ESG Integration in Supply Chain Finance Guide

Karel Maly

October 2, 2025

Integrating ESG criteria into supply chain finance isn't just a "nice-to-have" anymore; it's rapidly becoming a core part of business strategy. This approach is all about weaving Environmental, Social, and Governance factors directly into the financial decisions that underpin your supply chain. It's a move away from purely transactional relationships towards creating true, value-aligned partnerships that build resilience and unlock new financial opportunities.

Why ESG Is the New Blueprint for Supply Chain Finance

Think of a traditional supply chain as a simple, old-school electrical circuit. It gets the job done, moving goods and capital from A to B. But it's fragile. One break in the line, and the whole system can shut down. In today’s world of constant disruption and heightened expectations, that old model just doesn’t cut it.

Now, picture an ESG-integrated supply chain as a modern smart grid. It’s intelligent, responsive, and built to last. It actively monitors the flow of resources, reroutes power to prevent outages, and constantly optimises for efficiency. This is exactly what ESG integration in supply chain finance accomplishes.

By embedding sustainability criteria into financial agreements, companies, suppliers, and financiers create a much stronger, more transparent ecosystem. This isn't just about ticking compliance boxes; it's a strategic framework for building a future-proof operation. To really see how this works in practice, it helps to understand the wider context of a comprehensive guide to international supply chain management.

A Strategic Shift Driven by Market Realities

This shift towards sustainable supply chains isn't happening in a vacuum. It's a direct response to real-world market pressures and emerging opportunities. For instance, a Deloitte survey revealed that 71% of companies in the CEE region, including the Czech Republic, are already tackling sustainability, with another 20% planning to start soon. The key takeaway? Market trends and customer demand are huge catalysts, showing that ESG has gone mainstream.

This data highlights a crucial point: ignoring ESG is no longer a viable option. It affects everything from your brand’s reputation to your ability to secure capital.

ESG principles are reshaping how we define value. Financiers now see strong ESG performance as a clear indicator of lower risk, better management, and long-term operational resilience.

This new perspective fundamentally changes the dynamic between buyers and suppliers. The conversation is no longer just about price and delivery schedules. It now includes:

- Environmental Performance: Are you tracking carbon emissions, managing waste effectively, and using resources efficiently? A solid system for emissions tracking is vital here.

- Social Responsibility: This is about ensuring fair labour practices, safe working conditions, and ethical sourcing throughout every tier of your supply chain.

- Governance Quality: This focuses on transparency, ethical business conduct, and having robust risk management frameworks in place.

By making these elements a priority, businesses aren't just doing good—they're building a powerful competitive advantage that resonates with investors, customers, and regulators.

Key Pillars of ESG in Supply Chain Finance

To break it down further, let's look at how each ESG pillar specifically applies to supply chain finance. The following table summarises what each component focuses on and how it directly influences financial decisions and incentives.

| Pillar | Focus Area in Supply Chains | Impact on Finance |

|---|---|---|

| Environmental | Carbon footprint reduction, waste management, sustainable sourcing, water usage, and pollution control. | Better financing rates for suppliers meeting emission targets; access to "green loans"; lower insurance premiums. |

| Social | Fair labour practices, worker safety (OH&S), diversity and inclusion, and community engagement. | Reduced operational risk; eligibility for social-impact funds; enhanced brand reputation attracting investment. |

| Governance | Ethical conduct, supply chain transparency, anti-corruption policies, and data security. | Increased investor confidence; lower cost of capital due to perceived lower risk; stronger, more stable supplier relationships. |

Ultimately, these pillars work together to create a more holistic view of a supplier's health and long-term viability, moving beyond simple credit scores to a much richer, more accurate assessment of risk and opportunity.

Getting to Grips with ESG-Driven Finance

Before we can see how ESG transforms supply chain finance, we need to understand the two pieces of the puzzle separately. Let's start with the basics: what exactly is Supply Chain Finance (SCF)?

At its core, SCF is all about keeping the financial wheels of a supply chain turning smoothly by optimising cash flow for everyone involved.

