise while making sure the most complex bits of CSRD are handled correctly from day one.

What Are the First Three Things We Should Do?

Feeling a bit overwhelmed? Don't be. Just focus on a few key actions to get the ball rolling. Here’s where to start:

- Build a Cross-Functional Team: Get people from finance, operations, HR, and legal in a room together. You need all these viewpoints from the very beginning.

- Run a Quick Materiality Assessment: You don't need a perfect, exhaustive list yet. Just start mapping out the sustainability topics that are most obviously important to your business. This will give you an initial focus.

- Do a Data Gap Analysis: Figure out what information you already have and, more importantly, what you're missing. This tells you what data you need to start collecting right away.

Ready to turn CSRD compliance from a headache into a real business advantage? The AI-powered platform from Carbonpunk automates your data gathering, gets you audit-ready, and delivers the insights you need to meet every requirement. See how we can make your sustainability reporting journey simpler.