Picture a large, well-established company—the buyer—working with a bank to support its smaller suppliers. The buyer might extend its own payment terms to 60 or 90 days, which is great for its own working capital. But instead of leaving its suppliers in a lurch, the SCF programme allows them to get paid by the bank almost immediately, often within days. The best part? They get this early payment at a very low interest rate, one based on the buyer's excellent credit rating, not their own.

It's a genuine win-win. The buyer manages its cash more effectively, while the suppliers get quick, affordable access to capital. This keeps them liquid, stable, and reliable.

Now, let's bring ESG into this picture.

Adding an ESG Layer to the Financial Model

ESG-driven finance takes this proven SCF model and adds a powerful new dimension. It shifts the conversation from just "Is this supplier financially sound?" to include "Is this supplier operating in a responsible, sustainable way?" The letters E, S, and G stop being just boxes to tick for a corporate responsibility report and become hard-nosed factors that directly impact financial deals.

This means a supplier's performance against key sustainability goals can unlock better financing rates or more favourable payment terms. Suddenly, ESG is no longer just a cost centre; it’s a clear financial benefit.

By linking a company’s sustainability performance directly to its cost of capital, ESG integration makes responsible business practices profitable. Better performance equals better financial terms. It’s that simple.

So, what do these three pillars actually look like on the ground, in a real supply chain?

-

Environmental (E): This is all about a company's footprint on our planet. In a supply chain context, this means concrete actions like cutting carbon emissions from transport, reducing water consumption in factories, minimising waste, and using sustainably sourced materials. A strong 'E' score isn't just good for the environment; it signals a business that's efficient and ready for future climate regulations. If you want to dive deeper, our guide on carbon accounting for supply chains explained is a great place to start.

-

Social (S): The social pillar is about people. How does a company treat its employees, its customers, and the communities it touches? We're talking about fair labour practices, safe workplaces, a commitment to diversity, and a zero-tolerance policy for human rights abuses. A supplier that excels here is typically more stable, with happier, more productive staff and less risk of a brand-damaging scandal.

-

Governance (G): Governance is the rulebook a company lives by. It’s a measure of transparency, ethics, and accountability. This includes everything from solid anti-corruption policies and data security to clear reporting and effective board oversight. Good governance is a sign of a well-run, low-risk company, which gives financiers the confidence they need to invest.

By weaving these E, S, and G criteria into financial agreements, we create a powerful incentive for the entire supply chain to raise its game. It’s not about punishing laggards, but rewarding those who are genuinely committed to doing business the right way. This shift changes how we look at risk, building a supply chain that is more resilient, more ethical, and ultimately, more profitable for everyone.

Actionable Frameworks for ESG Integration

Putting theory into practice demands a clear roadmap. To really embed sustainability into your financial operations, you need a structured framework that turns broad ESG goals into concrete actions and real incentives. These models are the "how-to" guide for making ESG integration in supply chain finance a reality.

Think of it like setting up a loyalty programme for your suppliers. Just as a frequent flyer earns better perks, a supplier who proves their commitment to ESG should unlock better financial terms. This simple shift turns sustainability from a box-ticking exercise into a genuine competitive edge.

Performance-Based Financing Models

One of the most powerful frameworks is performance-based financing. Here, the logic is simple: the cost of capital is directly linked to a supplier's verified ESG score. A higher score—which shows better environmental care, social responsibility, and governance—leads to more attractive financing, like lower interest rates on early payments.

This creates a fantastic, self-reinforcing cycle. Suppliers are genuinely motivated to improve their ESG game because it directly helps their cash flow. For your own business, this de-risks the entire supply chain by nudging partners to become more resilient and responsible.

For this framework to work, you need three things:

- Define Clear ESG Key Performance Indicators (KPIs): Get specific and measurable. Think in terms of tonnes of CO₂e reduced, the percentage of waste recycled, or confirmed compliance with fair labour standards.

- Establish a Tiered System: Create clear performance levels (e.g., Bronze, Silver, Gold) tied to specific financing discounts. This gamifies the process and shows suppliers a clear ladder to climb.

- Implement Robust Data Verification: You can't manage what you don't measure accurately. Use a mix of self-reported data, third-party audits, and technology platforms to ensure your ESG scores are trustworthy.

Positive Incentive Models

Another route is the positive-incentive model. Instead of tying financing rates to an overall ESG score, this approach rewards suppliers for hitting specific, pre-agreed sustainability milestones. This can be a much easier way to get started, especially with suppliers who are new to the world of ESG.

For example, a supplier might get a one-off bonus or a temporary rate cut for completing an energy audit, gaining a key safety certification, or rolling out a diversity and inclusion programme. The focus here is on progress, not perfection. It’s all about celebrating those incremental wins to build momentum for bigger changes across your network.

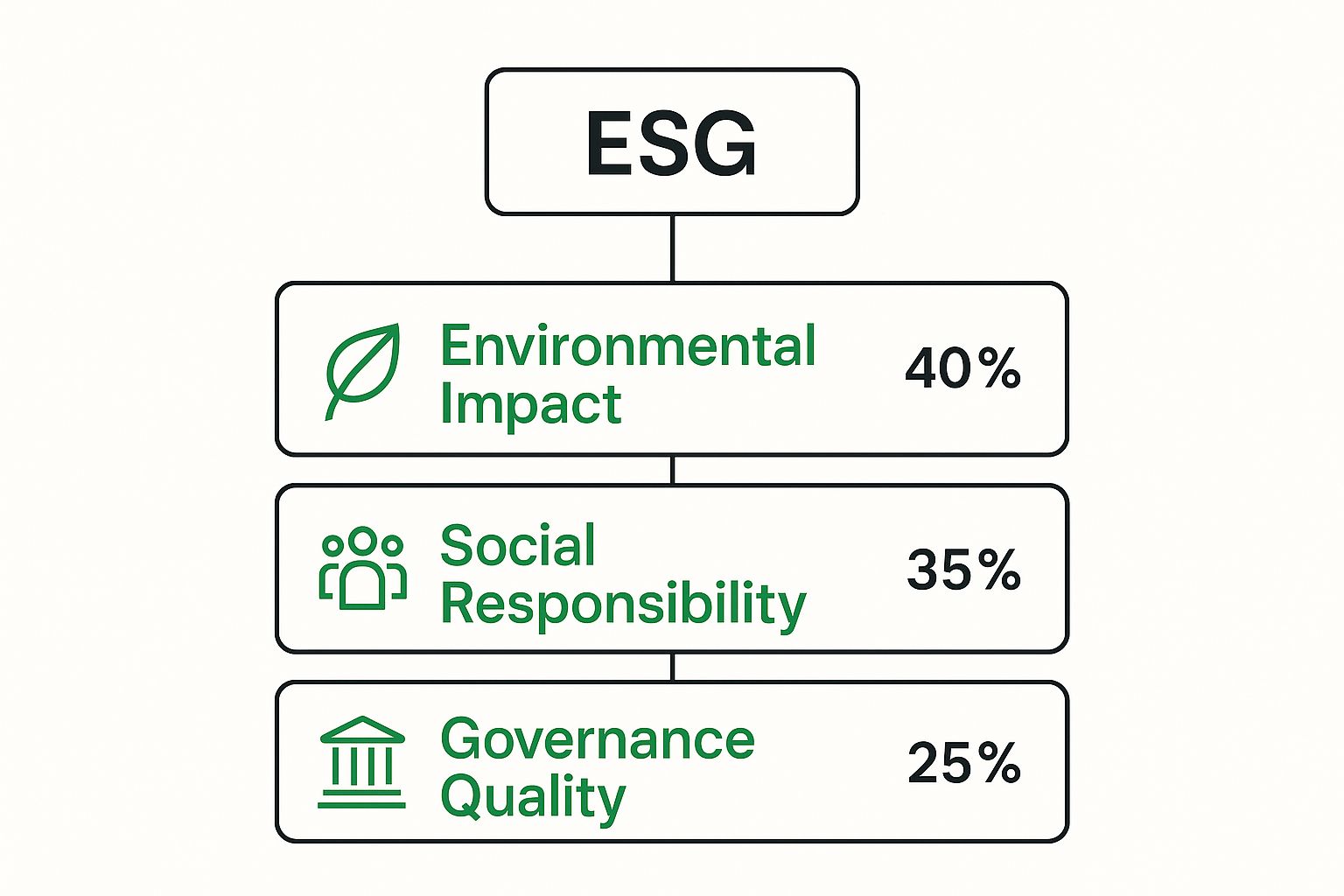

This image shows a typical weighting system used to evaluate the core pillars of an ESG programme.

As the breakdown shows, while all three pillars are essential, environmental impact often carries the most weight in supply chain assessments, with social and governance factors following closely behind.

Building Your Strategic Roadmap

No matter which model you lean towards, a successful rollout hinges on a solid strategic plan. This is about more than just picking a framework; it requires thoughtful preparation and open communication. A recent study on Czech companies confirmed that ESG risk analysis has become a vital part of corporate strategy and due diligence for both investors and business partners. To find out more, you can explore the research on ESG preparedness in Czech firms.

Your implementation roadmap should include several key steps, organised for clarity.

Effective ESG integration is not just a financial or procurement initiative—it is a cross-functional business transformation. Success depends on clear communication, shared goals, and the right technological tools to track progress accurately.

The journey starts by building a strong foundation. You need to define what ESG success actually looks like for your organisation and your unique supply chain. From there, it's a matter of selecting the right tools and clearly communicating your vision so that all your partners are on board and motivated.

For instance, a huge part of the environmental pillar is getting an accurate handle on your carbon footprint. You can learn more about that in our Scope 3 emissions tracking guide for modern enterprise teams. This ensures your KPIs are grounded in reliable data from day one.

The Real-World Payoff: Why an ESG Focus Makes Business Sense

Weaving ESG principles into your supply chain finance isn't just about doing good; it's about doing well. While the ethical argument for sustainability is compelling on its own, the financial and operational upsides are becoming too significant for any smart company to overlook. A well-executed ESG strategy has shifted from being a line item in the budget to a core driver of business value.

At the heart of this change is a new way of looking at risk. More and more, lenders and investors are treating strong ESG performance as a reliable sign of a company's long-term health. This opens up a direct route to tangible rewards for businesses that get serious about sustainability.

Unlock Better Financing and Favourable Terms

One of the most immediate perks of strong ESG integration in supply chain finance is getting better access to capital, often on more attractive terms. Financial institutions are actively funnelling money into sustainable ventures, and they see ESG-focused companies as much safer bets.

This isn't just theoretical; it translates into real money saved. Imagine your company has a verified, low-carbon supply chain. You might suddenly find yourself qualifying for a loan with a lower interest rate or gaining access to special "green loans" set up specifically to fund sustainable projects.

Lenders increasingly view solid ESG compliance as a sign of excellent risk management. A company that’s on top of its environmental impact and ensures fair labour practices is simply seen as more stable and less likely to face costly disruptions. That makes it a much safer investment.

This creates a brilliant feedback loop: your improved sustainability performance directly lowers your cost of capital. That frees up cash that you can then plough back into innovation and growth.

Build a More Resilient Supply Chain

Focusing on ESG forces you to get a much clearer, deeper view into every link of your supply chain. That transparency isn't just for show or for filling out reports—it’s a powerful tool for building a business that can withstand shocks. When you identify and tackle environmental or social risks early, you can often head off major disruptions before they even start.

Think about a company that depends on one key supplier in a region known for extreme weather events like flooding. An ESG-driven risk analysis would immediately highlight this weak spot, pushing the company to find alternative partners in more stable areas. It's this kind of proactive thinking that makes the entire supply network stronger.

- Dodge Major Risks: By getting ahead of potential issues, from new regulations to resource shortages, you can avoid expensive shutdowns.

- Create Stronger Partnerships: When you support your suppliers with fair payment terms and reward their sustainable efforts, they become more reliable and invested in your success.

- Become More Agile: A transparent supply chain means you can react much faster to unexpected global events or sudden changes in the market.

Strengthen Your Brand and Attract Top Talent

In today's world, a company's reputation is directly tied to its sense of responsibility. Customers are voting with their wallets, actively choosing businesses that align with their ethical and environmental values. Proving your commitment to ESG can set you apart from the competition, building deep-seated customer loyalty and trust.

That positive image has a ripple effect on recruitment, too. The best talent, especially younger professionals, are looking for more than just a paycheck; they want to work for organisations that share their values. A genuine ESG programme becomes a magnet for attracting and keeping these high-performers, leading to a more motivated and productive team. Ultimately, this lowers hiring costs and boosts your bottom line.

Of course, here is the rewritten section with a more natural, human-expert tone, following all your specified requirements.

Getting Past the Hurdles: Real-World ESG Implementation Challenges

While the case for an ESG-focused supply chain is compelling, the journey from idea to execution is rarely a straight line. Making the shift to ESG integration in supply chain finance isn't just about good intentions; it’s about realistically facing the obstacles that will inevitably pop up and having a smart plan to navigate them. For many businesses, especially those in markets like the Czech Republic, this can feel like a daunting and expensive undertaking at first.

Most of the headaches tend to fall into three buckets: wrestling with data, justifying the initial costs, and making sense of the ever-shifting world of reporting standards. Getting a handle on these pain points is the first, most crucial step in building an ESG programme that actually adds value instead of just piling on more paperwork.

The Data Collection Dilemma

Let’s be honest: getting good ESG data from a sprawling, multi-layered supply chain is probably the single biggest challenge you'll face. You might have a decent handle on your direct, tier-one suppliers, but what about their suppliers? Or the suppliers after that? Visibility gets murky fast, the further down the chain you go.

This isn't just a minor inconvenience; it's a major problem. Without reliable data, you can't set meaningful targets, track your progress, or even be sure that the ESG claims your partners are making hold any water. It’s a bit like trying to sail a complex shipping route with a hand-drawn map full of blank spots—you’re basically guessing your way forward.

To start getting this under control, you don't have to do everything at once.

- Launch a pilot programme: Pick a small, manageable group of key suppliers to test your data collection methods. This will quickly show you where the gaps and snags are.

- Embrace technology: Trying to manage this with spreadsheets is a fast track to frustration and errors. Modern carbon management platforms can pull in and verify data automatically, giving you one clear picture.

- Focus on what matters most: Pinpoint the suppliers that make up the biggest chunk of your spending or carry the highest ESG risk. A targeted approach will give you much better results than trying to cover everyone at once.

The 'Preparedness Gap' and the Regulatory Squeeze

Another huge hurdle is what I call the 'preparedness gap'. It's the tendency to seriously underestimate how quickly new regulations are coming and just how detailed they'll be. A lot of companies, particularly here in the Czech Republic, are simply not set up for the level of reporting that’s about to become standard practice.

For example, a recent analysis by Frank Bold pointed out that more than 1,000 Czech companies will soon be covered by the European Commission's new sustainability reporting rules under the Corporate Sustainability Reporting Directive (CSRD). The scary part? The same analysis shows most of these businesses are nowhere near ready for the intense data gathering this will require. You can dig into the full details of these upcoming ESG reporting standards to see what's coming.

Kicking the can down the road on ESG regulation is no longer a viable strategy. The companies that start building their data capabilities now will have a serious edge. Those who wait risk fines, operational headaches, and losing ground to competitors who got their act together sooner.

Closing this gap means getting proactive. It's time to treat ESG reporting with the same rigour as financial reporting. That means investing in the right tools, training your people, and building the internal processes to make sure you're ready when the deadlines hit.

Tackling Costs and Navigating the 'Alphabet Soup' of Standards

Of course, we can't ignore the very real concerns about upfront costs and the confusing mess of reporting frameworks out there. Shelling out for new tech, training, and potential third-party audits can feel like a big ask, particularly for smaller suppliers in your network.

Then there's the "alphabet soup" of standards—GRI, SASB, TCFD, and others. It can be bewildering, often leading to companies doing the same work multiple times to satisfy different stakeholders. This lack of a single, universal standard makes it tough to benchmark performance and compare apples to apples across your supply chain.

This is where a bit of pragmatism goes a long way. Before we look at some common challenges in more detail, remember the solution isn’t to do everything at once. It’s to focus on the frameworks that actually matter to your industry and your key partners. And most importantly, reframe the spending. It's not a cost; it's an investment in a stronger, more resilient business that’s ready for the future. Nine times out of ten, the long-term financial payoff from a robust, sustainable supply chain will far exceed those initial expenses.

To help you anticipate and manage these issues, the table below breaks down some of the most common obstacles and offers practical ways to address them.

Common Implementation Challenges and Practical Solutions

| Challenge | Potential Impact | Recommended Solution |

|---|---|---|

| Poor Data Quality & Gaps | Inaccurate reporting, flawed decision-making, and inability to track progress effectively. | Implement a phased data collection strategy, starting with high-risk/high-spend suppliers. Use technology platforms for automated validation and verification. |

| Supplier Reluctance or Incapacity | Small and medium-sized suppliers may lack the resources or expertise to provide detailed ESG data, creating bottlenecks. | Offer training, resources, and standardized templates. Emphasise shared benefits and link ESG performance to preferential financing or better terms. |

| Lack of Internal Expertise | Teams may not have the necessary skills to manage ESG data, interpret regulations, or drive a cohesive strategy. | Invest in targeted training for key personnel. Consider hiring an ESG specialist or engaging with external consultants for initial setup and guidance. |

| High Initial Investment Costs | The cost of new technology, consulting fees, and audits can be a barrier, especially for smaller businesses. | Develop a clear business case highlighting long-term ROI, such as operational savings, risk reduction, and improved brand reputation. Explore government grants or green financing options. |

| Complex Regulatory Landscape | The variety of reporting standards (e.g., CSRD, GRI) can create confusion and redundant work. | Conduct a materiality assessment to identify the standards most relevant to your industry and stakeholders. Focus on one primary framework to build on. |

| Integrating ESG into Procurement | ESG metrics are often treated as an afterthought rather than a core component of sourcing and supplier evaluation. | Revise procurement policies and RFPs to include specific ESG criteria and weightings. Train procurement teams to evaluate suppliers holistically. |

By anticipating these challenges, you can build a more resilient and effective ESG integration plan from the outset, turning potential roadblocks into opportunities for improvement and strategic advantage.

The Future of Sustainable Supply Chains

The push for ESG in supply chain finance isn't just a passing trend. It's a fundamental shift in how we define business value and measure risk, and it's here to stay. Looking ahead, this integration is only going to get deeper and more sophisticated, powered by new technologies that make sustainability truly transparent and verifiable.

This isn't just about ticking boxes for regulators. It's a genuine opportunity to build the kind of resilient, efficient, and ethical supply chains the future demands. We're quickly moving beyond static, once-a-year sustainability reports. The future is dynamic, real-time scoring. Imagine a world where a supplier's ESG performance is monitored continuously, and their financing terms flex automatically based on live data. That's not science fiction; it's right around the corner.

The Rise of Technology and Transparency

So, what's driving this change? Technology. New tools are emerging that give us the power to actually verify claims and cut through the noise of greenwashing.

Two areas, in particular, are leading the charge:

- Artificial Intelligence (AI): AI is getting incredibly good at sifting through massive, messy datasets. Think satellite imagery, shipping manifests, and energy reports. It can spot anomalies and flag inconsistencies, providing a level of assurance that self-reported data simply can't match.

- Blockchain Technology: By creating a secure and unchangeable digital ledger, blockchain brings a new level of transparency. Every transaction and movement of goods can be recorded, making it possible to trace a product’s entire journey from raw material to final delivery. This is how you verify claims about ethical sourcing or a product's true carbon footprint.

As we look further down the road, advanced manufacturing is also becoming a huge part of the conversation. For anyone curious, exploring the sustainability and green aspects of 3D printing reveals how innovation is fundamentally changing production itself. Ultimately, this technological shift is all about building trust through data you can actually believe.

The next frontier for ESG is credibility. Businesses won't just be judged on their promises, but on the quality of their data and the transparency of their transition plans. Technology is the key that unlocks this level of trust.

A Call to Action for Czech Businesses

For businesses here in the Czech Republic, this evolution presents a clear choice. You can see this as just another compliance headache, but that’s a short-sighted view that will leave you exposed.

The smarter approach is to see it for what it is: a powerful way to innovate and gain a competitive edge. Proactive ESG integration in supply chain finance doesn't just look good; it fortifies supplier relationships, genuinely reduces risk, and attracts the right kind of investment.

The journey doesn't have to be overwhelming. It begins with a single step. Start by taking an honest look at your current operations. Talk to your key suppliers. Figure out which ESG issues truly matter most to your business and your industry.

The tools and frameworks are out there, and the market is clearly rewarding the leaders who act decisively. By starting today, you’re setting your organisation up not just to survive this transition, but to thrive in a global economy where sustainability and profitability are finally being seen as two sides of the same coin.

Got Questions About ESG and Supply Chains? We’ve Got Answers

As more businesses start weaving ESG principles into their supply chain finance, it's only natural that questions pop up. Let's tackle some of the most common ones to help you get started on the right foot.

As a Small Business, Where Do I Even Begin with ESG?

The best place for any small business to start is with a materiality assessment. It sounds complex, but it's really just about figuring out which ESG issues matter most to your specific industry and have the biggest impact. You don't have to boil the ocean.

Pick one or two high-impact areas to focus on first. Maybe that's tracking your energy consumption to get a handle on the 'E' (Environmental), or perhaps it's implementing stronger workplace safety standards to address the 'S' (Social). Simply starting to track this data shows you're serious.

A smart move is also to have a frank conversation with your biggest customers. Ask them what they care about. Their ESG requirements can give you a clear, practical roadmap for your own efforts.

What’s the Difference Between Green Finance and ESG Finance?

This is a really common question, and it's easy to get them mixed up. Green finance is laser-focused on the 'Environmental' side of things. It's all about funding projects with clear, positive environmental benefits, like building a solar farm or investing in technology to reduce waste.

ESG-integrated supply chain finance, on the other hand, takes a much wider view. It looks at a company’s overall performance across all three pillars: Environmental, Social, and Governance. A financing programme tied to ESG will reward a supplier for their total performance—including fair labour practices and transparent leadership, not just their carbon emissions.

Think of it this way: Green finance backs a specific green project. ESG-integrated finance rewards a company for being a good corporate citizen all-around.

How Can I Make Sure My Suppliers Are Being Honest About Their ESG Claims?

Verifying what your suppliers tell you is absolutely critical. Without it, your entire ESG programme is built on shaky ground and you risk "greenwashing." The most effective way to keep everyone honest is to use a few different methods together.

Here’s a practical approach to verification:

- Ask for the Data: Start simple. Ask your suppliers for their performance data using a standard template so you can compare apples to apples.

- Bring in a Third Party: For your most important or highest-risk suppliers, it's worth hiring a third-party auditor. They can conduct on-site checks and give you an unbiased validation of the data.

- Use Technology: Modern platforms can do a lot of the heavy lifting. They often use AI to analyse the data you receive, check it against public records, and automatically flag anything that looks off.

- Put it in the Contract: Make ESG compliance a formal part of your supplier agreements. This sets clear legal expectations and gives you the right to perform regular audits to ensure they’re sticking to the plan.

By combining these tactics, you create a solid verification system that encourages real accountability.

Ready to stop wrestling with spreadsheets? Carbonpunk has built an AI-driven platform that automates emissions tracking, creates audit-ready reports, and gives you real insights to build a truly sustainable supply chain. See how to simplify your ESG data management at https://www.carbonpunk.ai/en.